These eight forces are structural, and cannot be erased by tax cuts or policy tweaks.

If there is any economic assumption that goes unquestioned, it's the notion that profits will remain robust for the foreseeable future. This assumption ignores the tidal forces that are now flowing against profits.

Any discussion of corporate profits must start by noting the astonishing rise in US corporate profits since the heyday of the late 1990s dot-com boom. From 0 billion to .4 trillion in a few years is not just extraordinary—it's unprecedented.

Yet rather than wonder if this incredible spike higher is temporary, the financial media assumes nosebleed-level profits are a new and wonderful plateau that can only move higher in the future.

Interview Charles Hugh Smith: Optimizing Bad Policy Guaranteed to Fail

This confidence ignores the systemic tidal forces working against profits.

1. Higher costs of capital. Another blithe assumption is that capital will cost almost nothing to borrow, as far as the eye can see and that the demand for low-yield corporate debt will remain insatiable.

The yield on bonds is rising in important markets, and while many observers reckon rates will soon return to zero (or less than zero), others see the potential for a trend change from declining rates (a 45-year trend) to rising rates.

Rising borrowing costs pressure profits.

2. Rising wages and labor overhead. Even if wages remain stagnant, the overhead costs of labor—healthcare, workers compensation, pensions, etc.—are increasing for structural reasons. Factor in global pressure to raise minimum wages and competition for the most productive labor/skillsets and the cost of labor is rising on multiple fronts. Rising labor costs pressure profits.

3. Urbanization. An unprecedented number of working-age people have migrated from largely self-sufficient rural economies to high-cost urban economies that require much more cash income. As Immanuel Wallerstein has observed, urbanization pushes wages higher, regardless of the era or the nation experiencing the urbanization.

You may also like Howard Davidowitz on Retail Plunge, Trump Presidency

While cheerleaders focus on the higher income of these tens of millions of new urban dwellers, and on the potential for corporations to sell them more products and banks to lend them money, low-wage workers spend the vast majority of their income on rent, food, and transport. Beyond these essentials, opportunities to earn fat margins selling to the urban poor are scarce.

4. Expanding competition and market saturation. Have you noticed how companies are getting into everyone else's business? You see all sorts of non-building supplies being sold in Home Depot, for example. With sales stagnant in the developed world and in emerging markets hit by recession or currency devaluations, expanding into established markets is seen as one of the few ways to grow sales and profits.

There is an upper limit to this trend, of course. McDonalds can grow sales by opening branches in Walmarts, and Starbucks can expand sales by opening a shop in every Target, but we're clearly reaching saturation on retail outlets everywhere. As for online sales—everybody's trying to expand their online sales, but often at the cost of lost bricks-and-mortar store sales.

5. Trade wars and de-globalization. Profits have soared for corporations that have mastered long global supply chains that serve a wide range of regional markets. Any disruption in these long supply chains due to geopolitical tensions, trade disputes or domestic pressures to relocate production back in the home country will increase costs incrementally.

6. Higher taxes. The rotation from relying of monetary expansion (quantitative easing, bond purchases, etc.) for growth to fiscal expansion (borrow and spend for infrastructure, etc.) will eventually require higher taxes on labor and capital to fund the higher fiscal spending. Higher taxes pressure profits.

7. Debt saturation. Debt has been rising across the board for the eight years of "recovery," and a slowing of debt expansion means there will be less money available to spend on goods and services. Slowing debt and slowing sales pressure profits.

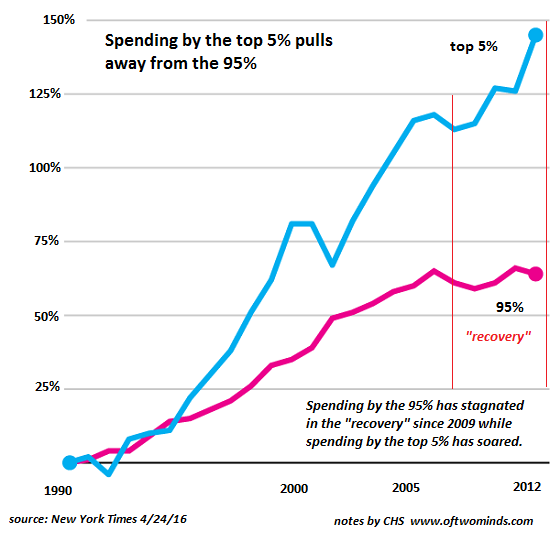

8. Decline of the wealth effect. Most of the wealth effect—the psychological sense of feeling wealthier and thus more prone to borrow and spend—is concentrated in the top 5% of households that own most of the assets that have bubble higher over the past eight years. (A lesser wealth effect has trickled down the next 15%.)

The wealth effect's influence on consumption is readily visible in this chart that shows spending by the top 5% has pulled away from the spending of the bottom 95%.

Should the bubblicious asset classes that have experienced strong gains—stocks, bonds, and housing—suddenly encounter turbulence or an actual downdraft (gasp), the wealth effect will quickly wear thin, potentially impact the biggest spenders that have been driving corporate profits.

These eight forces are structural, and cannot be erased by tax cuts or policy tweaks.