There seems to be a prevailing consensus in the market analysis I’ve been reading, that head and shoulders patterns are always reversal patterns and their completion is inevitable. Not True. Often, they can form, what we call, continuation patterns – i.e. consolidations. It has been my view for two months that the market is going through a mini rotation out of growth and momentum stocks into value stocks found in large-cap; however, if you take a step back from that story, the market is largely in a consolidation post the 2013 gains. This still stands, and if the economy can show further improvement, investors will have to take notice.

As I mentioned, head and shoulder patterns aren’t always reversal patterns that form tops and bottoms. They can be continuation formations. As long as the pattern doesn’t complete with a break in the neckline, it can be merely a consolidation. A break needs to be confirmed by a 1-3% move and usually these breaks retest.

Here in 2010, the S&P 500 completed a H&S top with a break below 1050, down to 1025 which was a 2.3% move; however, upon retesting, the index did not hold below the neckline, thus becoming a bear trap.

The recovery wasn’t over. It merely needed a break. After the Flash Crash in May, investors were pretty spooked. Yet, it didn’t cause the next bear market and the market recovered along with the economic numbers. The economic numbers in the first quarter of 2011 were the strongest the recovery had seen up until that point.

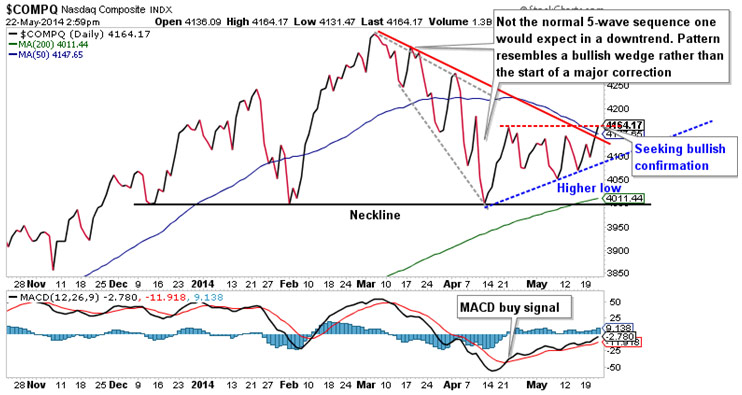

The Nasdaq Composite’s head & shoulder pattern has been discussed a lot. As it stands, the neckline near the February lows has held as support and has, as of yet, still held. Note, interestingly, that the downtrend since the March high has broken and the intermediate-term trend is on the verge of confirming a new uptrend if the index closes above 4162 on a closing basis. MACD turned in late April. Today looks like the NASDAQ will close above the 50-day moving average which is yet another positive development.

It’s not enough for the NASDAQ Composite to break above the 50-day moving average. We need a majority of stocks within the composite doing the same. As it stands right now, 33 percent of the NASDAQ composite stocks are trading above their 50-day moving average. This number has climbed from 24 percent on May 8th and may be leaving the oversold condition that has lasted for a month. We’ll need to see this number continue to rise from here, which is likely if the NASDAQ can breakout above near-term resistance (mentioned earlier).

Percentage of Nasdaq Issues Above the 50-day Moving Average

The Wilshire 5000 Composite has been a composite I’ve turned to recently with the noise in small-cap and large-cap stocks. The Wilshire 5000 is a full-cap index. So without concern over market cap, what can a composite full of 5000 companies tell us? Answer: The market has been consolidating in an ongoing uptrend. So far, there are no signs the trend has reversed, especially while long-term trends continue to rise and support this market.

I mentioned a couple of weeks ago that the value trade over growth may be reversing. More evidence has continued to surface over the past two weeks that shows this may be the case.

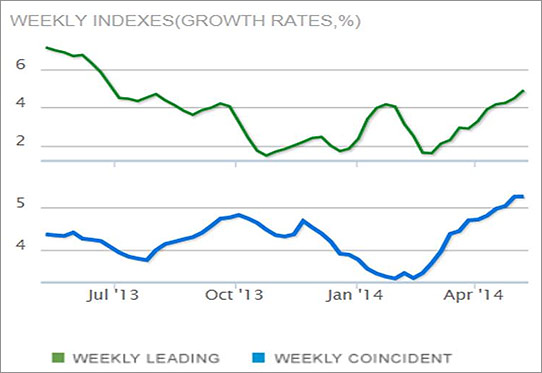

One of the reasons I’ve been so bullish over the past two months despite the rotation out of momentum stocks into value and large-cap has been the steady rise in economic conditions. The leading economic indicators (LEIs) continue to rise despite the winter correction and stand today at fresh highs.

Source: businesscycle.com

If the LEIs were rolling over here, I’d be much more inclined to believe that a significant pullback and correction was likely. As you can see from the chart above, this isn’t the case. In fact, the growth rate is breaking out for both the LEIs as well as the coincident index which tells us where things are “now”. So if the tomorrow and the now numbers are telling you there are good things in your future, that’s probably a good thing.

Source: businesscycle.com