A couple of days ago Cullen Roche at Pragmatic Capitalist, a daily must read site, posted a very interesting piece on hyperinflation stating:

"The latest reading from the Billion Prices Project clearly confirms the latest CPI readings from the government. This index appears to debunk many of the known conspiracy theories about the government’s inflation data. The latest reading of just over 2% confirms much of what Ben Bernanke has been saying over the last year – that inflation would prove transitory."

Cullen is very correct. Hyper-inflation is not a threat. Hyper-inflation comes from a complete loss of faith in a currency from the threat of losing a war (Weimer Republic), an economic collapse or some other catastrophic event. The U.S., even with all of our economic ills and woes, is still the safest place, in terms of liquidity, depth and strength, to store excess reserves. The near historic low yield on government treasuries tell the story here. However, inflationary worries continue to grab daily headlines as gasoline approaches $4 per gallon.

What is important is whether or not inflationary pressures, regardless of where they come from, have reached levels that could impact economic growth. While we are seeing commodity based inflation, primarily in food and energy, is that alone enough to offset the deflationary pressures we see in many other areas such as service businesses and retail? We see direct evidence of this deflation in the number of retailers that have resorted to deep discounting and continuous promotions in order to attract buyers. Consumers, likewise, have moved down the scale as to where they shop from high end retailers to dollar stores (even Wal-Mart is now too pricey for many) as frugality has become a new American mantra. The deflationary pressures from the decline in housing also impacts many other areas of the economy as well. yet

In my view there are three components which really drive inflation - the velocity of money, wages and commodity prices.

The Velocity of Money

Also called the "velocity of circulation" it is the average frequency with which a unit of money is spent on new goods and services produced domestically in a specific period of time. Velocity has to do with the amount of economic activity associated with a given money supply.

What this chart shows is exactly what we have known for quite some time - money is not flowing through the system. While there are many criticisms over the validity of the velocity of money measure - the use here is much more simplistic as a representation of demand. In order for prices, across the entire spectrum, to rise there has to be more demand than there is supply. If the velocity of money is increasing then the "demand" in the system is rising thereby allowing producers to raise prices. The problem of pricing is not something that just occurred recently. If you think back to 2001 auto companies were offering "employee discounts" and "zero percent financing" to move automobiles. For more than just the last couple of years "Black Friday" has continually been inched back and now starts on Thursday so that retailers can make their numbers. The decline in "activity" has been slowly creeping through the system since the beginning of the century and now we are back to levels not seen since 1963.

Wage Inflation

Secondly, in order to have higher levels of inflation you need wages to be rising. As wages rise individuals are able to consume more increasing aggregate demand which will lead to higher prices. Unfortunately, wage and salary disbursements, on a year over year basis, have been on the decline since 1980 commensurate with the weaker economic growth. As we showed in our post on why "4% GDP Growth Will Remain Elusive" the spread between living standards and incomes was supplemented by debt. While wages have turned up post the recessionary lows they are still sharply lower than at the turn of the century. This deterioration in wages, combined with constraints on credit, has continued to put pressure on the ability of producers to raise prices. As a consequence we continue to see more and more reliance on discounting to move inventories.

Commodity Prices

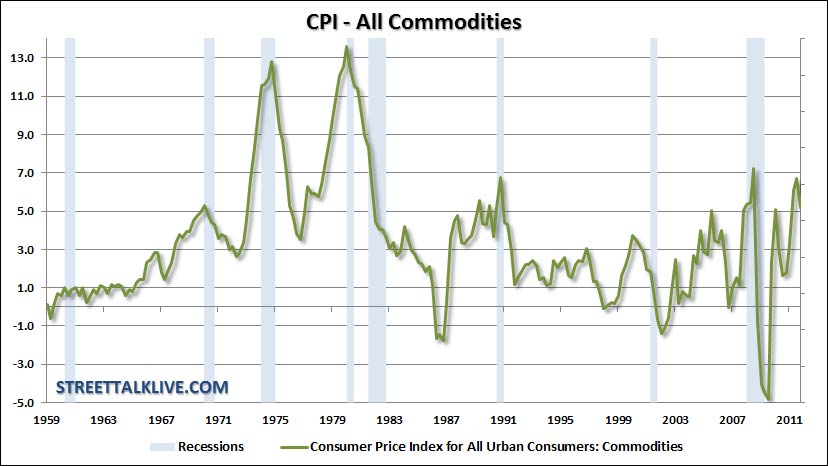

Finally, commodity prices are the headline event that everyone notices. Rising costs of milk, bread, gasoline and the basic essentials of survival slap them in the face on a daily basis. While deflationary pressures exist in everything from apparel to iPads - these items are not consumed on a daily basis and the psychological impact is felt far less. Nonetheless, commodity prices are important in the consideration of inflation due to the impact on personal incomes

Consumption is a critical part of overall economic growth and higher commodity prices, particularly food and energy costs, can have an immediate and direct "psychological" impact on consumers especially if it occurs quickly. Consumers can adjust to higher prices over time as long as wages are rising at a commensurate rate, however, today that is not the case. This is why the increase in commodity prices has been such a focal point with the average "American".

The High-Inflation Index

None of these items individually or collectively point to hyper-inflation. However, in order to measure the impact of these components on the overall economy I have used a simple average of the three to create an index. The index clearly shows the inflationary pressures of the late 70's which gives us a confidence level in the validity of the assumptions. The dashed line is the average level of the index since 1959.

What is very interesting is that there is actually a fairly good correlation between the rise and fall of the index and overall real GDP growth. When the index has risen above its average level the economy has begun to weaken or receded into recession. Currently the inflation index is at 11.97 which is slightly above the long term average of 11.6. While this does not mean that the economy will go sliding off the cliff - it does indicate that pressures on the economy are currently rising.

However, and more to Cullen's point, the threat of hyper-inflation is non-existent under the more classic definition. While the U.S. economy certainly has its share of problems the likelihood of a complete economic meltdown is extremely re. Furthermore, due to the deflationary pressures that currently exist in everything from housing, services and retail, combined with a weakening velocity of money and high unemployment levels, it is unlikely that we will see the high inflationary events that we saw in the 70's when the index soared above 25.

Rising commodity prices certainly can hamper the growth of the economy - I am not discounting that $4 a gallon gas can't squash an already sub-par economic growth rate. I agree with Cullen that the fears of a hyperinflationary event are far overblown. Inflationary pressures are rising as there has been a recovery in the economy since the recessionary lows. The question now is the sustainability of that growth going forward.

Source: Street Talk Live