The Dow reached an all-time high of 14,253 on Tuesday and naturally, the financial press drew lots of attention to this fact. Conspicuously absent from the media attention, however, was a complete lack of enthusiasm. The perma-bull cheering section was eerily quiet as widespread apathy was evident. This continues a trend of muted investor psychology which, from a contrarian standpoint, is refreshing given how far the market has come since November.

It was also surprising to see a feature article on the Yahoo.com landing page entitled, “Why the Dow Is Still Rising After Yesterday’s High.” Instead of cheering the Dow’s accomplishment as mainstream media sources are wont to do, the article by John Maxfield urged investors to tread cautiously and to not “get too excited.” My how things have changed since 2007!

Another article appeared on Yahoo’s financial site with the headline: “With Dow Industrials at Record Highs, When Will Gravity Take Hold?” So here we have another example of observers waiting for the inevitable pullback instead of focusing on the all-time high. It’s another clear instance of the seismic shift in investor psychology since the credit crisis. Investors have been psychologically conditioned to mistrust any rally and to expect it to be followed by a sell-off.

Investors are always looking for ways to criticize this bull market. Probably the biggest complaint right now is the lack of volume on the rallies compared to previous years. One reason for this is the lack of participation among small, retail investors. In fact it’s unprecedented that for a bull market of this duration (four years and counting) the retail investor still, to a large extent, hasn’t returned.

While it’s true that volume has been historically lackluster, I can’t help wondering how much of the diminished share turnover is due to corporate cash flows. Corporations have been huge contributors to this bull market in the way of dividends and share buybacks. As one prominent analyst has pointed out, many dividends are funneled back into the market.

Another criticism of the post-2008 recovery bull market, especially in its early stages, was that it was driven primarily by cost-cutting measures on the part of corporations. While there was undoubtedly some truth to that assertion, cutting costs can only take you so far. Sooner or later the benefits of cost cutting will reach their limits and, if you want to keep the positive trend going, you have to start showing increased sales.

Indeed, corporate sales figures are in many ways a more important measure than net earnings. A rising trend in revenues can serve as an excellent “heads up” indication that a company’s undervalued stock is about to turn up. Aside from internal sector momentum and price momentum, I consider sales momentum to be one of the most important things an equities trader should look at when evaluating a stock.

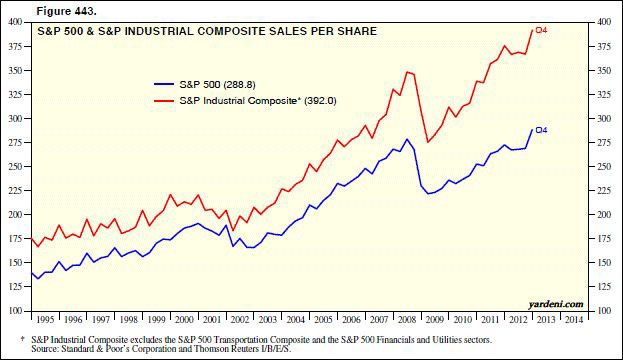

As it turns out, corporate revenues have risen appreciably during the last several quarters. According to Dr. Ed Yardeni (blog.yardeni.com), S&P 500 revenues per share bottomed during Q1-2009 and are up 30.2% through Q4-2012, and 5.9% year over year. Revenues for the S&P 500 Industrial Composite, which excludes Transportation, Financials, and Utilities, is up 42.4% over this same period, and 4.4% y/y. “Both measures are at record highs,” writes Yardeni, “and I am predicting that revenues will increase 5% this year and next year.” The following graph is from Yardeni's blog and illustrates this positive trend.

Meanwhile forward revenues, the time-weighted average of these two forecasts, rose to a new cyclical high. The strong revenue trends is a strong support for this bull market.

Gold

Despite the exodus from gold and into equities, gold’s decline hasn’t been nearly as precipitous as that of the gold/silver mining stocks. Nor has gold suffered to the degree one would expect given the inflows into equities and mutual funds. Take the 1-year chart for the SPDR Gold Trust ETF (GLD) for instance. Although the Dow Jones Industrial Average (DJIA) made a new all-time high on Tuesday, GLD is still above its lows from last June. And while GLD hasn’t managed to close above its 10-week moving average since November, its decline has been fairly contained until now.

While the average retail investor may not be lining up to buy gold, clearly the deep-pocketed investors who have been in the “buy and hold” camp these last 10 or more years haven’t been dumping the metal. The question is why not, and if they are still holding what is it that has convinced them that gold is still worth holding? In other words, are there informed investors who know something the average small-time investor doesn’t know?

Consider two potential trouble spots that could serve as a trigger for a gold price reversal further down the road: Asia and Europe. China’s Shanghai Composite Index has been diverging lower against the rally in the Dow Jones Industrial Average (DJIA) lately, leading some analysts to believe that China will face economic headwinds in 2013 unless it significantly boosts government spending. China’s government has pledged to do just that but the market remains unconvinced.

Moreover, China’s government has announced its intention to deflate the country’s real estate bubble. Among other measures, homeowners selling property will have to pay a capital gains tax of 20 percent of the profit they make on the transaction. (Homeowners will previously taxed 1-2 percent of the total sale price). Other measures include higher interest rates and minimum down payments for those buying a second home in cities with high real estate prices, according to news source Xinhua. When governments try to control market trends it always carries a major risk of disaster. If economic history is any guide there will almost certainly have negative consequences for China and, potentially, other economies.

The euro zone, meanwhile, is headed for a fourth consecutive quarter of economic contraction, as surveys of purchasing managers indicate business activity shrank at a fast pace in February. According to the Wall Street Journal, the composite Purchasing Managers' Index for the euro zone fell to 47.9 in February from 48.6 in January. The sub-50 reading means activity across the currency bloc's manufacturing and services sectors declined month-to-month. “That will likely feed calls for a reconsideration of the euro zone’s strategy for tackling its fiscal and banking crises,” writes Alex Brittain and Paul Hannon in WSJ, “which has relied heavily on austerity programs that have had a larger negative impact on growth than policy makers had expected.”

As Europe’s economic prospects were viewed as improving in November through January, the euro rose while gold fell. Since February, however, the euro has been declining while gold has slowed its rate of descent and is clearly trying to bottom on a short-term basis.

To reiterate our ongoing theme of recent weeks, a revival of overseas economic troubles later this year will almost surely benefit gold. The latest European economic setbacks, along with China’s dangerous real estate experiment, could prove to be a precursor for more troubles down the road. Any such increase in global economic woes will be sure to rekindle the yellow metal’s safe haven status among investors seeking protection.

Lessons from the late Ralph Bloch

I was saddened to learn of the recent passing of Ralph Bloch, former chief technical analyst for Raymond James. Ralph was an inspiration to me back when I began studying technical analysis, and I always enjoyed reading his weekly stock market commentaries in the Mansfield Chart service.

Bloch could best be described, in the words of one of his colleagues, as “old school.” He majored in old-fashioned chart reading the Edwards & Magee way and he eschewed many of today’s commonly used technical indicators. In an interview for a well known financial magazine he was asked if he ever used the stochastics indicator. He replied, “Number one, I haven’t a clue what it is, and number two, I’m not even sure I can spell it.” He believed that most technicians today are over-reliant on computer trading systems and have gotten away from the basics of what he called “Technical Analysis 101.”

Bloch made a point of reading Edwards & Magee’s classic work, Technical Analysis of Stock Trends, along with Jesse Livermore’s pseudonymous Reminiscences of a Stock Operator at least once a year, believing that everything a trader needs to know is contained in these books. He was also a chartist par excellence. He once defined a stock chart thusly: “All a chart is are people’s perceptions of what they think the fundamentals are when they put their money where their mouth is.” He added that when investors put their money where their mouth is, “that’s when technical analysis takes place.” He believed that both disciplines, technical and fundamental, confirm each other.

Ralph also emphasized the limitations of technical analysis, believing that it’s primarily a tool for making short-term forecasts. He was quoted by Investors Business Daily as saying, “It is a mistake to use it for anything longer” than short-term planning. In an interview with Chris Wilkinson in the book, Technically Speaking, he added: “People who make long-term calls usually go down with the ship.”

He believed his job as a technician was to look at the market every day and judge whether or not it was healthy. To do this he embraced a bottom-up approach by looking at individual stock charts first, followed by the indicators. He defined a strong market as being one where the Dow Industrials are making new highs, the Transports are confirming, and the Advance-Decline Line is also confirming and making new highs.

Bloch was a big believer in tape reading and was one of the last pure practitioners of the art on Wall Street. He challenged anyone to match his record on Wall Street, believing strongly that “Technical Analysis 101” would beat new-fangled computer trading systems and arcane indicators. He believed that analysts who follow myriad technical indicators are purposely avoiding making a decision. As Wilkinson wrote of Bloch in 1996, “His simple and basic approach” made him “immune from ‘analysis paralysis,” a condition of mental immobility resulting from too many indicators generating conflicting signals.”

He was a member of a dying breed on Wall Street whose accuracy in making stock market calls was unsurpassed. He will be greatly missed.