For every action there is an equal and opposite reaction

-Newton’s Third Law of Motion

While central bankers are “experts” on economic theory, we would all be well served if they had a little education on real world physics—that is, those immutable laws governing the universe that aren't subject to the whims of economic mis-interpretation. One of the most well-known of these comes from Sir Isaac Newton’s three laws of motion, which is that for every action there is an equal and opposite reaction.

It is imperative for central bankers to learn their actions are not made in a vacuum but have wide array of consequences for inflation, economic activity, and currency fluctuations. While US Fed Chairman Ben Bernanke may state that inflation is well contained, it appears he may finally get his wish of higher inflation which he stated in the December 2010 FOMC meeting was below desired levels.

What’s the easiest way to boost the inflation rate? Simple, just depreciate the home currency. This was exactly what FDR did in the Great Depression to break the back of deflation, and Fed Chairman Benanke, a student of the Great Depression, is following right along in conjunction with President Obama in carrying out FDR’s game plan as highlighted by David Rosenberg below.

In addition to knowing it is a mid-term election year in 2010, we also know that we have a President who has, step by step, been taking feathers out of FDR’s cap in dealing with this modern day depression. The one item that has yet to be utilized is U.S. dollar depreciation, and if memory serves us correctly, FDR snuffed out the worst part of the Great Depression when he unilaterally devalued the dollar relative to the gold price in 1933 by 60% (ultimately fixing the price of gold at $35/oz in 1935).

We’re not sure that President Obama is going to re-price the dollar price of gold, but the catalyst for a weak-dollar policy may lie in further expansion of the Fed’s balance sheet and de facto printing of excess greenbacks, which may well have been the quid pro quo for Mr. Bernanke’s reappointment. (Just a few months ago, the White House had reportedly published a short list of possible replacements for the Fed Chairman, but we will only find out in the memoirs how much horse trading went on behind closed doors. But suffice it to say that a President that is becoming actively involved in the New York governorship race is quite capable of doing all it takes to ensure a desirable political outcome.)

David Rosenberg, Glusking & Sheff

Market Musings & Data Deciperhing (09.25.2009)

While not overtly coming out and devaluing the USD like FDR did in 1933, Bernanke’s quantitave easing programs of expanding its balance sheet (while the rest of the world is either raising rates or openly stating their concerns about inflation) is a de facto devaluation of the USD, and that is exactly what is occurring. Both Bernanke’s announcement of QE1 in March of 2009 and his hinting of QE2 in his Jackson Hole speech in August 2010 directly impacted the USD. Both programs combined have now driven the US Trade Weighted Real Broad Dollar Index to a new all-time low.

And how might this play into Bernanke’s opinion that inflation rates are too low? Easy, devalue the USD and up go commodity prices. As seen below, there is a negative correlation between the CRB Raw Industrials Index (black line) and the USD (green, inverted). Of note, the secular bear market in commodities using the CRB Raw Industrials Index as a proxy stopped dead in its tracks when the USD peaked in late 2001. Also of note, the CRB index peaked in 2008 when the USD bottomed. Conversely, the CRB index bottomed in late 2008 when the USD peaked. The CRB index has broken out to new highs as commodity traders are likely pricing a lower USD ahead.

What is ironic is that Fed Chairman Bernanke wants higher inflation as he stated inflation rates are too low, but he is quite selective on taking credit for inflation. Last week Bernanke met the press and took full credit for asset inflation but deflected any notion he is contributing to goods inflation as highlighted in the Barron's article below (emphasis added).

Bernanke Takes Credit for Stocks' Rally, Disavows Commodities' Rise

Proving Lincoln's adage you can fool some of the people all of the time, Bernanke asserted to the credulous DC press corps that while the Fed's purchases of Treasury securities played a role in the rise in stock prices since last August, they did not affect the prices of commodities, notably food. Moreover, he rejected the premise that the civil unrest seen in Egypt and Tunisia could be attributed to Fed policy, which the questioner contended was responsible for higher food prices.

Commodity prices, including food, were driven by supply and demand, the Fed chairman argued. And that demand was being elevated by rising prosperity in emerging economies, which means a desire for a better diet. That, in turn, was mainly responsible for the sharp rise in food prices.

At the same time, the liquidity created by the Fed's purchases of up to 0 billion of Treasury securities was working as planned, Bernanke continued. According to the Fed chairman, QE2 has boosted asset prices, notably stocks; lowered market volatility and thus, risk; narrowed corporate-credit risk spreads; and has lifted inflation premia in the Treasury Inflation Protected Securities market. That Treasury yields are higher since the Fed started buying Treasury securities is not inconsistent with QE2's working.

That's been the Fed's story, and Bernanke was sticking to it.

With regards to commodities inflation in developing economies, Bernanke asserted that central banks there were equipped to deal with it. They could raise interest to quash price pressures and also allow the exchange rates of their currencies to appreciate to counter imported inflation.

The latter assertion bolsters suspicions that the motivation of QE2 was to force emerging economies to permit appreciation of their currencies. In other words, to debase the greenback to lower unemployment. And especially relative to the currency of America's most important trading partner, the Chinese yuan.

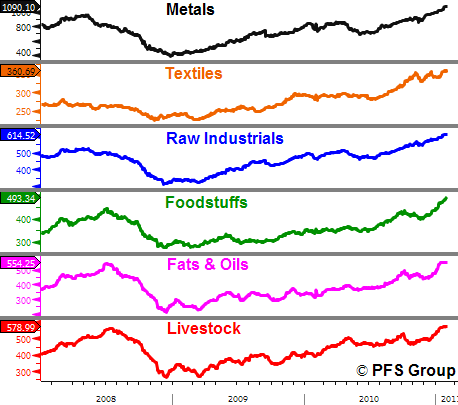

While Bernanke may be able to deflect the notion of higher agriculture prices to weather and foreign demand, it isn’t just agriculture prices that are rising but all commodities simultaneously as seen by the CRB sub indexes below.

It is disingenuous for Bernanke to claim credit for the positive inflation (asset inflation from higher stock prices) but to reject the idea he is causing the negative kind of inflation (goods inflation, higher commodity prices). The chart below clearly illustrates that the trends in the USD play a role in the trend of the stock market and commodities.

Returning back to the Barron’s article above, it suggests widespread suspicions that Bernanke is trying to force developing nations like China to revalue their currencies higher to combat commodity inflation spanning the globe. If in fact foreign countries revalue their currencies, the USD will depreciate against them and help stimulate US exports, bringing back inflation. As shown in the first figure above, the US Trade Weighted Real Broad Dollar Index hit an all-time low last month and a revaluation of foreign currencies by foreign central banks will only put more pressure on the USD and higher inflation.

What the Fed wants, the Fed Gets

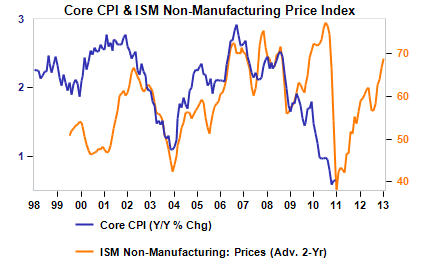

Back in December the Fed stated that inflation is too low. It takes time for higher commodity prices to filter into the economic system, however, the Fed is now getting what it wants. Looking at the bogus “core” consumer price index (bogus, because it excludes food and energy from calculating inflation) you'll notice a sizeable jump in the inflation rate throughout 2011 and into 2012, which is suggested by the high corelation between the ISM Non-Manufacturing Price Index and the CPI over a ten year period.

Another useful gauge in determining future core CPI rates comes from the National Federation of Independent Businesses (NFIB), whose survey of small businesses across the nation provides a helpful read what small businesses are doing and seeing. As seen in the table below, there has been a large jump in the net percentage of firms planning on raising prices to the highest level in years. Part of the reason they are increasing prices is they believe they can as seen by a higher net percentage expecting higher real sales in the future. The NFIB Price survey leads core CPI by 14 months and supports the ISM Non-Manufacturing Price index as it is also suggesting higher inflation for the rest of the year.

Given core CPI rates are slated to start rising right now and continue to increase throughout the year, is it any wonder that bonds are selling off and gold remains strong after a minor pullback? If the USD breaks down further and core CPI numbers start to rise, commodities are likely to rise even further and investors will look upon the current weakness in gold as a great buying opportunity before the inflation train leaves the station. Perhaps the key investment theme for 2011 will be pricing power as inflation eats into corporate profits and slams bond and fixed income investors.