The structural flaw at the heart of the E.U. dooms it and the euro to either dissolution or radical transformation.

To understand the structural flaw which dooms the European Union, we need to start with the Union's fundamental financial characteristics.

The European Union established a single currency and trading zone for the classical Capitalist benefits this offered: a reduction in the cost of conducting business between the member nations and a freer flow of capital and labor across borders.

This "liberalization" of trade and capital flows is often referred to as Neoliberal Capitalism: short-hand for opening markets and enabling free enterprise to take on tasks formerly reserved for government (the Central State) or State-sanctioned corporations.

The key feature borrowed from Classical Capitalism is that the risks of enterprise and the investing of capital are (supposedly) transferred from the State to the newly liberalized private sector. But this turns out to be a charade played out for propaganda purposes: when the expansion of credit and financialization ends (as it must) in the tears of asset bubbles deflating and massive losses, then the Central State absorbs all the losses which were supposedly private.

I define Neoliberal Capitalism much differently: markets are opened specifically to benefit the central State and global corporations, and risk is masked by financialization and then ultimately passed onto the taxpayers. The essence of Neoliberal Capitalism is: profits are privatized, losses are socialized, i.e. passed on to the taxpayers via bailouts, sweetheart loans, State guarantees, the monetization of private losses as newly issued public debt, etc.

The Central State benefits from the explosion of tax revenues created by financialization and the expansion of credit, and from the vast swag showered on political parties and apparatchiks by the global corporations.

From a Neoliberal Capitalist perspective, the union consolidated power in a Central State proxy (The E.U.) and provided large State-approved cartels and quasi-monopolies access to new markets.

From the point of view of the citizenry, it offered the benefit of breaking down barriers to employment in other Eurozone nations. On the face of it, it was a “win-win” structure for everyone, with the only downside being a sentimental loss of national currencies.

But there were flaws in the structure that are now painfully apparent. The Union consolidated power over the shared currency (euro) and trade but not over the member states’ current-account (trade) deficits and budget deficits. While lip-service was paid to fiscal rectitude via caps on deficit spending, in the real world there were no meaningful controls on the creation of private or state credit or on sovereign borrowing and spending.

Thus the expansion of the united economy via the classical Capitalist advantages of freely flowing capital and labor were piggy-backed on the expansion of credit and financialization enabled by the Neoliberal Capitalist structure of the union.

The alliance of the Central State and its intrinsic desire to centrally manage the economy to benefit its fiefdoms and Elites and classical free-market Capitalism has always been uneasy. On the surface, the E.U. squared the circle, enabling stability, plentiful credit creation and easier access to new markets for all.

But beneath this beneficent surface lurked impossible-to-resist opportunities for exploitation and arbitrage. In effect, the importing nations within the union were given the solid credit ratings and expansive credit limits of their exporting cousins, Germany, The Netherlands, France, Finland, et al. In a real-world analogy, it’s as if a sibling prone to financing life’s expenses with credit was handed a no-limit credit card with a low interest rate, backed by a guarantee from a sober, cash-rich and credit-averse brother/sister. Needless to say, it is highly profitable for banks to expand lending to credit-worthy borrowers.

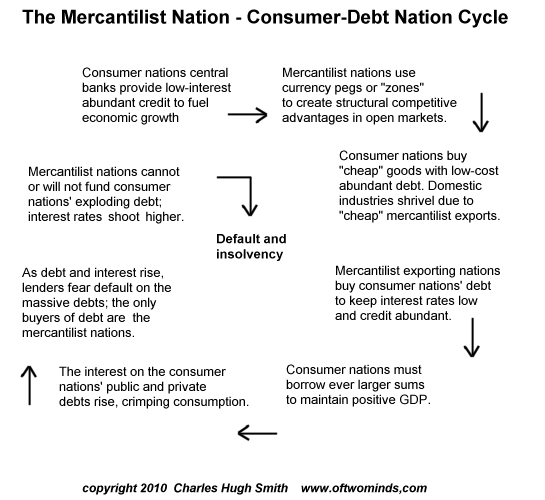

At the same time, the mercantilist exporting nations had engineered an immensely profitable fixed-currency zone which kept their exports cheap within importing nations, regardless of whatever imbalances developed. In the pre-euro days, current-account (trade) imbalances between, say, Germany and Italy were resolved by Italy devaluing its currency to the point where German imports became expensive and Italian exports became cheap. That ability to re-balance capital and exports flows was sacrificed by the imposition of the euro on all member nations.

This dynamic is illustrated in this chart:

Credit at very low rates of interest is treated as “free money,” for that’s what it is in essence. Recipients of free money quickly become dependent on that flow of credit to pay their expenses, which magically rise in tandem with the access to free money. Thus when access to free money is suddenly withdrawn, the recipient experiences the same painful withdrawal symptoms as a drug addict who goes cold turkey.

Even worse--if that is possible--free money soon flows to malinvestments as fiscally sound investments are quickly cornered by State-cartel partnerships and favored quasi-monopolies. The misallocation of capital is masked by the asset bubble which inevitably results from massive quantities of free money seeking a speculative return.

The E.U.’s implicit guarantee to mitigate any losses at the State-sanctioned large banks--the Eurozone’s equivalent of “too big to fail” banks--enabled a financial exploitation that is best understood in a neocolonial model. In effect, the big Eurozone banks “colonized” member states such as Ireland, following a blueprint similar to the one which has long been deployed in developing countries such as Thailand.

This is a colonialism based on the financialization of the smaller economies to the benefit of the big banks and their partners, the Member States governments, which realize huge increases in tax revenues as credit-based assets bubbles expand.

As with what we might call the Neoliberal Colonial Model (NCM) as practiced in the developing world, credit-poor economies are suddenly offered unlimited credit at very low or even negative interest rates. It is “an offer that’s too good to refuse” and the resultant explosion of private credit feeds what appears to be a “virtuous cycle” of rampant consumption and rapidly rising assets such as equities, land and housing.

Essential to the appeal of this colonialist model is the broad-based access to credit: everyone and his sister can suddenly afford to speculate in housing, stocks, commodities, etc., and to live a consumption-based lifestyle that was once the exclusive preserve of the upper class and State Elites (in developing nations, often the same group of people).

In the 19th century colonialist model, the immensely profitable consumables beingmarketed by global cartels were sugar (rum), tea, coffee and tobacco—all highly addictive, and all complementary: tea goes with sugar, and so on. (For more, please refer to Sidney Mintz’s classic history, Sweetness and Power: The Place of Sugar in Modern History.)

In the Neoliberal Colonial Model, the addictive substance is credit and the speculative and consumerist fever it fosters.

In the E.U., the opportunities to exploit captive markets were even better than those found abroad, for the simple reason that the E.U. itself stood ready to guarantee there would be no messy expropriations of capital by local authorities who decided to throw off the yokes of European capital colonization.

The “too big to fail” Eurozone banks were offered a double bonanza by this implicit guarantee by the E.U.: not only could they leverage to the hilt to fund a private housing and equities bubble, but they could loan virtually unlimited sums to the weaker sovereign states or their proxies. This led to over-consumption by the importing States and staggering profits for the TBTF Eurozone banks. And all the while, the citizens enjoyed the consumerist paradise of borrow and spend today, and pay the debts tomorrow.

Tomorrow arrived, and now the capital foundation--housing and the crippled budgets of post-bubble Member States--has eroded to the point of mass insolvency. Faced with rising interest rates resulting from the now inescapable heightened risk, the citizenry of the colonized states are rebelling against the loss of their credit-dependent lifestyles and against the steep costs of servicing their debts to the big Eurozone banks.

Concurrently, taxpayers and voters in the mercantilistic/exporting member states such as Finland and Germany are rebelling against being saddled with the ever-rising costs of bailing out their weaker neighbors.

Now that the losses resulting from these excesses of rampant exploitation and colonization by the forces of financialization are being unmasked, a blizzard of simulacrum reforms have been implemented, none of which address the underlying causes of this arbitrage, exploitation and financialization.

Understood in this manner, it is clear there is no real difference between the monetary policies of the European Central Bank and the Federal Reserve: each seeks to preserve and protect the “too big to fail” banks which are integral to the Neoliberal State-cartel partnership.

Both are attempting to rectify an intrinsically unstable monopoly-capital/State arrangement--profits are private but losses are public--by shoving the costs of the bad debt and rising interest rates onto the backs of the home-country taxpayers. The profits from this vast arbitrage and Neoliberal colonialist exploitation were private, but the costs are being borne by the taxpaying public.

Any policy maker or pundit who is confident this is a stable arrangement will find his/her confidence was misplaced.

If you would like to post a comment, please go to DailyJava.net.