The Federal Reserve meeting for December came with few real surprises. The two important actions that were eyed by the financial markets were the pledge to continue artificially suppressing interest rates and the extension of monetary actions. Both of these goals were met.

While the Fed had already entered into a third Large Scale Asset Purchase program (QE 3) in September, which purchases $40 billion each month in mortgage related securities, they also announced of an additional program (QE 4) to replace the expiring "Operation Twist." Unlike "Operation Twist" which used maturing securities to purchase new holdings - the new program will be an outright monetization program of $45 billion each month of Treasury bond purchases. This will bring the total purchases of fixed income securities by the Fed each month to $85 billion.

However, the Fed did make a very significant change in its policy stance in December by implementing the "Evans Rule" and linking their monetary policy actions to specific economic targets. From the Fed's release:

"To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee views these thresholds as consistent with its earlier date-based guidance. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent."

The problem, of course, with setting specific targets for employment and inflation, in terms of monetary policy actions, is that reported levels of employment and inflation can be materially different than real employment levels and inflation.

However, what was overlooked by much of the media was the release of the Fed's economic outlook and forecasts. In past articles I have discussed the problems with these forecasts (see here and here) and why they are not an accurate prediction of what the Fed really thinks. To wit:

"The problem for the Federal Reserve is that they face a severe challenge, when communicating to financial markets and media, which is the creation of a self-fulfilling prophecy. Imagine that following an FOMC meeting Bernanke stated: "The policies and actions that we have implemented to date have done little to curb economic weakness. The economy is in much worse shape that we have previously communicated as the transmission system of Fed policy through the economy, and the financial markets, is obviously broken."

The immediate reaction to such a statement would be a complete meltdown of the financial markets. Such a decline in the financial markets would negatively impact consumer confidence which would subsequently throw the economy into a recession. Therefore, communication from the Federal Reserve must be very guided in its approach - not too hot or cold. This"goldilocks" approach works to create a "glide path" to the Fed's destination while giving the financial markets and economy time to adjust to the incremental adjustments to forecasts. Therefore, when the media reporters grab onto a sound byte that the 'next year is going to very good' it should be taken within the context of the trend of the economic data and what is driving it."

The Fed has been slowly guiding economic forecasts lower since 2011. The reality is that the long range forecast of 2.6% economic growth is not a boon of economic prosperity, corporate profitability, increasing incomes or a secular bull market."

With the most recent meeting of the Federal Reserve came the quarterly release of the Fed's economic projections we can update our tables and charts.

Economy

When it comes to the economy the Fed has consistently overstated economic strength. Take a look at the chart and table. In January of 2011 the Fed was predicting GDP growth for 2011 at 3.7%. Actual real GDP (inflation adjusted) was 1.6% or a negative 56% difference. The estimate at that time for 2012 was almost 4% versus 1.8% currently.

We have been stating repeatedly over the last 2 years that we are in for a low growth economy due to the debt deleveraging, deficits and continued fiscal and monetary policies that are retardants for economic prosperity. The simple fact is that when an economy requires nearly of debt to provide of economic growth the engine of prosperity is broken.

As of the latest Fed meeting the forecast for 2013 and 2014 economic growth has been revised down as the realization of a slow-growth economy has been recognized. However, the current annualized trend of GDP suggests growth rates in the next two years that will roughly be half of the Fed's current estimates of 2.6% and 3.4%. As we have stated over the past year - a recession in 2013 remains a strong likelihood given the current annualized trend of economic growth since 2000. A recession followed by a rebound in 2014 would leave economic growth running at annual rate close to 1%-1.5% versus the current estimate of 3.35%. In other words, like with all other Fed forecasts, these numbers will be revised down.

What is very important is the long run outlook of 2.6% economic growth. That rate of growth is not strong enough to achieve the "escape velocity" required to substantially improve the level of incomes and employment that were enjoyed in previous decades.

Unemployment

With the Fed's new goal of targeting a specific unemployment level to monetary policy could potentially put the Fed into a box. Currently, the Fed sees 2014 unemployment falling to 6.75% and ultimately returning to a 5.5% "full employment" rate in the long run. The issue with this full employment prediction really becomes what the definition of reality is.

Today, average Americans have begun to question the credibility of the BLS employment reports. Even Congress has made an inquiry into the data collection and analysis methods used to determine employment reports. Since the end of the last recession employment has improved modestly but has mostly been centered around temporary and lower paying positions. More importantly, where the Fed is concerned, has been the drop in unemployment rate due to a shrinkage of the labor pool rather than an increase in employment.

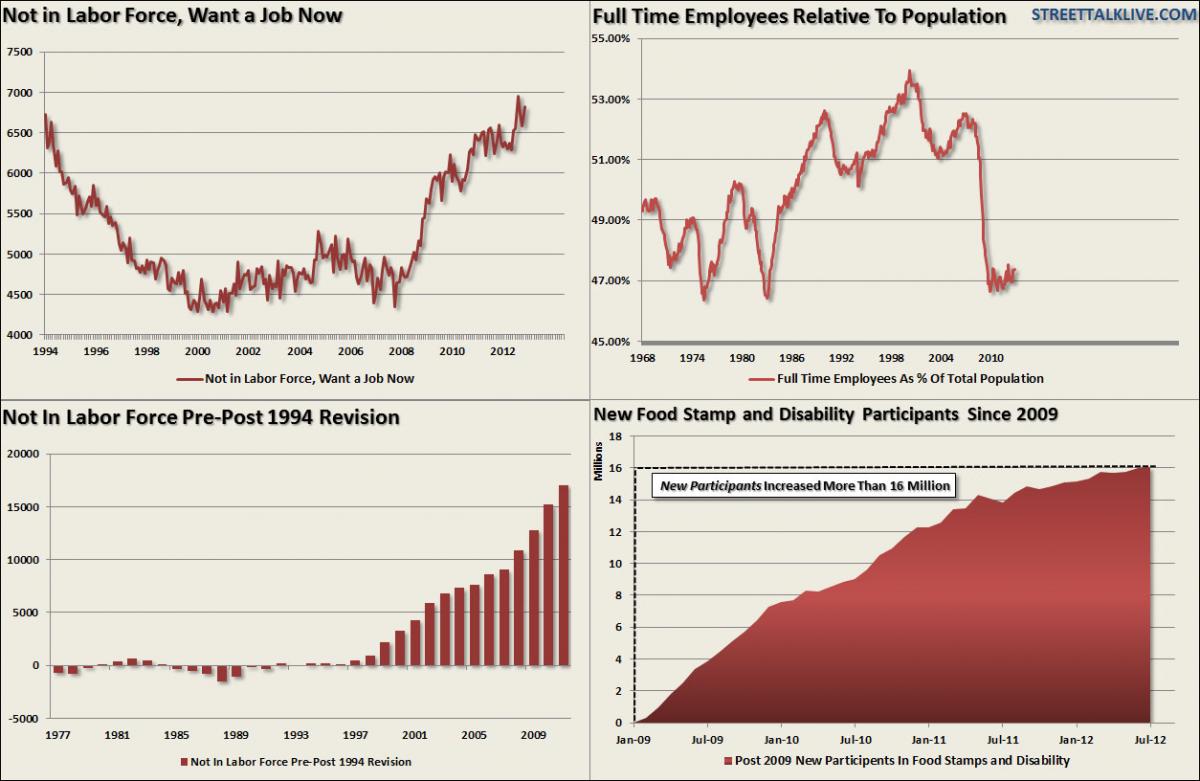

The problem that the Fed will eventually face, with respect to their monetary policy decisions, is that effectively the economy could be running at "full rates" of employment but with a very large pool of individuals excluded from the labor force. The chart below shows three levels of unemployment.

The U-3 level of unemployment is what the BLS reports as the "official" unemployment rate. The U-6 rate includes all those in the U-3 report plus those working part-time for economic reasons. The "real unemployment" rate simply adds those that have been unemployed longer than 52-weeks to the U-6 rate. This was originally considered the U-7 rate during the Clinton Administration before it was eliminated to improve the unemployment statistics for political reasons.

The problem for the Fed is that while the U-3 rate has fallen in recent months other unemployment measures have not. This is shown in the 4-panel chart below:

More importantly, this large and available labor pool will continue to compete for the available employment which will suppress wages, and ultimately, consumption. The chart below shows the annual change in average hourly earnings which has shown no recovery since the end of the last recession unlike what was seen previously.

Importantly, while the Fed could very well achieve its goal of fostering a "full employment" rate of 6.5% - it certainly does not mean that 93.5% of working age Americans will be gainfully employed. It could well be a victory in name only.

Inflation

When it comes to inflation, and the Fed's outlook, the debate comes down to what type of inflation are you actually talking about. The table and chart below show the actual versus projected levels of inflation.

The Fed significantly underestimated official rates of inflation in 2011. However, in 2012 their projections and reality have come much more aligned. For the average American the inflation story is entirely different. Reported inflation has little meaning to the avearge consumer as the real cost of living has risen sharply in recent years. Whether it has been the cost of health insurance, school tuition, food, gas or energy - these everyday costs have continued to rise substantially faster than their incomes. This is why personal savings rates continue to fall as incomes remain stagnant or weaken. It is the rising "cost of living" that is weighing on the American psyche. The chart below shows the impact of rising food and energy costs as a percentage of disposable personal incomes on the consumer's ability to save.

This is what the average American sees as inflation. However, with current deflationary pressures pulling headline inflation down from 3%, at the beginning of this year, to 1.7% currently the Fed's prediction appears to be fairly accurate. The question, however, is how long can inflation remain suppressed at or below 2% which is the long run prediction of the Fed? More importantly, where the consumer is really concerned, will it even matter?

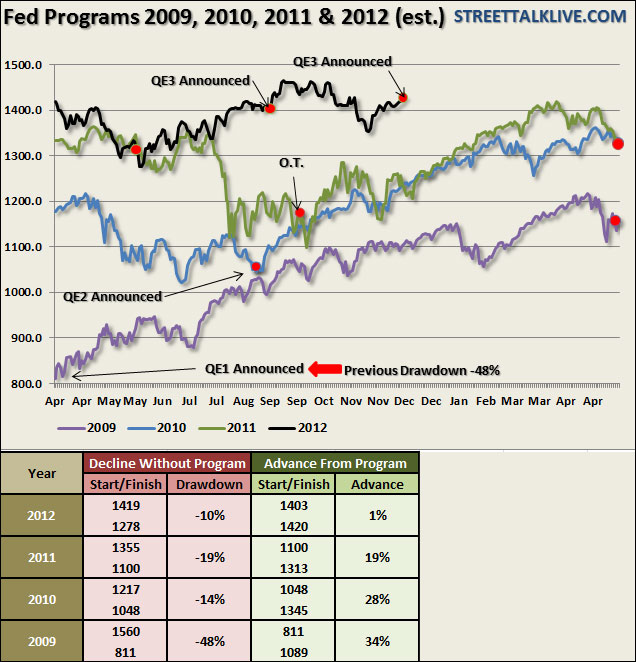

The Diminishing Effects Of QE

With the Fed embarking on its fourth Large Scale Asset Purchase program (Quantitative Easing or Q.E.), and deploying specific performance targets, the question of effectiveness looms large. Bernanke has been quite vocal in his testimonies over the last year that monetary stimulus is not a panacea. It is up to Congress to enact fiscal programs to turn the economic "titanic" away from the iceberg of debt and back onto a safe course to economic stability. That plea has fallen upon deaf ears.

With the Fed now fully engaged, and few if any policy tools left, the effectiveness of continued artificial stimulation is clearly waning. Lower mortgages rates, interest rates and excess liquidity served well in priming the pumps of the real estate and financial markets when valuations were extremely depressed. However, four years and four programs later, stock valuations are no longer low, earnings are no longer depressed and the majority of real estate related actvity has likely been completed.

It is for this reason that the returns from each subsequent program have diminished. The reality is that Fed may have finally found the limits of their effectiveness as earnings growth slows, economic data weakens and real unemployment remains high.

Reminiscent of the choices of Goldilocks - it is likelty the Fed's estimates for economic growth in 2013 is to hot, employment is too cold and inflation estimates may be just about right. The real unspoken concern is the continued threat of deflation and the next recession.

One thing is for certain; the Fed faces an uphill battle from here.

Source: Street Talk Live