In Part 1 of this three part series I addressed where and how the net worth of the middle class was stolen. In Part 2, I will tackle who stole your net worth and in Part 3, why they stole your net worth. Now let’s zero in on the culprits of this crime.

Dude, Who Stole My Net Worth?

“Thus far, both political parties have been remarkably clever and effective in concealing this new reality. In fact, the two parties have formed an innovative kind of cartel—an arrangement I have termed America’s political duopoly. Both parties lie about the fact that they have each sold out to the financial sector and the wealthy. So far both have largely gotten away with the lie, helped in part by the enormous amount of money now spent on deceptive, manipulative political advertising.” – Charles Ferguson – Predator Nation

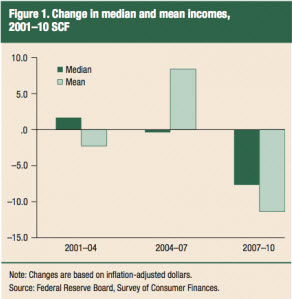

When you dig into the charts and data supplied by the Federal Reserve generated report, the data which goes back to 2001 tells a story not addressed by the deceptive, manipulative, political propaganda that passes for investigative reporting by the captured mainstream media. The chart below compares the median versus mean income growth from the last three Fed consumer surveys. Overall, it reveals a lost decade of negative income growth for the average middle class family. In the early part of the decade the average middle class family made some progress as jobs were relatively plentiful and the internet crash mostly impacted the rich, who own most of the stocks in the country. This is why the median income rose while the average income fell. The wealthy have a large impact on the average because they own the vast majority of assets in this country. The stock market debacle was unacceptable to the oligarchs and their money printing puppet Greenspan.

Both the liberal and conservative wings of the ruling oligarchy were in complete agreement. A new bubble needed to be blown in order to refill the coffers of the ruling class. Paul Krugman spoke for the liberal wing:

"To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble."

Greenspan and his handpicked successor Bernanke represented the conservative wing by reducing interest rates to ridiculously low levels, failing to carry out their regulatory obligations, encouraging recklessness, and purposefully failing to acknowledge and deflate the greatest housing bubble in world history:

“American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage.” – Alan Greenspan – February 2004

“House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.” – Ben Bernanke – October 2005

“With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly.” – Ben Bernanke – November 2005

The master plan worked like a charm from 2004 through 2007 as you can see by the tremendous surge in average income. The stock market rocketed by 75% between 2003 and 2007 and national home prices shot up by 50%. Wall Street creatively invented no doc, negative amortization, interest only, subprime mortgages and generated a frenzy of demand from anyone that could scratch an X on a loan document, just as Greenspan had demanded. Being “sophisticated” financial institutions, they were able to assemble thousands of shit loans that were certain to default into one big derivative package of shit and their captured lackeys at the “sophisticated” rating agencies stamped a AAA rating on the smelly pile of feces. Always looking out for the best interests of their clients (aka muppets), the upstanding Wall Street firms sold the derivative piles of shit to them as can’t miss investments. Wall Street profits went off the charts. Billions in bonuses flowed to the rich and powerful Wall Street titans. Mega-corporations generated record profits as consumers utilized the Fed induced tsunami of easy debt to buy BMWs, 72 inch HDTVs, home theaters, stainless steel appliances, granite counter-tops, Caribbean cruises, Jimmy Choo shoes, and Rolex watches in a mad frenzy of consumer delusion.

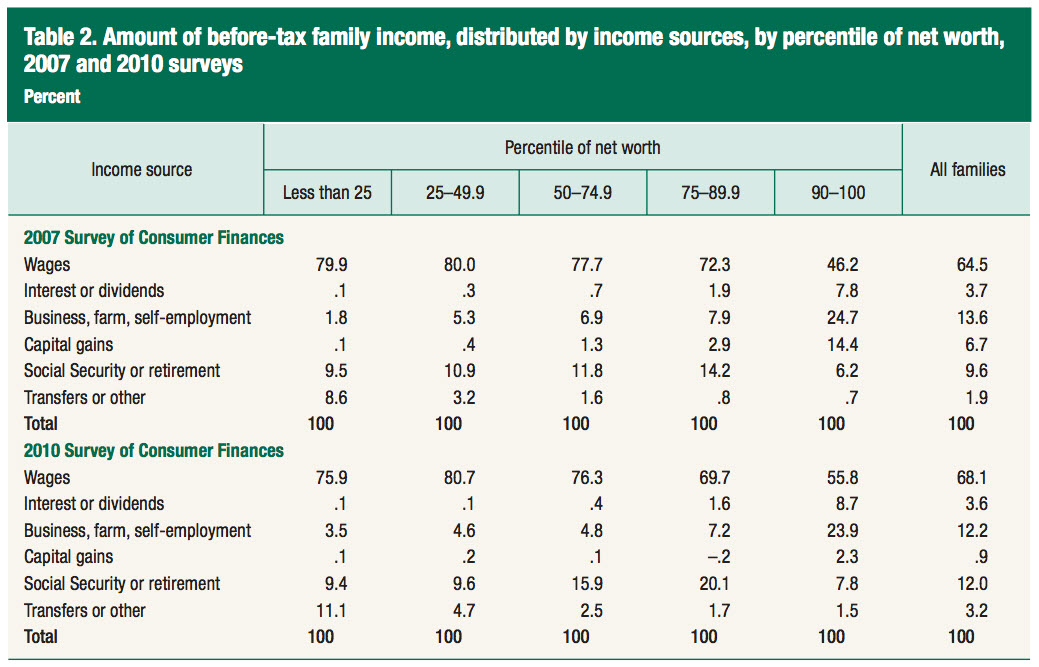

What you might also notice in the chart above is that median household income somehow declined during this decadent orgy of corporate fascist pleasure. How could this be? Table 2 from the Fed report makes it clear. The vast majority of households in this country generate 75% to 81% of their income from wages. Virtually none of the income generated in 85 million households (the bottom 75%) comes from interest, dividends or capital gains. You need money to make money. The top 10% only generated 46% of their income from wages. The report does not provide details on the top 1%, but wages most certainly account for less than 20% of their income. Interest, dividends and capital gains represented 22.2% of the income for the top 10%, while it represented less than 1% of income for the bottom 75%. This data is the smoking gun that proves that Federal Reserve policy and control fraud on a grand scale by the titans of Wall Street was designed and executed to benefit only the wealthy elite billionaire class and their co-conspirators. All the income gains during this time accrued to the psychopathic amoral financial oligarchy. The average family saw their real wages decline and anyone lured into the housing market during this time frame by the “sophisticated” financial experts at Citicorp, Bank of America, Wells Fargo, Merrill Lynch, Countrywide, Washington Mutual, Wachovia, Bear Stearns, Goldman Sachs, Lehman Brothers, and the other members of the Too Big To Fail criminal syndicate was set up for epic loses.

As expected, the psychopathic banker class could not be satisfied with the results of their looting. Their gluttonous voracious greed culminated in a historic collapse of the worldwide financial system resulting in a housing implosion, stock market crash and 8 million middle class Americans losing their jobs. The Fed report does show that average household income declined more than median household income after this historic financial oligarchy created collapse. One look at Table 6 from the Fed report will explain why. Only 15% of families own stocks and only 50% have retirement accounts. Approximately 50 million households in the country have virtually no stocks and less than 30% have retirement accounts. The top 10% wealthiest households, with a median household net worth of .2 million, proportionately own 3 times as much stock as the average family and 90% have retirement accounts. Therefore, the 57% crash in stocks impacted the top 10% to a greater extent, while the average family was most impacted by the 28% drop in home prices.

Despite the fact that the median net worth of the top 10% actual rose from .17 million in 2007 to .19 million in 2010 (while the bottom 80% saw their net worth decline by 36%) the losses in the stock market were intolerable to the banker predators and their captured government parasite politicians. All the “solutions” to the Wall Street induced financial debacle have been designed to benefit those who committed the crime and should have done the time. The singular design of those pulling the strings was to replenish the treasure chests on Wall Street, engineer a stock market rally to pump up the net worth and capital gain income for the 1%, and protect the vested interests of the financial elite. All the obscene criminally generated profits created during the boom were privatized into the grubby hands of the financial predators, while the subsequent gargantuan losses were socialized onto the backs of the American middle class taxpayers and future unborn generations.

TARP was rammed through the captured Congress by the oligarchs despite a 300 to 1 opposition from the public in order to protect obscenely wealthy bankers, stockholders and bondholders. The 0 billion of debt financed political pork, disguised as stimulus, was doled out to corporate contributors, union thugs, and a myriad of other special interests. Zero interest rates are specifically geared to generate billions of risk free profits for Wall Street and to force retirees to gamble their dwindling retirement funds in the rigged stock market. Bernanke and Paulson threatened the limp wristed pocket protector CPAs at the FASB into allowing Wall Street banks to make up the value of their loan portfolios in order to mislead the public regarding their insolvency. The tripling of the Federal Reserve balance sheet from 0 billion in September 2008 to .9 trillion today was done to remove the toxic assets from the balance sheets of the Too Big To Fail Wall Street cabal at 100 cents on the dollar. QE1, QE2, and Operation Twist have had the sole purpose of providing the “sophisticated” financial elite with the funds to pump into the stock market using their high frequency trading super computers.

The subsequent Federal Reserve contrived 100% increase in the S&P 500 has repaired the damaged balance sheets of the moneyed interests, while the average middle class family has sunk further into debt and despair. The powerful entrenched sociopathic marauder class cares not for the average middle class American. They can barely conceal their contempt and disgust for the masses as they blatantly flaunt their hegemony and supremacy over our decrepit decaying corrupted economic system. M. Ramsey King described the disgusting display last week:

“Jamie Dimon’s appearance before the Senate Banking Committee was a sickening display that clearly demonstrated that Congress has been thoroughly corrupted by Wall Street. Instead of grilling Dimon, Senators acted like overly affectionate puppies fighting each other for an opening to smooch their master.”

The destruction of the middle class has been methodical and systematic. The top 10% of earners had a median net worth of .19 million, or 192 times as much as the median wealth of ,200 of those in the bottom 20% in 2010. In 2007, the top 10% had 138 times as much wealth as the bottom 20%. In 2001, it was 106 times as much. With the continued rise in the stock market, declining real wages for the middle class, and further home price declines, the gap between the top 10% and the bottom 20% has continued to widen. The level of pain being experienced by the middle class has reached an unprecedented extreme. A few data points from David Rosenberg make that clear:

- Forty-six million Americans (one in seven) are on food stamps.

- One in seven is unemployed or underemployed.

- The percentage of those out of work defined as long-term unemployed is the highest (42%) since the Great Depression.

- 54% of college graduates younger than 25 are unemployed or underemployed.

- 47% of Americans receive some form of government assistance.

- Employment-to-population ratio for 25- to 54-year-olds is now 75.7%, lower than when the recession “ended” in June 2009.

- There are 7.7 million fewer full-time workers now than before the recession, and 3.3 million more part-time workers.

- Eight million people have left the labor force since the recession “ended” — adding those back in would put the unemployment rate at 12% instead of 8.2%.

- The number of unemployed looking for work for at least 27 weeks jumped 310,000 in May, the sharpest increase in a year.

I would add a few more data points to David’s list of woe:

- Over 7.5 million homes have been foreclosed upon by the Wall Street bankers since 2008.

- The National Debt has increased by .7 trillion (57% increase) since September 2008, while real GDP has risen by 5 billion (2.3% increase) since the 3rd quarter of 2008.

- Interest income paid to senior citizens and savers has declined by 0 billion (29% decline) since September of 2008 due to Ben Bernanke’s ZIRP.

- Government transfer payments have risen by 0 billion (32% increase) since September 2008, while private industry wages have risen by 0 billion (4.7% increase).

- The price of a gallon of gas has risen from .70 in December 2008 to .53 today.

- Food prices have risen by 7% to 10% since late 2008, even using the falsified BLS data. A true assessment by anyone who actually goes to a grocery store (not Bernanke – his maid does the shopping) would be a 10% to 20% increase.

The middle class has a gut feeling they are being screwed by somebody, they just can’t figure out who to blame. The ultra-wealthy elite keep up an endless cacophony of propaganda and misinformation designed to confuse an increasingly uneducated and willfully ignorant public while blurring the facts for those educated few capable of understanding the truth. They have been able to keep the masses dumbed down through government run education; distracted by sports, reality TV, Facebook, internet porn, and igadgets; lured by mass media messages of materialism; and shackled with the chains of debt used to acquire the goods sold by mega-corporations. We’ve become a society oppressed by a small faction of ultra-wealthy masters served by millions of impoverished, uneducated, sedated slaves. But the slaves are getting restless and angry. The illegally generated wealth disparity chasm is growing so large that even the ideologue talking head representatives of the elite are having difficulty spinning it. Even uneducated rubes understand when they are getting pissed on.

“Senator, don’t piss down my back and tell me it’s raining” – Fletcher – Outlaw Josey Wales

The situation is growing increasingly unstable and has left the country susceptible to an extreme outcome when this teetering tower of debt topples.

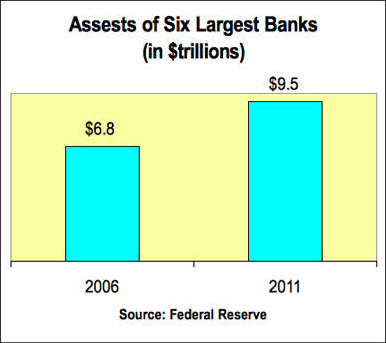

The moneyed interests have brilliantly pitted the middle class against the lower classes through their control of the media, academia, and the political system. They have cleverly blamed the victims for their own plight. They have convinced the general public that millions have lost their homes to foreclosure because they were careless, greedy and stupid. They blame the Community Reinvestment Act. They blame others for taking on too much debt when they were the issuers of the debt. The Wall Street moneyed interests created the fraud inducing mortgage products, employed the thousands of sleazy mortgage brokers, bullied appraisers into fraudulent appraisals, paid off rating agencies, bribed the regulators, bet against the derivatives they had sold to their clients, threatened to burn down the financial system unless Congress handed them 0 billion, and paid themselves billions in bonuses for a job well done. But, according to these greedy immoral bastards, the real problem in this country is the lazy good for nothing parasites on food stamps and collecting unemployment, who need to stop complaining and pick themselves up by their bootstraps and get a damn job. It’s a storyline used against Occupy Wall Street and anyone who questions their right to plunder what is left on the carcass of America. The vilest fraud in the history of man was perpetrated by these evil men and not one executive of these firms has been prosecuted. Obama, the champion of the little people, has proven to be nothing but a figurehead for the powers that be. Proof that the Wall Street syndicate is winning the war couldn’t be any clearer than the fact that the top six criminal banks now have 40% more of the nation’s assets in their vaults than they did before they burned down the economy.

The demonization of the victims continues, while the perpetrators prosper. The sociopaths appear to be winning; just as they seemed to be winning in the later stages of the Roman Empire.

“And we often fall into this bias on the prompting of con men and sociopaths of the predator class who use it to justify their own criminal actions and personal injustice. They are not burdened with empathy for their victims, and even delight in their misfortune. But they must find ways to make their actions more acceptable to society as a whole that normally does have such concerns for equity and justice.” – Jesse

“Are we like late Rome, infatuated with past glories, ruled by a complacent, greedy elite, and hopelessly powerless to respond to changing conditions?” – Camille Paglia

I think you know the answer to this question.

If you missed the first part of this series, CLICK HERE to read it.

Source: The Burning Platform