Oil is the lifeblood of modern society, powering over 90% of our transportation fleet on land, sea, and air. Oil is also responsible for 95% of the production of all goods we buy and ultimately drives the natural rhythms of recession and recovery. We define this as the “Petro Business Cycle”.

The post-crash world we have inhabited since the credit crisis of 2008 has been defined as "The New Normal"—a phrase used to describe an economic and market environment much different than the three decades that preceded it. In contrast to the past, the "New Normal" will mean a lower living standard for most Americans. It will be a world of lower economic growth, higher unemployment, stagnant corporate profits, and the heavy hand of government intervention in all aspects in the economy. For investors it will be an environment marked by volatility, zero interest rates, and disappointing equity returns.

The age of leverage is coming to an end as consumers, businesses, and governments are forced to rein in their balance sheets. For consumers it will mean less discretionary spending as higher taxes and inflation erode the purchasing power of wages. Businesses will have fewer profit opportunities and find it more difficult to replicate the growth rates of the booming '80s and '90s. Governments will struggle with the illusion that their fiscal and monetary stimulus will produce long lasting effects on the economy. Eventually profligate government spending will give way to an age of austerity now beginning to spread across Europe. It will either be done voluntarily or involuntarily by the heavy hand of the market.

It should be obvious by now to the casual observer that change is in the air. The economy and the markets aren't acting normal. Despite trillions of dollars of fiscal stimulus, unemployment has remained high and economic growth has remained anemic. It has taken zero percent interest rates and copious amounts of money printing to keep the economy from falling back into a recession. The deflationary forces of deleveraging have fused with inflationary monetary forces with the end result leading to stagflation.

There are new drivers of economic growth that are altering the way the economy behaves. In the past, the rise and fall in interest rates determined economic booms and busts. When economic growth accelerated and inflation heated up, the Fed would raise interest rates to cool the economy down and combat higher inflation. In a normal business cycle, rates would rise until either the economy fell into recession or the stock market contracted. Oftentimes we got both a recession and a bear market.

Conversely, when the economy fell into recession or stocks headed into a bear market the Fed would reverse course and lower interest rates in an effort to re-stimulate the economy. This remained the pattern for over half a century as shown in the graphs above. The normal business cycle would last between 3–5 years between trough and peak. This pattern was altered during the '80s and the '90s due to the debt supercycle. Rising levels of debt and falling interest rates extended the business cycle leading to only one recession per decade and an extended bull market in stocks that lasted nearly two decades, as seen below:

The extension of the business cycle during the '80s and '90s was made possible by the combination of four macro forces: low oil prices, declining long and short term interest rates, disinflation, and fiscal stimulus. This produced an average growth in GDP of 3.6% during these two decades—a time period heralded as the "New Economy" with above average economic growth, low levels of inflation, and booming stock markets. As most investors came to find out however, the "New Economy" turned out to be a chimera, shattered by the bursting of the technology bubble and the 2001 recession.

The government and the Fed fought the bursting technology bubble and the recession with the same tools used in previous decades. The Greenspan Fed lowered the fed funds rate from a high of 6.5% in 2000 to 1.0% by the summer of 2003. The Bush administration ramped up government spending dispelling the myth of government surpluses. The deficit exploded along with government spending.

This time, the results weren't the same. Instead of the robust economic growth of the 1980s and 1990s the average growth rate of GDP had declined to 2.4%, more than a full percentage point despite burgeoning budget deficits and the lowest interest rates in half a century. Like the previous two decades both long and short-term interest rates continued to decline and the government provided constant fiscal stimulus. However, two macro forces changed the outcome. Oil prices no longer remained stable. Instead they were rising to record levels. Inflation was also on the rise. These two forces were intertwined.

The U.S. economy was no longer the sole engine of economic growth. Emerging markets—especially the BRIC countries—were experiencing rapid industrialization that required greater amounts of energy to produce the goods and services demanded by a growing middle class.

In turn, this combined economic growth placed additional strains on the energy sector. Supply wasn't keeping pace with demand. The result was market forces drove the price of oil higher. OPEC and non-OPEC production was simply unable to keep up with global energy demand. The result was prices rose and spare capacity shrunk. Prices rose at the margin.

Source: BP Statistical Review of World Energy, pg. 12

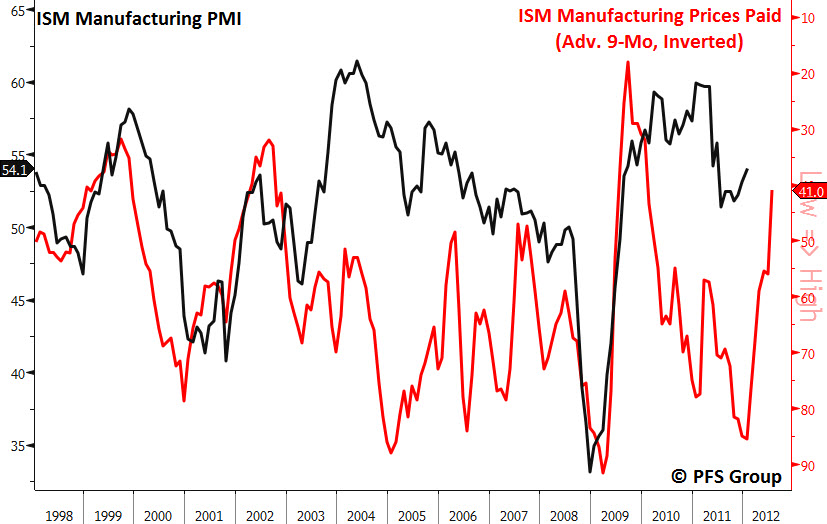

It is this new dynamic of rising energy prices that is now determining economic outcomes. Few have recognized this new economic pattern. Francois Trahan describes this new dynamic as the outcome of inflation. In a period when interest rates are at zero, inflation is acting as the new fed funds rate. As shown in the graph below there is a close correlation between the ISM Manufacturing Index Prices and the ISM Manufacturing Index. When prices rise economic growth weakens, when prices fall economic growth strengthens.

Trahan would argue that there is a close correlation between inflation rates and anticipatory indicators such as the LEIs and the stock market. This can be viewed in the graph below of CPI, the LEIs, and the stock market.

What can be noted here is the close interrelationship between a leading indicator like the ISM Manufacturing Index and the stock market. This pattern has emerged from the economic recovery that began in March of 2009. What we have seen emerge over the last few years is a new economic paradigm that repeats itself with increasing regularity. We have entered a period whereby policymakers' ability to sustain economic expansions has become limited. The limiting factor has become inflation. No longer can the government or the Fed count on long protracted periods of economic growth. In its place has emerged an entirely new dynamic of shorter and more volatile economic cycles, a fact we've seen demonstrated in 2010 and 2011. This dynamic is likely to be repeated this year and beyond.

In our own work we have found that there exists a closer relationship between the price of oil, the LEIs, and the stock market, as seen below:

If you want to know where the economy is heading, watch the price of oil. Oil is used to power over 90% of our transportation fleet from land, sea, to air. It is responsible for 95% of the production of all goods found in stores. It is also directly linked to 95% of our food products, from the fertilizer used in the planting cycle to the diesel used in tractors to the trucks that transport the food to processing plants and grocery stores. Look behind nearly any consumer item, building material, or medical device and you will find it linked to oil in some way. Plain and simple, we live in a petroleum-based society. It is the common thread behind all industrial/modern economies. Without oil our present way of life would cease to exist. For this reason, it is not only the most highly sought-after resource by nations worldwide, but also critical in driving the natural rhythms of recession and recovery. We define this as the "Petro Business Cycle".

There are eight phases to this cycle which have been repeating since this economic recovery began in March of 2009. The eight steps are as follows:

The Petro Business Cycle

- Fiscal & monetary stimulus is applied to the economy

- Economic growth accelerates as a result of stimulus

- Demand for energy picks up as global GDP growth picks up

- Energy prices rise along with energy demand as supply struggles to keep pace

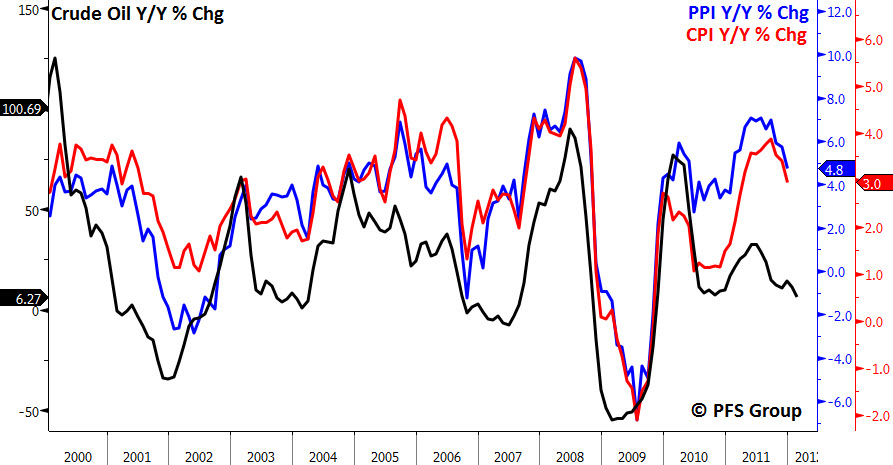

- Rising energy prices cause the prices paid component to rise leading to a rise in both the PPI and CPI

- Rising inflation feeds through to the economy—LEIs begin to peak and roll over

- Falling LEIs lead to slower economic growth and falling equity markets

- A weakening economy and faltering equity markets force another policy response and the cycle repeats itself

This is exactly what happened in 2010 and in 2011. As energy prices and inflation rose in the spring of 2010 the economy and the markets began to weaken. By the beginning of summer, Mr. Bernanke was writing op-ed pieces in The Wall Street Journal highlighting the Fed's exit strategy. As the summer progressed and the economy weakened the Fed chairman surprised the markets at the central banker's conclave at Jackson Hole. The markets got their first glimpse of QE2 which was launched in November. By early spring of the following year the LEIs and the stock market were rising again as monetary and fiscal stimulus were reapplied through quantitative easing and a payroll reduction tax which began in January. Things worked fine for the first six months of the year. Then came the oil shock triggered by the Arab Spring. Libyan oil production went offline. Fukushima also created demand for more diesel fuel. The result was West Texas Intermediate Crude oil prices went from to 5 a barrel by May 2nd. Brent Crude rose even higher reaching the upper 0s. Naturally, the LEIs began to roll over as higher oil prices fed through the economic system leading to a rise in the PPI and the CPI.

Higher rates of inflation caused by the rise in oil prices led to a weakening economy and stock prices fell.

The trend continued until oil prices troughed in early October. By mid-summer the effects of falling oil prices were first seen in the drop in the prices paid components of the regional Fed surveys and ISM reports.

This eventually led to a falling PPI and CPI by early fall. By then the Fed announced "Operation Twist", and clearly indicated that it was willing to keep interest rates at zero until at least mid-2013. That date has been extended to late 2014, with QE3 on the table in case the economy weakens again...especially in an election year.

Currently, the economy has been gathering strength as reflected in a rise in leading economic indicators and the stock market, both supported by subsequent economic reports at the regional level. Since oil prices and the LEIs troughed in early October, both the economy and the stock market have risen.

For the moment, like 2010 and 2011, things look good as long as oil prices hold around current levels. On the economic front things are firing on all cylinders. The unemployment rate is falling, housing is improving, credit is expanding, and money supply is growing again. Investor risk appetites have improved along with rising stock and commodity prices. The "risk on" trade is back.

However, within the context of the ongoing "Petro Business Cycle", an improving economy should eventually lead to rising energy prices. Rising energy prices will act like a tax on consumers as more of their discretionary income will be diverted to pay for basic necessities. As consumption falls the economy will weaken once more. Thus, the whole cycle will repeat itself again.

I believe we're beginning to see the first glimpse of this in rising gasoline prices nationwide. If energy prices continue their upward climb this will eventually give way to another deflationary burst in the economy and fearful markets. Perhaps the Fed is already preparing for this by hinting at QE3 and by extending ZIRP well into late 2014. The latest FED and CBO forecasts for next year call for a rising unemployment rate and slower GDP growth. It would appear at the moment that 2012 is shaping up to look similar to 2010 and 2011—a good first half, a weak summer and early fall, to be followed by a strong yearend finish.

Summary

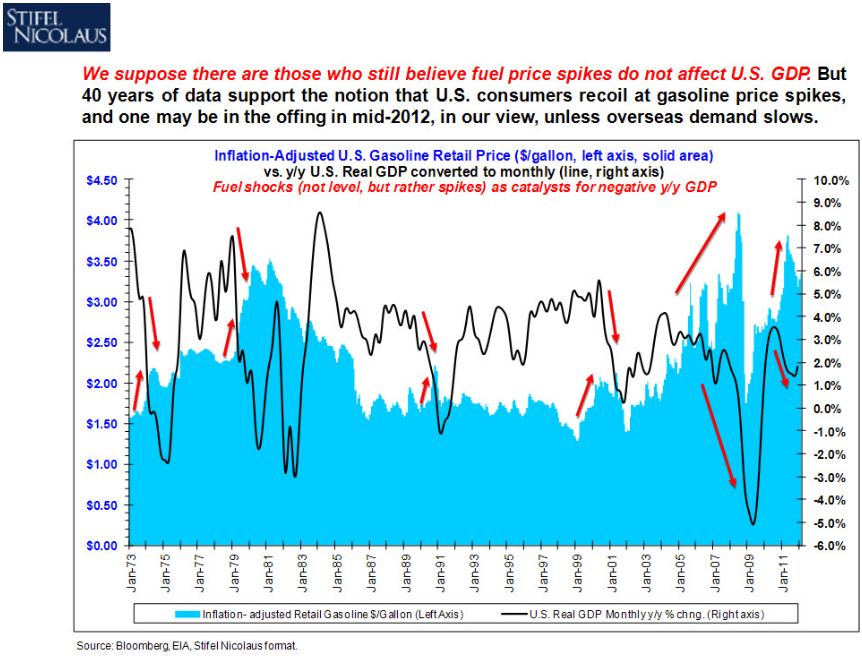

For the skeptical among you I've provided the graph below, courtesy of Stifel Nicolaus.

The graph illustrates the impact of gasoline spikes and their impact on the year-over-year change in GDP growth. It is a graph the Fed and the administration should ponder. In an age of tight energy supply/demand dynamics it should act as a subtle reminder of the limits to government policy. We live in an era of energy supply constraints, a time of emerging market growth which is adding demand far beyond the margin. Rising emerging market growth is exceeding the drop in demand experienced in the moribund developed economies. Like all market prices their outcome is determined at the margin. For the moment that margin is the emerging world.

The tight energy supply/demand dynamics places a limit on government policy response. The Fed can no longer count on the benign disinflationary environment of the '80s and '90s. That world no longer exists. There is a new paradigm that has been created by the advent of resource scarcity. This places limits on what the government can do to affect economic outcomes. What I believe we will see in the future is shorter business cycles that will be analogous to the weather patterns in nature. Since this new paradigm is unlikely to be recognized at first I suspect the same policy mistakes will be repeated. The first half of the year will be the strongest part of the cycle. This will be followed by weakness in late Q2 and early Q3, leading to a strong year-end finish in Q4; a complete business cycle within a single year. Welcome to a new era, the birth of the petro business cycle and the "New Paranormal."