Today’s AM fix was USD 1,715.00, EUR 1,347.42, and 1,075.84 GBP per ounce. Yesterday’s AM fix was USD 1,730.50, EUR 1,345.86, and GBP 1,080.75 per ounce. Gold rose $2.10 or 0.12% in New York yesterday and closed at $1,718.30. Silver hit a low of $31.209 then recovered in late trade but still finished with a loss of 0.56%.

Gold rose for a third day yesterday after confirmation that President Barack Obama won re- election, while stock markets fell sharply and treasuries headed for the biggest advance in 11 weeks.

Robust investment demand continues and may intensify after the election and exchange traded products backed by gold attracted .5 billion of inflows in October alone.

Total inflows in commodities ETPs were .1 billion last month, taking assets under management to 1.6 billion for Blackrock Inc alone according to Bloomberg.

Many analysts believe that President Obama’s re-election is the “best- case” scenario for precious metals due to implications for monetary and fiscal policy. Obama faces chronic high unemployment, weak economic growth and the upcoming fiscal cliff, not too mention very difficult geopolitical challenges in the form of Israel, Iran, Russia and China.

Today, The European Central Bank has its rate decision at 1245 GMT and they are expected to leave rates unchanged.

Investors are now again focussing on the US fiscal cliff which will enact 0 billion in tax hikes and severe budget cuts, if no action is taken by the US Congress, than the US will fall deeper into its recession.

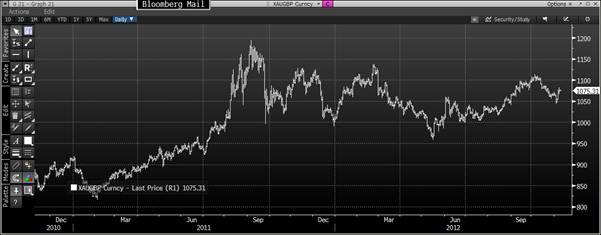

XAU/GBP Currency 2 Years – (Bloomberg)

XAU/EUR Currency 2 Years – (Bloomberg)

Gold bullion is not only supported by the uncertainty of the “fiscal cliff” but the Eurozone debt crisis is set to deepen again.

There remains the real risk of an exit from the single currency by one or more members and of course the risk of a global recession and Depression which will be responded to by more loose monetary policies by various central governments.

More of the world's rich are moving their gold, silver and other valuables away from the economic turmoil in the West to the Asian capitals of Singapore and Hong Kong according to Reuters (see commentary).

This is prompting vaulting and storage specialists in the increasingly prosperous region to increase their capacity by creating extra vaulting space.

Depositories in Asia report that there are a lot of enquiries from European banks, not because the banks themselves necessarily want to move the assets to Asia, but because their clients are asking them to.

These clients include rich Asians who want their valuables closer to home as well as Westerners.

Singapore and Hong Kong are two of the favoured destinations. Both have seen a significant increase in gold importations in 2012.

With Chinese demand for gold and silver surging depositories are looking to cater to the huge growing swathe of wealthy Chinese and this is leading to increasing vaulting services being offered in Singapore, Hong Kong and now even Shanghai.

China is on its way to overtake India as the world's biggest gold consumer this year, as India's gold demand has taken a blow on record rupee prices and higher import tax while Chinese consumers' appetite for gold remains resilient.

We have firsthand experience of this increasing preference for secure bullion storage as we have seen an increased preference for storage in Zurich and Hong Kong.

Zurich remains the preferred destination for most western investors and of investors internationally but we and other bullion providers are seeing some western clients opt for secure storage in Asia.

There is a definite sense amongst some of our American and European clients that storing gold in Zurich and Asia is safer than in London, New York, Delaware or elsewhere in U.S. and this trend is set to continue.

Throughout history capital has flowed to where it is most favourably treated and today there is a definite move to own capital and assets outside of massively indebted and near insolvent western democracies.

Obama’s second term is likely to see Ben Bernanke continue to devalue and debase the dollar which will lead to increased investment demand and store of wealth demand for gold and to investors seeking storage in Zurich, Singapore and Hong Kong.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

Cross Currency Table – (Bloomberg)

News

Gold Rises as Investors Increase ETP Holdings to All-Time High - Bloomberg

Gold flat as US fiscal worries support dollar - Reuters

China to overtake India in overall gold demand: GFMS - Reuters

UK pension funds are holding more bonds than equities for the first time since 1950s – The Financial Times

Source: GoldCore