China’s growing debt-to-GDP ratio raises concerns for investors. Investment in traditional pollution-heavy and overcapacity-ridden industries is strong, despite many policy tools that help finance more lucrative sectors.

Inertia has been haunting China ever since it started its program of ambitious economic reform earlier this year. The original plan included reining in domestic debts and overcapacity, cutting red tape and liberalizing the market, all while maintaining a GDP growth rate of 7.5%. Yet the government is having a hard time dealing with rising debt levels and overcapacity, which may potentially stall China’s economic reforms.

[Hear: Puru Saxena: Hard Landing Coming to China]

According to The Economist, China’s credit-to-GDP ratio broke 200% in July 2014, the highest level since 2002 (see chart below). Some measures put China’s debt-to-GDP ratio at over 250% as of July 2014. The burgeoning credit was facilitated by “a burst of government stimulus” in the second quarter, with eased-up lending from the banks. The government support successfully put the economy back to a growth rate of around 7.5% in the second quarter from a year earlier.

However, the effectiveness of the government stimulus should not only be measured by its GDP boosting effects. The final destinations of the credit should also be taken into account, especially when China is in the middle of structural reform. Easy money going back into overcapacity-ridden industries is against the spirit of the reforms and could make the current 7.5% growth rate unsustainable.

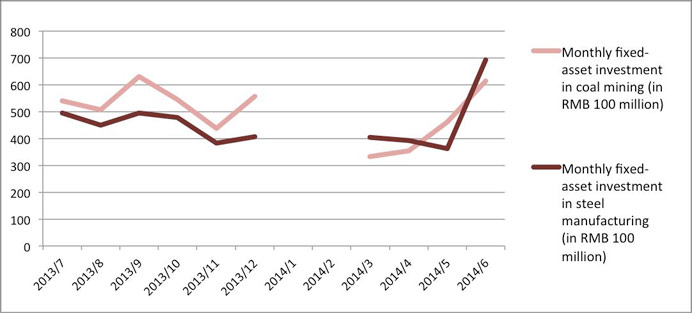

So far, no comprehensive data is available to give us a clear answer. However, recent rising fixed-asset investments in steel manufacturing and coal mining industries, along with recovering production volume of steel and cement, for example, tell a worrying story (see the two charts below). Notably, 45.45% of the major steel manufacturers generated net losses in the first quarter of 2014, which was 14.77% higher than the same period in 2013, thanks to overcapacity.

Source: National Bureau of Statistics. Note that the way the original data was compiled by National Bureau of Statistics made it impossible to calculate the monthly increase in fixed-asset investment in the two sectors during January and February 2014.

Source: National Bureau of Statistics. Note that the figures for January and February 2014 are averaged numbers calculated from the total output during the two months. National Bureau of Statistics does not separately maintain output data for those two months.

Indeed, stimulus measures included loosened reserve requirements for qualified lenders, quickened spending from regional governments and faster construction of railways and public housing. Since last year, the government has put strong emphasis on reining in debt, but always backed down when deleveraging became painful and replaced credit tightening with credit easing. Lying at the center of China’s dilemma is its somewhat self-contradictory economic reforms: one cannot deleverage the economy without hurting the GDP.

[Hear Also: Diane Coyle - GDP: A Brief But Affectionate History]

Apparently, the Chinese government is now prioritizing its GDP target. According to a government statement in July 2014, China will continue targeted measures to manage the economy and must meet its economic development goal. As one scholar put it: “Politically, Beijing is not yet ready to deal with much slower growth.”

Given the existing track record of China’s economic reforms, it seems likely that the government, in the future, will sustain the overall volume of its traditional GDP boosters while increasing the scale of the private sector, service industries, and other new economic drivers. This seems to be an ideal compromise that balances the need for GDP growth and economic restructuring. Meanwhile, the economy will have to endure high debt-to-GDP ratios for some time.