We’re all sitting on the edge of the chair waiting for word from the Fed and then waiting a bit more to hear from Bernanke. I’m of the opinion that this is all being orchestrated. The questions to be asked at the press conference have been sanitized, Bernanke has seen what questions that will be posed in advance.

The hardest questions for Bernanke to answer will be on the issues of Fed Policy and it’s implications to core inflation. The Fed has said repeatedly that they don’t care about headline price increase. But the problem is that the headlines are about to kill the economy (again). How much more do gas prices have to rise before it triggers another downward leg? My answer to that is, "not very far at all".

The WSJ had an article this morning by my favorite guy, Jon Hilsenrath. Jon teed up the question of headline versus core inflation in this piece (link).

Jon looks at inflation expectations based on the five-year TIPS spread and five-year coupon bonds. This is his conclusion based on the information presented:

It’s not an alarming rise and the latest downward drift should comfort some officials. Over a longer stretch of time, it doesn’t like much of a big move.

Jon does his best to minimize the inflation debate with these quotes from Janet Yellen:

Information derived from the Treasury inflation-protected securities (TIPS) market also suggests that financial market participants’ longer-term inflation expectations remain well anchored.

Much of the increase in five-year inflation compensation….. appears consistent with a normal cyclical recovery after adjusting for those effects.

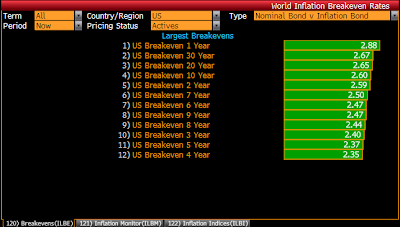

Both the Fed and the WSJ are using market-based data to make a point. Inflationary expectations are tame in their view. But what numbers do they use to draw this important conclusion? The answer is they chose the most favorable comparison. Looking only at the five-year implied inflation give the most favorable outcome. Consider this chart:

I’m nit-picking here. But I think this is an indication of what we will hear from the Chairman later today. I’m betting that he attempts to blunt the inflation story. He will use the same analysis that the WSJ used this AM.

I call this a “double spin”. The Fed and the WSJ are teaming up to manage the news and to frame the debate. Look for Jon Hilsenrath to ask Bernanke a question on inflation expectations and expect Bernanke to answer using only the five-year data. If that should happen, it will be the confirmation of the collusion between the Fed and the WSJ.