Listen to this podcast on our site by clicking here or subscribe on iTunes here.

Late last month, CNBC reported “Southern California home sales crash, a warning sign to the nation.” The main culprits cited for the crash in one of the largest housing markets in the nation were higher rates, affordability concerns, and a shortage of available homes for sale.

FS Insider recently spoke with leading housing expert Rick Sharga on whether the recent crash in Southern California is indeed a major warning for the rest of the nation, the headwinds facing the real estate market in the months ahead, and whether housing is in another bubble.

Here's what he told our listeners in a recent podcast, Is the US Housing Market Heading for a Crash?.

Southern California Warning

Though we’ve seen some price declines, particularly in high-priced coastal areas of Southern California, Sharga isn’t a big proponent of the notion that what happens in Southern California is a predictor of what will happen in the rest of the country.

Southern California is an unusual market due to several factors that probably aren’t relevant to someone living in St. Louis, for example. That said, there are some important lessons we can take from what’s happening in So Cal right now.

The reality is, we’re probably seeing this market hit an affordability wall, so to speak. In a normal housing market, Sharga stated, prices reach a point that causes buying activity to slow down, which leads to prices softening.

“I wouldn't be surprised at all if that’s the trend we're seeing up and down the coast of California right now,” Sharga said. “Particularly in some of the more expensive areas of Southern California, we've seen both sales and prices start to come down a bit.”

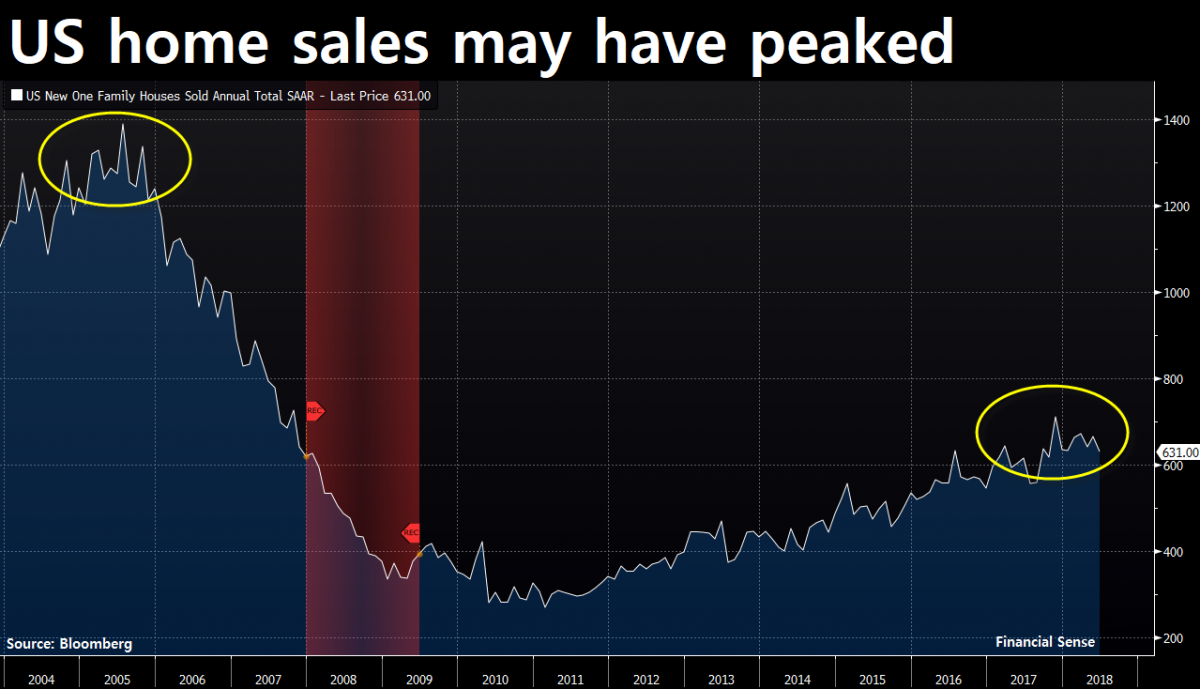

Source: Bloomberg, Financial Sense® Wealth Management

Headwinds Developing

There are several factors at play in both what has driven prices so high in several markets, and what might be impeding price appreciation from here.

The price driver up to now has really been classic Economics 101, Sharga stated—supply and demand.

In a lot of markets in California, the available inventory of homes for sale can be measured in weeks, not months, which is what we’d expect in a typical, healthy market, where we would want to see around 6 months’ worth of inventory.

Also, wages haven’t kept pace with home price increases. Year-over-year, we’ve seen roughly a 7 percent appreciation in some markets, where wages have only gone up between 2 and 3 percent.

Interest rates are going up, as well, Sharga noted, though fortunately, these have slowed down a little bit in terms of mortgage rate increases. Altogether these factors can definitely act as headwinds as they begin to impact markets.

“At some point, that math just doesn't work anymore for a lot of buyers,” Sharga said. “Affordability in California in particular is tough. … In some cities in California right now, less than a third of residents can actually afford to buy a median-priced home. So whatever the mortgage rates do at this point is just really adding fuel to that fire.”

Are We in a Housing Bubble?

The good news is, the market we’re living in now doesn’t resemble the market we saw that led to the housing bubble and crash around a decade ago.

Some markets are probably overheated, Sharga noted, but they’re not characteristic of a bubble where properties are grossly overvalued.

There’s no broadly accepted definition of what constitutes a housing bubble, he said, but we’re probably looking at prices coming down between 5 and 10 percent, which is indicative of a correction rather than a bubble.

“The (2005 housing) bubble was really facilitated by bad lending practices, where people who really shouldn't have qualified for a loan were put into a property that was overpriced with a teaser rate on an adjustable rate loan that just blew up,” Sharga said. “We’re not facing that kind of scenario right now. People do have equity in their homes. The price-to-income ratios aren’t completely out of whack. I don't think we're in a bubble, but I would not at all be surprised to see prices correct.”

Listen to this full interview with Rick Sharga by clicking here. For more information about Financial Sense® Wealth Management and our current investment strategies, click here. For a free trial to our FS Insider podcast, click here.