In this Edition

As with much of the euro area, the US is in a debt trap. All the politicking in DC does not change this economic fact. The federal debt is going to be devalued. Yet even now, amid a new economic slowdown, US consumer price inflation is set to remain positive following a large spike in global food prices. Few things damage economic confidence more than food price inflation. Combined with the escalating financial crises in the euro area and also now in US municipals, the global slowdown already underway is likely to accelerate, leading to a further deterioration of sovereign finances. The debt trap is deepening, with ominous consequences for monetary and price inflation. The dollar and most currencies remain severely overvalued; gold and most commodities, undervalued.

Guess What’s Coming to Dinner (Again)?

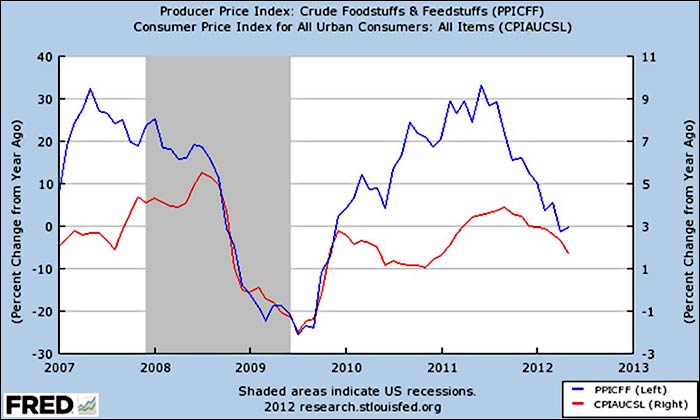

In October 2010, I wrote in the Amphora Report titled Guess What’s Coming to Dinner: Inflation! that sharply higher agricultural commodity prices were going to contribute to a rise in consumer prices in the coming months. Sure enough, there was a material rise in the US CPI and that of many other countries in the final months of 2010 and the first half of 2011. Both the 2007-08 and 2010-11 food price spikes and the subsequent rises in the headline rate of US CPI can be seen in the following chart:

Soaring Food Prices Led to Higher CPI in Late 2010 and 2011

Interestingly, the 2010-11 rise in the CPI occurred notwithstanding a modest decline in energy prices around the same time. The feed-through of energy prices into headline CPI is well-known and nearly coincident. So this period demonstrates that a sufficient rise in global food prices can overwhelm a modest decline in energy prices, if with a bit of a lag, and contribute to a material rise in the CPI.

In the chart below, we see how energy price inflation declined as the food price spike began to filter through into higher overall consumer price inflation:

Lower Energy Prices did not Fully Offset the Large Food Price Spike in 2010

As we know, in recent months, oil prices have fallen from around 0/bbl to . However, natural gas prices have risen from less than /MMbtu to over . The net result is a much smaller decline in wholesale energy price inflation than occurred in 2010. Turning to food, in recent months the price of soyabeans has risen by nearly 20%. Wheat and corn prices have risen by over 40%. The price of sugar has also risen, if only by about 12%.

Bringing these observations together and extrapolating into the future, we should be confident that the current food price spike is more than sufficient to contribute to a material rise in headline CPI in the coming months. There are also indirect and hugely underappreciated inflationary effects of higher global food prices. As I also wrote in the Amphora Report mentioned above:

[T]he food price shock in developing economies is going to add fuel to their inflationary fires. Amidst healthy economic growth and low unemployment, workers in these more dynamic economies are already pushing for higher wages, sometimes in the form of disruptive and occasionally even violent strikes. Rising wage demands will, at the margin, result in higher production costs generally. Some portion of these costs are likely to be absorbed into corporate profit margins but, naturally, some will be passed on to consumers in the form of higher prices. Also, keep in mind that these dynamic developing economies are precisely those which export all manner of consumer goods to the developed economies, notably the US.

In this way, the US and other developed economies are poised to import food price inflation not only directly, in the form of sharply higher food prices, but also indirectly, in the form of higher imported goods prices generally.[1]

If recent history is any guide, this analysis implies that the current downtrend in the CPI is unlikely to continue for long. Indeed, the ongoing, obvious fact of positive rates of CPI alongside the persistent deflationary pressures in the global economy provides accumulating evidence that artificially-generated inflation continues to overwhelm the naturally-occuring deflation, the net result being the dreaded ‘stagflation’ that Keynesian economists generally contend cannot happen.

But hold on a minute: Isn’t inflation “always and everywhere a monetary phenomenon”, as Milton Friedman and Henry Hazlitt reminded the economic mainstream in the 1960s? Aren’t we putting the price cart in front of the monetary horse here? Well, yes we are. The key reason why the natural deflation pressure mentioned above fails to result in consumer price deflation is the ongoing creation of money by central banks and the government deficits that they de facto monetise. Looking at the US, it is clear that money growth remains robust and the federal deficit, already huge in a historical comparision, will only increase with the economic slowdown.

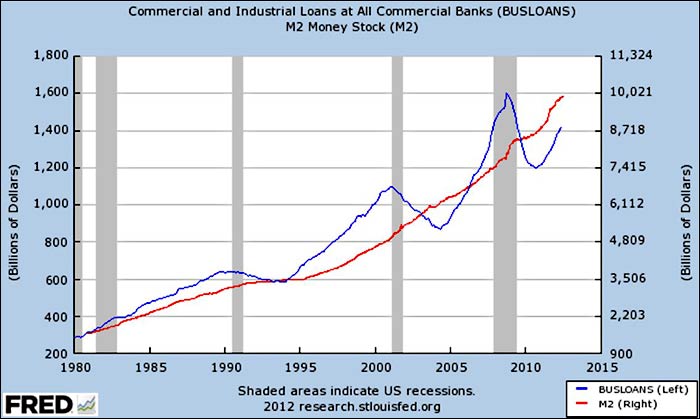

As Broad Money Growth Increases, Credit Reflation Continues Alongside

Looking at the chart above an exponential trend is clearly visible. Note also that the volatility of the credit cycle is growing. Ever more base money is required to create broad money/credit which is in turn required to create nominal GDP growth which is required to generate real GDP growth.

Unfortunately for the Fed and other economic policymakers, by the time you get to the last link in this chain—real GDP growth—the economic effect of the new money/credit has become so diluted that little real growth is achieved in exchange for incurring an exponentially rising debt burden.

A look at the failure of ‘austerity’ to reduce deficits in the euro-area provides an apposite example. While on paper tax increases can reduce deficits, in practice, when economies are already overindebted and the general regulatory burden is large, tax increases tend not to make much difference. Indeed, they can make the fiscal situation worse. Those contemplating the US ‘fiscal cliff’ should take note.

Welcome to the Debt Trap

The US is in a debt trap, plain and simple.[2] Yet policymakers refuse to talk about it because to admit that it is a debt trap is to admit policy failure. After all, it is rather difficult to blame a government debt trap on ‘free-markets’. (Not that free markets had much to do with the world’s most regulated industry—finance and banking—blowing itself up in 2008. No, such colossal blowups require vast amounts of government intervention.)

That said, the US is not in the same debt trap as much of the euro-area because its debts can be systematically devalued through monetisation by the national central bank. In the euro-area, this requires some degree of consensus, and the interests of all members are not congruent. Hence the constant back-and-forth between those who want to be bailed out of their debt traps, and those who are being called upon to do the bailing.

The US has no such monetary straightjacket, or any fiscal straightjacket for that matter. President v Congress, Republicans v Democrats, left v right: If there is anything the post-WWII history of US monetary and fiscal policy should teach us, it should be that when it comes to growing the money supply and the federal debt, Washington DC is run by a single branch of government, a single party and a single point on the left-right spectrum. And this branch, the party that controls it and its political orientation is not something that changes with elections. It is a national political pathology.

But remember, the US debt is denominated in dollars. The Fed can assume a growing portion of the debt with incremental monetisation (QE3, 4 … X) and, Vóila! the debt can be devalued to whatever level that branch, that party, deems desirable. While this might imply that government salaries are also being devalued along with the debt, no matter, they can just vote themselves more of those periodic salary increases and all will be well in DC and also some rather nice Virginia and Maryland suburbs.

Those not in a position to vote themselves pay rises should consider buying some gold instead. Diluting dollars are not a store of value. Gold is.

Resources

[1] Guess What’s Coming to Dinner: Inflation! Amphora Report vol 1 (October 2010). The link is here.

[2] For a more detailed discussion of what constitutes a debt trap and how the US has fallen into one, see Reinhart and Rogoff, This Time is Different. Or, for a more contemporary discussion courtesy of a Paul Krugman v Ron Paul debate, see The Invisible Red Line, Amphora Report vol 3 (May 2012). The link to the latter is here.

Find THE GOLDEN REVOLUTION ON Amazon HERE.

"John Butler provides much illuminating detail on how the world′s monetary system got into its present mess. And if you′re wondering what comes next, this is the book to read."

—Bill Bonner, author of the New York Times bestsellers Empire of Debt, Financial Reckoning Day, and Mobs, Messiahs and Markets

"John Butler has written an indispensable reference on the subject of gold as money. His book is a combination of history, analysis, and economics that the reader will find useful in understanding the use and misuse of gold standards over the past century. He breaks the book into a long series of essays on particular aspects of gold that the reader can take as a whole or in small bites. It is technical yet accessible at the same time. The Golden Revolution is a useful and timely contribution to the growing literature on gold and gold standards in monetary systems. I highly recommend it."

—James Rickards, author of the New York Times bestseller Currency Wars: The Making of the Next Global Crisis

"In The Golden Revolution, John Butler makes a powerful case for a return to the gold standard and offers a plausible path for our nation to get there. Enlightened investors who blaze the trail will likely reap the greatest reward. For those still wandering in the dark, this book provides necessary light to keep you headed in the right direction."

—Peter Schiff, CEO, Euro Pacific Precious Metals; host of The Peter Schiff Show; and author of The Real Crash: America′s Coming Bankruptcy—How to Save Yourself and Your Country

"John Butler′s historical treasure trove empowers the reader to understand, prepare, and act. To have a chance to emerge unscathed from financial turmoil, join the Golden Revolution. I have."

—Axel Merk, Merk Funds; author of Sustainable Wealth

"The Golden Revolution is another indispensable step on the road map back to sound money. John Butler′s experience of the modern ′fiat′ banking world, combined with his understanding of the virtues of a disciplined monetary system, allow for genuine insight into the practical steps that could, and surely will, be taken to reestablish gold as money."

—Ned Naylor–Leyland, Investment Director MCSI, Cheviot Asset Management

"Ex scientia pecuniae libertas (out of knowledge of money comes freedom).John has used his exemplary knowledge of money to lay out a cogent framework for the transition of society based on fiat money to a more honest society forged by gold. He has taken complexity and given us simplicity. Monetary economics and its interrelationship with geopolitics, finance and society is extraordinarily complex, but he has managed to assimilate a vast array of information and distill it in a simple and thoughtful framework. That is an art many academic writers never achieve."

—Ben Davies, cofounder and CEO, Hinde Capital

Source: Amphora Report