Euro

We start with a look at the Euro which is bouncing from an important turning point. For those unfamiliar with the Danielcode time and price methodology, there are a host of articles available in my Financial Sense archive and under the ‘Articles’ tab at www.thedanielcode.com. Briefly, we expect markets to turn when time and price are squared, and whilst price is always the final arbiter, the DC time charts create valuable clues and sometimes insights:

The Euro has a habit of using the 62 and 70 DC time cycles for major turns. This is a 6 day chart so turns at this level tend to be meaningful. Right now, Euro has found a DC retracement at 1.2666 and is bouncing from its “Heathen” 70 cycle.

S&P

This vital market has been holding up strongly through the litany of bad news from Europe. In the previous edition (under the ‘Trading Reports’ tab at the Danielcode website) I reviewed this market against a number of European and Asian markets and concluded on 12/01/11 that this market had made a normal correction and there was “No hint of Armageddon in this chart”. Indeed our advice that S&P was already in an upward trending trade channel was good for almost 100 points for longer term traders.

The retracement to the DC 59% ratio kept the trend up and contradicts the bearish bias much loved by the permabears. A better understanding of this market can be gauged by stepping back to the 12 day chart below:

This chart made its May high right at the dominant 59 ‘week’ (6 trading days makes a DC week) time cycle and tested the 2nd iteration of its DC trading channel last October. Normal market behaviour is for S&P to try and regain its median. If this trend continues then it will arrive at the DC Black line at 1476.07 in mid-September, which will set up President Obama’s re-election bid in November to a nicety.

T Bonds

US T Bonds continue their amazing levitation act at 2 standard deviations from the mean of its trading channel. Historic low interest rates combined with unlimited liquidity, coupled with the Fed’s specific recognition that the Russell Index is a prime measure of the success or otherwise of its policies, gives you a good insight into why Presidential election years exhibit a strong upwards bias in US Equity markets.

I suspect that there is little to no upside in the following chart.

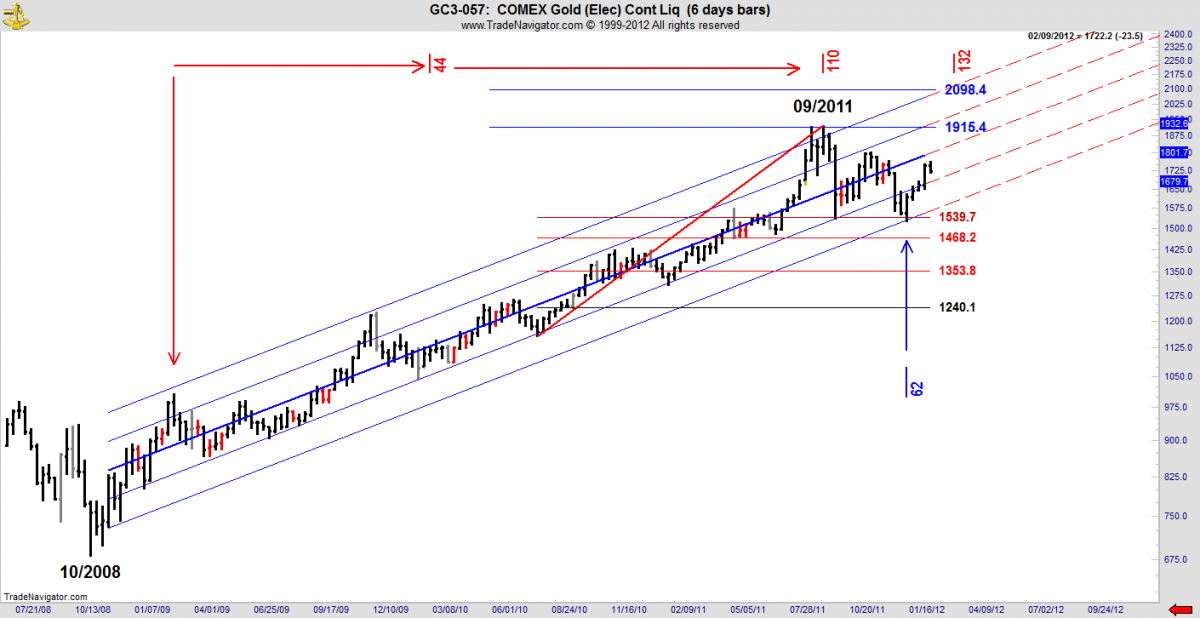

Gold

Gold fever is much abated of late as it made its 2011 high in September and corrected 50% of its operating range. This market got very overbought into its recent high as evidenced by its parabolic climb to 2 standard deviations from the mean of its DC trading channel. Newton’s Laws teach us that an equal and opposite reaction is a norm for all objects in motion, and indeed, a correction to 2SDs down is a natural course for markets to make having hit the opposite high. The correction held at 50% of the operating range and all of this tends to the view that what we have seen is just a normal correction.

But I suspect that there is more afoot here as gold has changed its nature with the sell off and its habitual joie de vivre and traditional elan are missing.

In fact we are seeing a sea change in market sentiment, almost as if the Christmas break administered a large dose of stay calm medicine. Bad news is now good news and good news is even better. The European debt crisis is wholly discounted by equity markets as the ECB, with a new Italian President, has opened the cheap loans spigot with carefree abandonment of tough collateral requirements.

Indeed Mario Draghi the new ECB president seems to have been inoculated with the Bernanke “Whatever it Takes” doctrine as central bank largess in US, UK and Europe reaches new heights every day, apparently with zero impact at least on official inflation numbers, and no exit plan in sight. One suspects that there is no such plan. Just the imperative of postponing the inevitable.

As savers already know, you are the first of the sacrificial lambs as prudence is despised whilst ever more plans to support impoverished mortgagors are rolled out in US, a path that will no doubt be followed in the equally blighted property markets of Spain, Ireland, Portugal and the still to come thrill of a housing implosion in UK.

Down Under

Meanwhile, housing Down Under continues to set new records of price to income in complete denial of any concept of mean reversion. I have some interest in Australia’s Gold Coast property market in sunny Queensland which may be described as Queensland’s Miami. This week saw a traditionally huge property auction at the 5 star Palazzo Versace Hotel. Friday evening was described as the Classic Mansions Sale and I duly noted the results of the 9 selected mega mansions in the local paper, which recorded a huge crowd in keeping with the apparent entertainment appeal of seeing how the super rich live, but no bids on any of the offerings.

Interestingly the article was removed the next day, no doubt in keeping with media understanding that property ads remain a staple of the print media and nothing must be done to spook the punters.

Following the nasty rumour that Australian banks had set a 70% LTV on the Gold Coast market, at least at the higher end, I surmised that as property prices are a direct function of bank’s risk appetite (gullibility?), the higher end of the market was in for a nasty jolt, and so it transpired the next day with must sell foreclosures setting the pace with a 50% plus write down on luxury apartments and for those houses that did sell, euphemistically touted as “Beat the Bank” opportunities, realising substantial losses on their previous 2003-2006 sale prices, to apparently set pre 2003 prices as those now realisable for those who must sell.

Incredibly, but not surprisingly, the selling agents touted this hugely promoted calendar event as a great success, and no doubt it was for those collecting comm, but little joy for vendors and banks. For those in US, please be aware that jingle mail is a peculiarly American concept. Elsewhere, mortgagors personally guarantee their loan and foreclosure is followed by nasty legal enforcement against the person, which is why deleveraging in the Down Under markets will be slow steady and sternly resisted at every step.

In fairness it should be noted that whilst the Gold Coast/Surfers Paradise is now Australia’s 6th largest city, it is primarily a holiday destination, and as such does not benefit from endless urban growth by relocation and immigration that graces the major cities, but the cracks are showing. To complete my evaluation of this great debacle I patiently scrolled through 268 comments from Bulletin readers, who unanimously condemned auctions as a selling method and in particular focused ther ire on the selling agents who were accused of wholesale greed, rapine and worse for the Gold Coast property market. Interestingly, I could not find one comment that acknowledged that a shift in the wind was afoot.

Indeed there are none so blind as those who will not see!

On a personal note, I'd like to announce that Danielcode has entered its 4th year with Financial Sense and I wish you all a happy and prosperous 2012. I record my thanks to Adam, Mary and all of the Puplava family who so graciously launched this innovative and different look at markets in this great publication on December 27, 2007.

John Needham