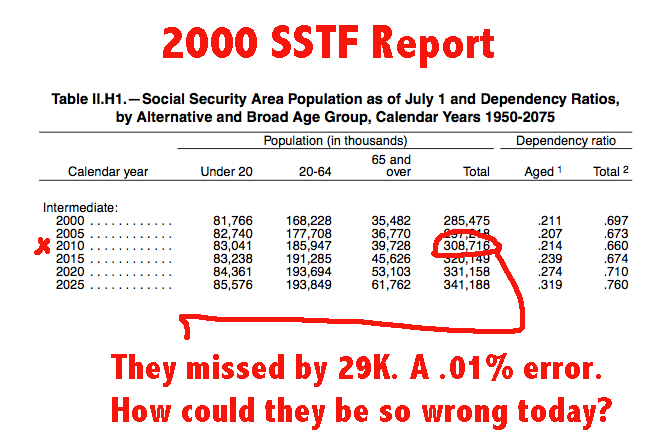

The census numbers were a surprise to me. Our population is growing at a much smaller rate than I had thought. Less than 1% per annum, the lowest since the 30s. My first thought was that this was probably not anticipated 10 years ago. So I looked up one credible source for population forecasts. The Social Security Trust Fund lives and breathes this stuff. I looked at the 2000 base case (intermediate) assumptions for population in 2010. I was very surprised to see that they hit the nail on the head. Good for them.

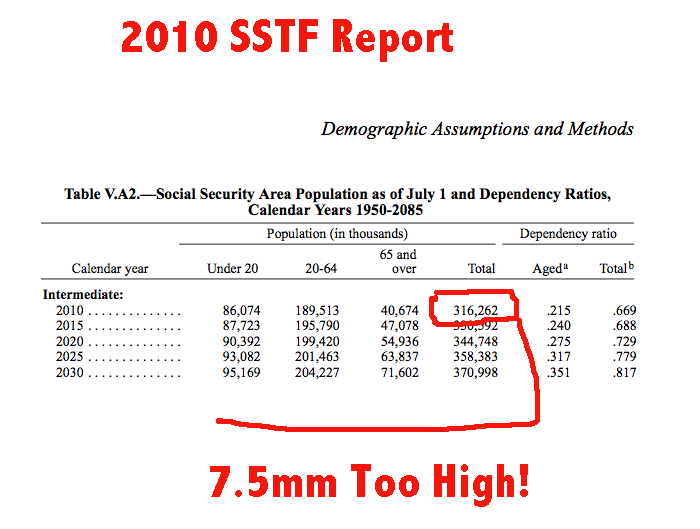

Just for the heck of it I looked up the 2010 SSTF report to see if the new forecasts were on track with the old ones. Then I got confused.

While the SSA correctly forecast what our population would be a decade ago, they are currently overstating the population by 7,500,000 people. That comes to a 2.4% overstatement as to just how many of us there are walking around. I found that interesting.

There is a direct correlation to total economic activity and population. The more people, the more GDP. The more mouths to feed, clothes to wear, transportation, shelter, healthcare the greater the output will be. The number varies from country to country so there is no definitive relationship between populations and GDP. For example, China has a population of ~1.3b and a GDP of ~5T, therefore the GDP per person is ,557. This number is much higher in the USA. Based on the census number and current GDP the US has a ratio of ,300 of GDP per person. Germany has a population/GDP ratio of ,000.

I don’t want to suggest that that if there were one additional person in the US that GDP would grow by K. It doesn’t work like that. But it is absolutely correct to say that if population were higher, GDP would be higher as well. Population drives demand.

Back to SSA. What are they going to do with their population estimates? The answer is they have to take them down. When they do, they will have to adjust ALL of their numbers. The have to adjust both short and long term estimates. Given that we now know that our population is smaller than SSA had assumed and is growing at a smaller rate, there are significant implications to the retirement system. All of those implications are negative.

From the census data alone SSA will be forced to conclude A) the date that the system goes negative is not 2037 and B) the date that SSA goes permanently cash flow negative is not 2015. Just from the census data I am now forecasting that the date that the SSA goes permanently cash negative was 2008. We will never see a return to a cash surplus. The 2037 drop-dead date will be shortened by a minimum of 5 years. I say they system explodes in 2030. These are very material changes.

Is the population data a game changer on the debate that is now raging on the fate of SSA? I think it is. If you were worried about the long-term solvency of the system and its impact on the broad economy before, you should be much more worried about those things after the census report.

In 2000 SSA correctly forecast the population for 2010. In the same 2000 report SSA forecast a CASH surplus at SS for 2010 of billion. The actual result of 2010 will be a deficit of billion. The 0b miss is largely a function of the lasting impact of the 08 recession and the continuing high unemployment. That big miss is also function of our population growing at a smaller rate than what had been assumed.

At so many levels we are fooling ourselves as to how wealthy our country is and how quickly we should be growing. The estimates we use are out of whack with reality and therefore we have this false belief that we can and should be able to just grow our way out of trouble. This fundamental belief is part of the budgetary policy driven to stimulate higher growth. It is part of the Feds thinking in their effort to push against the string with policies like QE. Those policies will not achieve the desired effects. The reason is that there is less of us around then has been believed. Slow population growth will trump any stimulus Congress or the Fed throw at it.

If we did in fact have an extra 7.5mm people in the country and they contributed to economic activity by the k multiplier it would translate into additional GDP of ~3 billion. A very big number. That is approximately equal to the GDPs of Austria, Norway, Taiwan or Saudi Arabia. It is double that of Chile. The states of Virginia, Washington and Massachusetts have similar populations. On a pure population comparison the 7.5mm is equal to the entire population of countries like Israel, Switzerland and Hong Kong.

It will be interesting to see if D.C. recognizes the slow population growth in the US and ignores the implications. My guess is that that they will. But they will do so at our collective peril. There is an assumption in Washington that we can simply grow our way out of our problems. The census report says we can’t.