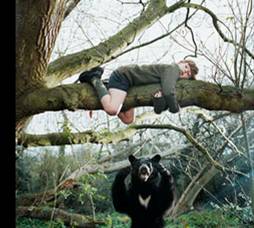

With Fed chief Bernanke trumpeting that the credit crisis is abating, a postscript to his promise that "the subprime problem is contained", and asserting that the US will not see recession, punters are feeling warm and fuzzy about US markets and apart from an occasional frown about gasoline prices, generally the thrust is that the worst is over. If you are in that camp you may have to think again. As our theme photo shows, tree climbing skills come in handy when bears are on the loose.

A report from the Bank of International Settlements (BIS) carried in this week's Banking Times drawn to my attention by Danielcode member Rob H has a very different view on what is coming down the track. This august body are not known for inflammatory stories or "look at me" blogger posturing. By nature (Swiss) it is inherently conservative. As its customers are central banks and international organisations, the BIS does not accept deposits from, or provide financial services to private individuals or corporate entities so we can assume that uniquely amongst banks it is likely to be unbiased and we can put some weight on its publicly voiced concerns.

Central bank body warns of Great Depression- The Bank for International Settlements (BIS), the organisation that fosters cooperation between central banks, has warned that the credit crisis could lead world economies into a crash on a scale not seen since the 1930s. In its latest quarterly report, the body points out that the Great Depression of the 1930s was not foreseen and that commentators on the financial turmoil, instigated by the US sub-prime mortgage crisis, may not have grasped the level of exposure that lies at its heart.

According to the BIS, complex credit instruments, a strong appetite for risk, rising levels of household debt and long-term imbalances in the world currency system, all form part of the loose monetarist policy that could result in another Great Depression. It also raises concerns about the Chinese economy and questions whether China may be repeating mistakes made by Japan, with its so called bubble economy of the late 1980s.

Levels of Pain

Of interest to impartial observers is how fragile sentiment is to relatively minor economic reverses. In US the Fed cannot bear the specter of a normally correcting market. The Bear Stearns fiasco is stark proof that the free enterprise system has effectively been abandoned at least for those privileged bodies under the wing of the Fed. Absent market discipline there is no risk and therefore no rigor. It is precisely because the capitalist system vents its fury on market failures that lessons are well learned.

Long before the Bear Stearns blow up, the Fed was propping up US markets. The over inflated and quite unrealistic valuations on public corporations must be preserved, at whatever cost apparently. This disease has now spread to UK where with minimal drops in housing prices the tabloids are screaming over the catastrophic effects on those who have abandoned savings in favour of more intensive property investments. On UK markets, Bloomberg reported today that

"The U.K. will demand disclosure of short selling in rights offerings and may restrict investors from borrowing the stocks after plunging share prices hampered banks' attempts to increase capital. The Financial Services Authority will impose the requirements June 20. They follow a slump in Royal Bank of Scotland Group Plc and HBOS Plc as they tried to raise 16 billion pounds ( billion) of capital by selling new shares. Britain, regarded as the most open of the world's financial centers, becomes the first major market in Europe to put limits on short-selling."

What the UK authority is really doing is joining its American cousins in seeking to short circuit price discovery to the downside, a normal function and safety valve of markets.

A steadfast refusal to accept market truths is the common thread. In tiny New Zealand the last sane banker in the western world, NZ Reserve Bank Governor Bollard stated "In real terms, we are projecting a 22 per cent fall in New Zealand (sic house prices). This compares to a 38 per cent fall in New Zealand real house prices following the first oil price shock in the 1970s," Nobody is listening.

In Europe ECB President Claude Trichet is acting with teutonic stoicism which shows the benefits of pan European pretense since Trichet is actually a French bureaucrat. Totally overwhelmed by the competing demands of the sick men of Europe, Trichet is reduced to an impotent bystander. UK Telegraph's Ambrose Evans-Pritchard has a different view:

ECB chief Jean-Claude Trichet has "signalled" a rate rise in July to combat 3.6pc inflation, much to the fury of Paris, Madrid, Rome, Lisbon and Dublin. It is a perilous path for Europe's monetary union."I would advise Mr Trichet to be more careful in his comments," said Spain's premier Jose Luis Zapatero. The counter-attack has begun. Spain's property crash is calamitous. House prices have tumbled 15pc since September, say the developers (APCE). Over 98pc of Spanish mortgages are on floating rates, priced off three-month Euribor. This rate leapt 32 basis points to 5.24pc after Mr Trichet opened his mouth. The ECB demarche is ominous for the rest of us as well. We may be watching a replay of the Bundesbank's ill-judged rate rise in October 1987, which sent the dollar into a tailspin and triggered the Black Monday crash.

The ECB official rate is 4% and has been unchanged for 12 months. They are no more going to take their medicine willingly than are US, Australia and a host of others with plenty of worse offenders in Asia. Denial to the end has become central bank policy de jure!

Parsing the Dollar

As the Dollar rally continues with the dollar headed for its biggest weekly gain in more than three years against the euro it is timely to review the larger picture. Recall that in February the Danielcode report issued a call for at least an intermediate bottom in the Dollar at 70.40. DX obliged by making its low for the year just 30 ticks away at 70.70. Given that we have demonstrated some insights into this market by accurately predicting the March low at a time that others were screaming for a meltdown, it is now timely to reflect on what those insights reveal. The chart below is the Danielcode monthly chart of DX:

The structure around the July 2001 high has created the current Daniel number sequence controlling this market. This sequence is shown in dark blue. So far we have seen price fall to four of these levels and every DC price level has elicited a reaction from the market. At 103 we got a three month rally that advanced 6.5 points. At 92 we got a another three month rally that advanced 7.5 points. At 81, the end of the first leg down we got an eleven month rally of 12.5 points.

The best interpretation of current price action is that we are in a small cycle rally that will last approximately three months and advance about 6 or 7 points. From the March low we are already into the third month and have advanced just 4 points so the clock is now ticking. Corrections are at best a three pronged affair. The first leg ran 41 months from July 2001 to December 2004. The second leg down began in November 2005 and ran 28 months into the March 2008 low.

On a time versus price basis the current rally is the weakest since the devaluation of the Dollar started in 2001. It bodes ill for the future of this market. A common pattern in markets is equality of range and time. This, the most likely outlook for DX puts the next leg at 48.66 to 52.79 a fractal of the old bull market and equality of time puts the next low at April 2009. The downward velocity that this outlook implies is quite staggering and implies an accelerated recognition of structural damage in international markets.

A DX move of this magnitude is unimaginable unless you are counting on seeing a re-run of the Great Depression of the1930s. Impossible you say? This scenario is exactly what the BIS is warning about!

International Markets

Absent the usual media hysteria, markets are doing exactly what they should as they reluctantly acknowledge the liquidity jet that has driven them to ridiculous valuations, egged on as always by those who benefit from these transactions. If regulators had been as concerned about stocks being bought on margin as they now are about short selling obviously impaired assets I guess we wouldn't be seeing the current unraveling. But then where would the fun be!

Here are the most important:

Hong Kong’s Hang Seng Index

China's Shanghai Composite. You need to see this on a monthly chart to appreciate the magnitude of recent moves.

London’s FTSE

India’s NIFTY 50 Index

Corn is trying to reverse from its weekly Danielcode target

Australia’s SPI 200

US Markets

Dow Jones Index- right at two degrees of Daniel sequence support.

S&P 500-following its DC numbers as usual. There are two degrees of DC support at the current low which are not readily apparent on this chart..

US T Bonds-nice one way trade from its 115^13 rally.

If you noticed that every market whether in US or international is observing its Daniel number sequence you should ask "how is this so?" All of the Daniel number sequences are available to subscribers at the Danielcode Online. Future DC numbers not yet used by the various markets have been removed in deference to my subscribers throughout this article. S&P, DJ and other CME indices are at contract rollover, a common time for a change in trend or definitive market move. More importantly, they are all at their DC numbers.

Gold

No Financial Sense article would be complete without a look at the Gold market. It has not featured prominently in my recent articles as it is presently biding its time whilst it determines whether the Armageddon scenario cautioned by the BIS will transpire or whether Bernanke et al really are masters of the universe and can conjure markets at their whim.

In NN Taleb's new book "The Black Swans," his definition of a black swan is a large-impact, hard-to-predict, and rare event beyond the realm of normal expectations. Taleb regards many scientific discoveries as black swans-undirected and unpredicted and applies this thought to markets. The term black swan comes from the ancient Western concept that "All swans are white." In that context, a black swan was a metaphor for something that could not exist. The 17th Century discovery of black swans in Australia morphed the term to connote that the perceived impossibility actually came to pass.

Taleb claims that almost all consequential events in history come from the unexpected, while humans convince themselves that these events are explainable in hindsight. Beautiful Lake Taupo in New Zealand's North Island where I spend much of the year is a collapsed volcanic cone that over the millennia has become a huge fresh water lake. On Lake Taupo, virtually at my front door, there are black swans. Hundreds of them, and nothing but black swans. And trout! Nary a white swan has ever been sighted, which might explain why I am so predisposed to black swan or "fat tail" events. I see them every day.

For Gold, the BIS scenario holds promise of a true moon shot if this black swan event transpires. Whatever the probabilities, Gold does not see them now as it works on a corrective pattern that is so far straight out of the text book:

As it has all year, Gold continues to make almost every turn on the daily chart at its DC numbers while punters assess if the correction will go deeper or if the markets' black swan will soon swim into sight. If it does your only alternative to Gold will be to run for the trees!

As it has all year, Gold continues to make almost every turn on the daily chart at its DC numbers while punters assess if the correction will go deeper or if the markets' black swan will soon swim into sight. If it does your only alternative to Gold will be to run for the trees!

I invite you to visit the Danielcode Online to get all the Daniel numbers for the extensive markets I cover. You will never be surprised by market behavior again.

Copyright © 2008 John Needham