Introduction

This is the 2nd installment in a series that examines data from the recently released Statistical Review of World Energy 2014. The previous post — World Sets New Oil Production and Consumption Records — delved into world oil production and consumption figures. Today’s post looks at the global natural gas picture.

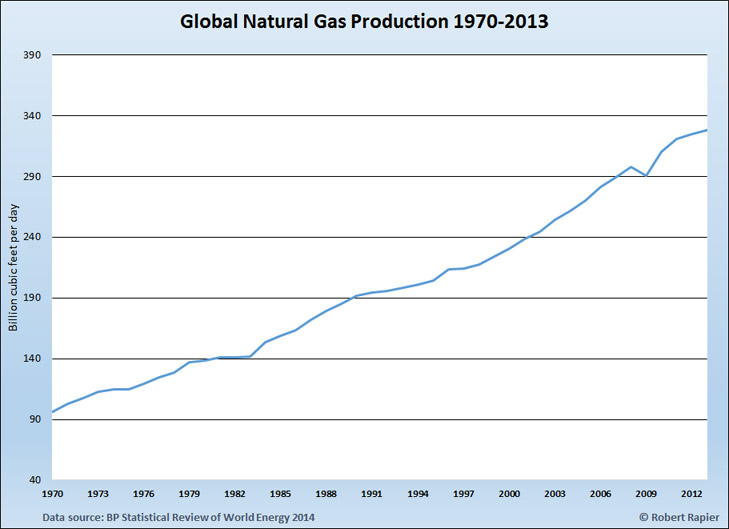

In 2013 global natural gas production advanced 1.1% to a new all-time high of 328 billion cubic feet per day (Bcfd). Except for a one-year decline in 2008-2009, global gas production has risen fairly steadily for about three decades, and production has more than doubled during that time span:

The U.S. Is Still Gas King

The U.S. continues to dominate both natural gas production (and consumption). In 2013, the U.S. set a new all-time high production record for the third straight year, with gas production rising to 66.5 Bcfd to lead all countries. In fact this was once again more natural gas than any country has ever produced in one year.

Natural gas production in Russia reached 58.5 Bcfd, good for 2nd place globally. The U.S. and Russia cumulatively produce 38% of the world’s natural gas. Far behind in third place was Iran at 16.1 Bcfd — good for 4.9% of global gas supplies. Rounding out the top five were Qatar at 15.3 Bcfd and Canada at 15 Bcfd.

However, U.S. natural gas consumption was still greater than consumption, rising to 71.3 Bcfd as utilities continued to look to natural gas as a cleaner alternative to coal. Despite an increase in the past 8 years of 17 Bcfd — an increase of nearly 35% — the U.S. remains a net importer (and the largest consumer) of natural gas.

Russia and Iran were second and third in natural gas consumption. They consumed, respectively, 40 Bcfd, and 15.7 Bcfd. The U.S. and Iran consumed at least as much gas as they produced, while Russia produced nearly 50% more than it consumed internally. The rest of Russia’s gas is piped primarily to Europe, but China recently signed a 0 billion deal with Gazprom that will supply China with Russian gas for the next 30 years. In 2013 China was the world’s fourth-largest consumer of natural gas at 15.6 Bcfd. Rounding out the top five among consumers was Japan at 11.3 Bcfd.

Natural Gas Reserves

Despite the surge in U.S. natural gas production, U.S. proved reserves have increased substantially over the years. Proved gas reserves in the U.S. reached an all-time high of 334 Tcf in 2011, fell in 2012, but surged in 2013 back to 330 Tcf. The increase in reserves is primarily a function of the pairing of hydraulic fracturing with horizontal drilling, which turned a big volume of natural gas resources into natural gas reserves for the first time (i.e., the “shale gas boom”). After two decades of declining to flat natural gas reserves, U.S. reserves have now risen 86% since 2000.

Global proved natural gas reserves have grown more consistently than U.S. reserves over the years, albeit not as sharply. Over the past decade global gas reserves are up 33%, and just eked out a new record in 2013 of 6,558 Tcf. While this record is a fraction of a percent higher than the previous record in 2011, global reserves have been effectively flat for the last two years.

Price and Differentials

The surge in U.S. gas production has had a dampening impact on domestic gas prices, but internationally prices have risen substantially over the past decade:

This combination has resulted in enormous differentials that have developed between U.S. natural gas prices and liquefied natural gas (LNG) prices in Europe and northeast Asia. These high differentials have resulted in a rush to build LNG export terminals in the U.S..

U.S. natural gas production is up 11.4 Bcfd in just the past five years. However, there are presently 13 pending proposals awaiting approval from the Federal Energy Regulatory Commission (FERC), with a total proposed export capacity of 17.9 Bcfd. Two projects have already been approved by FERC. Cheniere Energy (NYSE: LNG) and Sempra Energy (NYSE: SRE) have had projects approved with a combined proposed capacity of 4.46 Bcfd.

Conclusions

The global natural gas picture is dominated by the U.S. and Russia, and this will likely continue to be the case for the foreseeable future. But the U.S. is in 5th place globally in natural gas reserves, far behind countries like Iran and Russia. Ultimately the U.S. will probably yield its position as the top gas producer back to Russia.

Nevertheless, the shale gas boom in the U.S. has expanded natural gas production rapidly, which has led to a number of LNG export terminal proposals. But unless U.S. natural gas production continues expanding at the pace of the past five years, it is almost a certainty that these export facilities (among other drivers) will lead to higher U.S. natural gas prices.