The Extraordinary Becomes Normal

The lunatics are running the asylum. This is the only conclusion one can come to when considering the nonchalance with which what was once considered an extraordinary policy with a firm 'exit' in mind is now propagated as a perfectly normal 'tool' to be employed at the drop of a hat.

We refer of course to so-called 'quantitative easing' (QE), which really is a euphemism for money printing – even if not necessarily all of the central bank credit created ends up as part of the money supply. In fact, the experience of the Bank of Japan and the Bank of England with 'QE' was and is that it simply increases excess reserves and depresses already low interest rates a little further. Such excess reserves may be regarded as the tinder for an inflationary expansion of the money supply, but as long as no new credit is pyramided atop them, they may as well not exist.

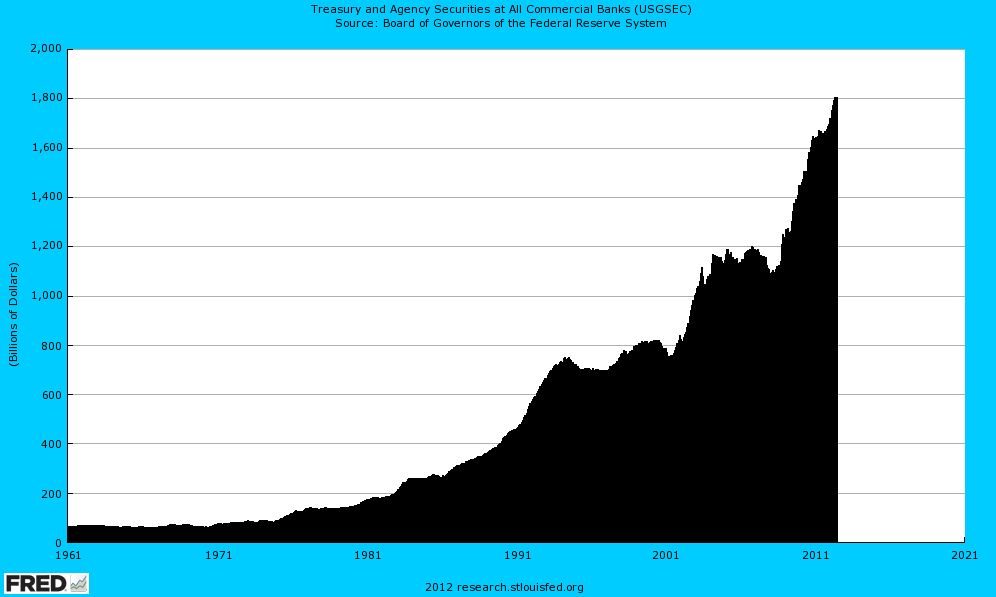

However, the Fed has been quite successful in boosting the money supply with the two iterations of 'QE' it has implemented thus far, in spite of both private sector lenders and private sector borrowers not prepared to add to the existing debt pile. We believe this is due to two factors: for one thing, the Fed also buys securities from non-banks. This not only increases bank reserves, it also increases deposit money directly. For another thing, commercial banks seem eager to increase their holdings of treasury bonds and are thus helping to finance a government that seems perfectly willing to engage in deficit spending on an astronomical scale. The banks have not only replaced the bonds they sold to the Fed during 'QE', they have expanded their holdings of treasury securities at an unprecedented pace.

For a rigorous explanation of the mechanics of 'QE', we refer readers to an earlier article on the topic which discusses them in detail: 'QE Explained' (we have written this as a reference article, as we thought at the time that many of the explanations that were forwarded elsewhere were not satisfactory).

Treasury and agency (GSE) securities held by commercial banks. Since agency bonds are these days issued by state-owned entities under 'conservatorship' they are effectively liabilities of the US treasury – perhaps not de iure, but de facto. Big expansions of bank holdings of treasuries usually tend to go hand in hand with recessionary periods and heavy deficit spending by the government – click chart for better resolution.

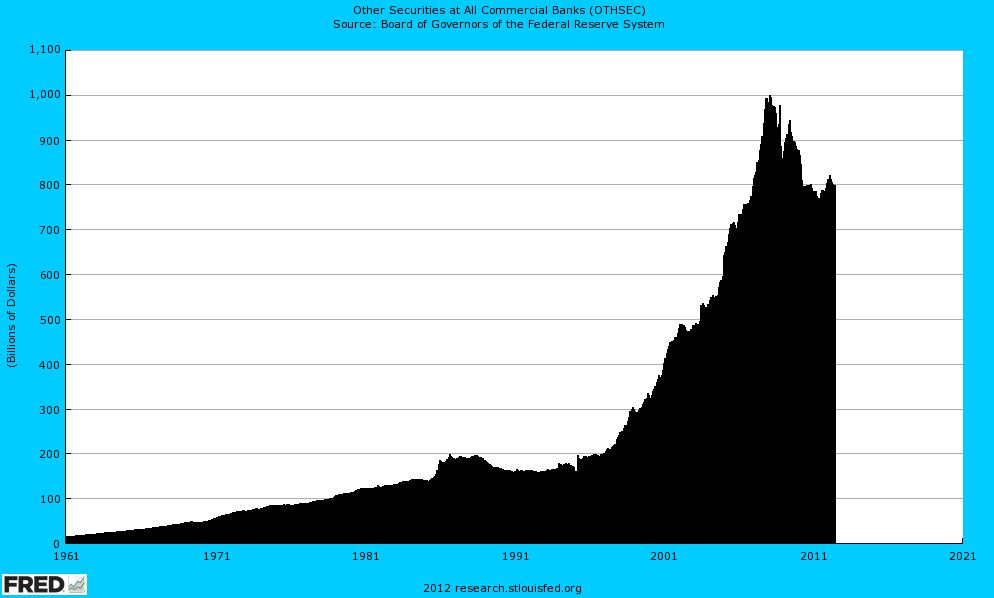

By contrast, the commercial banks have cut back on their holdings of 'other securities' since the 2008 'GFC'. The last time this happened was after the property bust of the late 1980's and the S&L crisis that followed in its wake – click chart for better resolution.

We have little doubt that if the Fed were to start 'QE3', it would once again succeed in boosting the rate of money supply growth. We also have little doubt that 'QE' will be tried again, even if the timing remains uncertain. One reason to expect more of the same is that in recent months, a slowdown in US true money supply growth has taken place. Not as rapid a slowdown as we thought we would see when 'QE2' ended, but that can probably be ascribed to dollars fleeing the euro area. A recent example is provided by Royal Dutch Shell's decision to remove its money from euro area banks and deposit it with US banks instead.

To put numbers on this, over the past quarter growth in 'narrow' money TMS-1 has slowed to 5.9% annualized and growth in the 'broad' money measure TMS-2 has slowed to 6.6% annualized. This may strike many people as plenty of inflation, but consider that the year-on-year growth of these two money supply measures stood at 11.9% and 13.4% respectively as of June 30 (even the year-on-year growth rates, although still hefty, represent a marked slowdown from the peak).

An economy that has become addicted to constant injections of new money is likely to falter very quickly once the money supply growth rate slows down. Although it is not knowable in advance what rate of money supply expansion is the new threshold for upsetting the economic apple-cart, it is probably higher than it used to be during the credit expansion of the pre-GFC boom period.

At the time, the year-on-year growth of TMS-2 slowed to low single digits (slightly above 2%) before an economic crisis struck – see the chart below.

What this chart also shows is that 'QE2' was preceded by a quick slowdown in money supply growth after the conclusion of 'QE1'. At the time, the ECRI WLI fell to territory that indicated an imminent relapse into recession was likely. The Fed quickly resumed its printing duties.

The year-on-year growth rates of TMS-1, TMS-2 and M2, via Michael Pollaro – a slowdown is underway ever since the Fed's 'QE2' program ended, but has been mitigated by money fleeing the euro area – click chart for better resolution.

Fed credit outstanding and the 12 month change in Fed credit – as can be seen, the Fed is no longer actively inflating – click chart for better resolution.

'Open-Ended QE'

On Tuesday, Boston Fed president Eric Rosengren, a noted 'dove', made waves by arguing in favor of an open-ended asset purchase program by the Fed, a kind of QE of undetermined size and without an expiration date, only limited by the attainment of certain macro-economic goals. This method is to be preferred to a 'fixed limit' QE operation according to Rosengren, as it would end the 'market's fixation with when the program will end'.

Rosengren has no vote at the FOMC this year, but he is still regarded as an influential member (he is slated to rotate into a voting slot next year). In fact, all the 'doves' should be considered influential considering who helms the Fed's governing board in Washington, namely Ben Bernanke and Janet Yellen (we have briefly discussed Mrs. Yellen's views yesterday).

Rosengren also argued that the Fed should not shy away from more easing just because it is an election year – a sign that the political implications of Fed action this year have been a topic of discussion at the central bank. His remark on that particular point is not without irony as can be seen below:

“Federal Reserve Bank of Boston President Eric Rosengren said the central bank should pursue an “open-ended” quantitative easing program of “substantial magnitude” to boost growth and hiring amid a global slowdown.

The Fed should set its guidance based on the economic outcomes it seeks and focus on buying more mortgage-backed securities, Rosengren said today in a CNBC interview. Without new stimulus, the jobless rate would rise to 8.4 percent at the end of this year and economic growth wouldn’t exceed its 1.75 percent average in the first half of the year, he said.

“What I would argue for actually is to have it open-ended, that we focus on economic outcomes,” Rosengren said. “It would be setting a quantity that you’re going to continue to buy until you get the economic outcomes that you want.”

[…]

“We’ve found that the economy has not grown as fast as we’d hoped and as a result I think it is an appropriate time to take stronger action,” Rosengren said. “A nonpartisan Federal Reserve should not be worried about the political cycle, it should be worried about the business cycle.”

(emphasis added)

This latter remark is ironic because the Fed's actions are the root cause of the business cycle – its suppression of interest rates after the bursting of the tech mania in 2000 was what set the stage for the housing boom and its aftermath.

What makes it all the more astonishing to hear Rosengren articulate this latest idea of 'monetary inflation without limit' is that it is so utterly bare of introspection regarding what has happened up to the current juncture.

It seems to us that it should be glaringly obvious that when the Fed boosted money growth last time around to help battle a recession, it set in motion the very boom that has cost us so dearly. And now the 'dovish' faction wants to continue doing it all over again, only on a much bigger scale?

Apart from his sole focus on short term outcomes, an important point that seems not be considered by Rosengren is the question of what should happen if the 'open-ended' QE policy were to fail to achieve its stated goals. He seems to assume that it will succeed in lowering unemployment and creating 'economic growth' as a matter of course. No other outcome is apparently conceivable. However, the effects of monetary easing on the economy are circumscribed by the state of the pool of real funding.

It goes without saying that money printing cannot create a single molecule of real wealth. If it could, then Zimbabwe wouldn't be a basket case, but a Utopia of riches. However, money printing does have both short and long term effects. In the short term, it can divert resources into bubble activities – all those economic activities that would not be considered profitable in the absence of monetary pumping. These activities of course create demand for factors of production, including labor, and tend to prettify the 'economic data' for a while – just as the housing bubble was widely regarded as an example of smooth 'non-inflationary' economic growth until it burst.

As it were, monetary pumping can not always be expected to produce even such short term improvements in the vaunted 'data'. If the economy's pool of real funding is stagnating or shrinking, there will simply be no wealth available that can be diverted into bubble activities. All currently existing economic activity is already funded – and it is important to realize that what funds it is not 'money', but real goods. Money is merely the medium of exchange that enables both economic calculation and the smooth functioning of the market.

To describe with a simple example what we mean, consider a very primitive island economy. Say that there are three fishermen who want to build a new boat to improve their productivity and hence increase their wealth. Building the boat takes time, during which they can no longer catch fish. They must therefore have enough food stored to see them through the boat building period – otherwise they will simply begin to starve and never be able to finish the project. If they hire additional helpers and pay them with money, then these helpers will also require food, shelter and so forth during the time it takes to build the boat. Unless someone else produces food in sufficient quantity to sell it to them, or they have a big enough store available, the project will come to grief. In other words, an adequate pool of real funding is a sine qua non if such an investment project is to succeed. It would obviously not help at all if these men increased the size of the money supply.

It is not different in a modern complex market economy – all economic activities require real funding in the end. The allocation of these inputs will only be rational when money is sound – any interference with the money supply and interest rates by a central planning agency will by necessity falsify prices and paint a false picture of the savings and consumption schedules of consumers and the size of the pool of real savings available for investment purposes.

It will therefore set bubble activities into motion – activities that fail to generate wealth, because they only appear to be profitable. If no wealth can be diverted into such activities because the pool of real funding is exhausted, then all that will happen is that additional money will raise prices, but it won't be possible to conjure even a short term mirage of an improving economy.

Of course the market economy is highly flexible and new wealth is created all the time, in spite of all the obstacles the economy faces. It is conceivable though that a point in time will come when the Fed pumps and there is no longer an effect that would fit its conception of economic recovery.

We must infer from Rosengren's idea of implementing open-ended QE until certain benchmarks in terms of unemployment and 'growth' are achieved, that in case they remain elusive, extraordinary rates of money printing would simply continue until the underlying monetary system breaks down.

Perhaps he should be cheered on to shorten the waiting time.

Boston Fed president Eric Rosengren: in favor of money printing without a fixed limit.

(Photo credit: Wendy Maeda)

Charts by: Michael Pollaro, St. Louis Federal Reserve Research

Source: Acting Man