In 1897, Samuel Clemens, best known by his pen name, Mark Twain, was in London for various speaking engagements when someone started a rumor that he was gravely ill, which was followed by another rumor that he had died. Frank Marshall White, an English correspondent for the New York Journal, contacted Twain to inquire about his health. In response, Twain is famously quoted to have said, “the report of my death was an exaggeration,” which has lived on through a number of popular variations.

Like the rumor of Mark Twain’s death, the financial press has been reporting for the last several years that active management is dead. When looking at the amount of money flowing towards active versus passively managed funds, one can readily see how these rumors took flight. According to data compiled by Bank of America Merrill Lynch (The Flow Show, 04/06/2017), since 2007, $2.1 trillion in assets have flowed into passive equity funds, which automatically track an index or segment of the market, with an equal amount flowing away from active equity funds, which are managed by a financial professional or portfolio manager.

The argument for passive management vs. active management is not entirely new but a case for the former has found much more consensus as the 8-year bull market in US stocks has pushed on, experiencing a prolonged period of above-average returns. However, as is so often the case, we believe that the pendulum from passive to active management will begin to turn in favor of the latter once again just as it did at the turn of the century—here’s why…

Past Performance Is Worse than Useless….It’s Downright Dangerous!

Most financial planners and advisors forecast the future by looking backward; they will take the average inflation and return rates for stocks and bonds over very long time periods—sometimes a century—and use that data to extrapolate future returns. Academically, this makes sense since stock market returns can fluctuate quite significantly over the short-term; taking an average smooths the data and provides an objective baseline. The most glaring problem with this approach, however, is that human beings do not have indefinite lifespans. Most of us don’t have the luxury to “smooth” our returns over a hundred year period to achieve the long-term average. For that reason, let’s take a look at a much more realistic and applicable scenario where we consider what happens to returns over a typical retirement time horizon of 20 years in the context of current market prices.

The graph below shows the S&P 500 real total price (in blue) going back to the late 1800s with the corresponding 20-year annualized real rate of return with dividends reinvested (in red). What you can see is that there have been several 20-year periods of strong stock market returns and several 20-year periods of below average market returns…and depending on where you start makes a world of difference.

Source: Doug Short, “The Latest Look at the Total Return Roller Coaster”

Buying the S&P 500 at a major bottom in 1920—just as the “roaring 20s” were getting started—produced annualized returns of nearly 10% per year by 1940 (far left black arrow). However, if you retired in 1930, your subsequent real 20-year annualized return was a whopping 0.41%. Then, if you were lucky enough to retire just as WW II was ending, your future 20-year real average annualized returns were in the double digits at 13.32% (middle arrow). Move forward another generation and those that retired in the ‘60s witnessed returns for the next twenty years at a paltry 0.40% per year. Those lucky enough to retire in the ‘80s, just as the greatest bull market in US history was getting started, saw the S&P 500 return nearly 14% per year for twenty years before the technology bubble burst in 2000 (far right arrow).

Again, the point of all this is to show that using long-term averages without considering where you are in the current market cycle can prove to be hazardous to both your financial health and your retirement portfolio. In that case, what are the primary determinant of above-average and below-average returns over shorter time periods, say 20 years, for example?

“Price is what you pay, the value is what you get.” – Warren Buffett

Intuitively, we know that valuations are one of the biggest determinants of future returns. We have all heard the concept of “buy low, sell high” as an investing practice, knowing that buying something richly valued will likely lead to subpar returns.

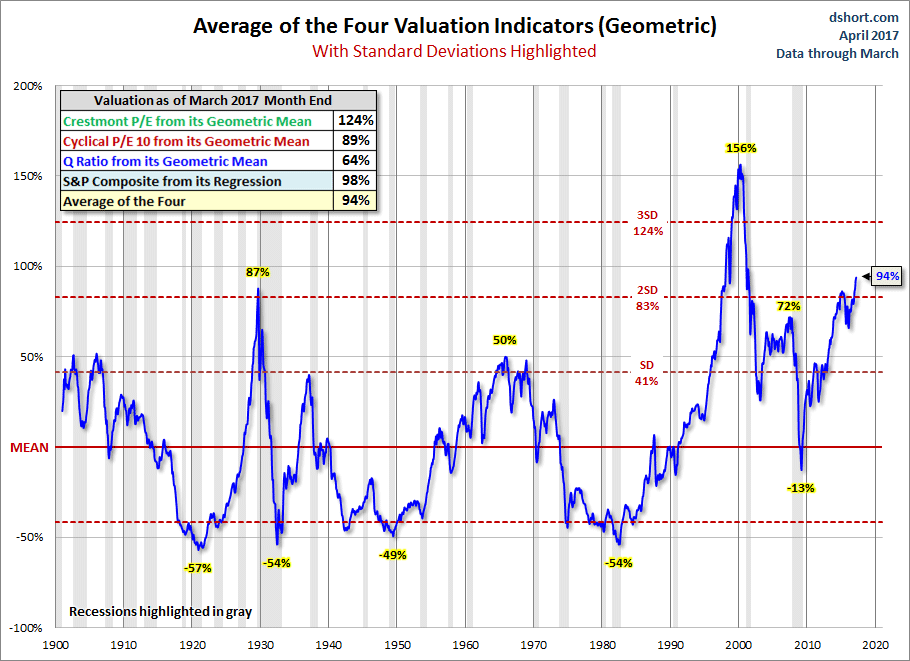

In the previous quarterly newsletter, we touched on valuations and included work from Doug Short who averages three valuation measures and one trend measure to calculate how overvalued the S&P 500 is from its historical average. In January, the market was 87% above its long-term average, which placed it as the third most expensive market in US history, exceeded only by the 1929 peak and the tech bubble of 2000.

As of March (the most recent data point), valuations on the S&P 500 are now the second most expensive in recorded history, as shown below.

Source: Doug Short

Given the above, what does that say about our investment horizon looking forward? The short answer is, not good!

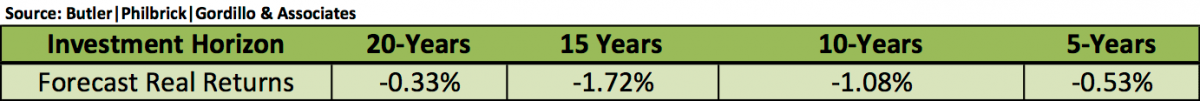

Studies conducted by Butler|Philbrick|Gordillo & Associates, suggest that valuations can be a useful tool for forecasting future returns. Illustrated below, shows their “Model Forecast Returns” vs. the “Actual 15-year Returns” annualized. The data was taken from various key market tops and bottoms over the past 100 years. As you can see, their model predicted a -1.27% annualized return for 15-years starting from the market top in 1929. The actual annualized returns were -0.15% per annum. Further predictions show below-average returns from the secular top in the market in 1968.

Their valuation model also proved to work well in forecasting future returns, with “low valuations” as a starting point. Their model reliably predicted strong returns following the major market bottoms like the lows experienced 1942 and 1982.

Unfortunately, as of June 2014, their expected annualized return forecast for the subsequent 15-years (through 2029) is a disappointing -1.72%.

Source: Shiller (2014), DShort.com (2014), Chris Turner (2014), World Exchange Forum (2014), Federal Reserve (2014), Butler|Philbrick|Gordillo & Associates (2014)

Their same valuations model, illustrated below, would also suggest poor annualized investment returns for the US stock market starting year end 2013.

Source: Shiller (2013), DShort.com (2013), Chris Turner (2013), World Exchange Forum (2013), Federal Reserve (2013), Butler|Philbrick|Gordillo & Associates (2013)

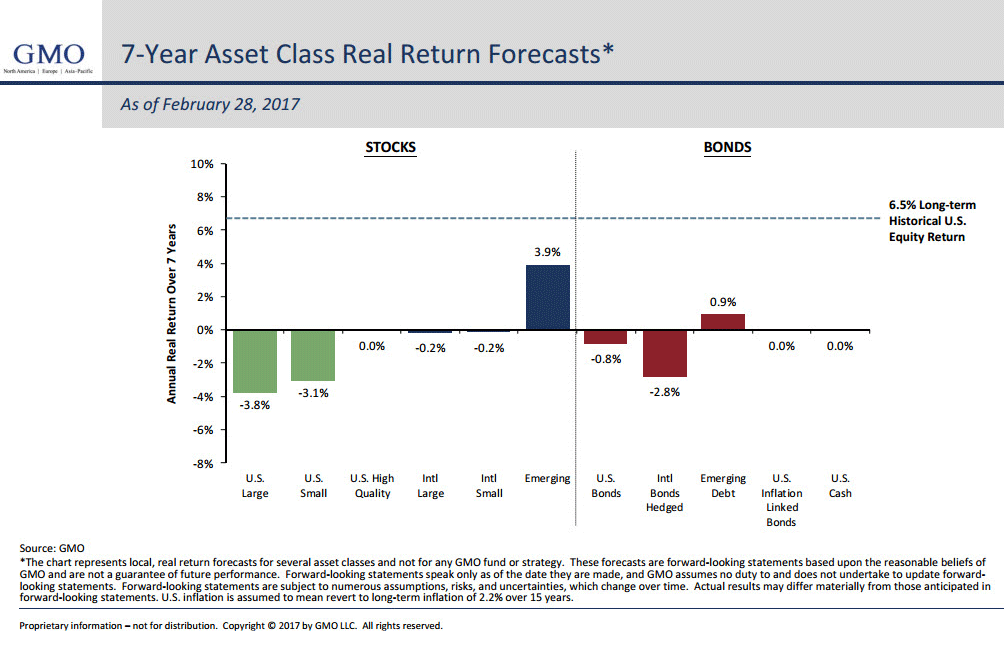

Butler|Philbrick|Gordillo & Associates are not alone in their predictions of “sub-par” future returns. Data from GMO, in the 7-Year Asset Class Real Return Forecasts shown below, estimates a -3.8% annualized return for large-cap US stocks, -3.1% for small-cap US stocks, with flat returns coming in across the board for US high-quality, large and small-cap international stocks. GMO is also forecasting negative returns for bond investors. According to GMO, US bonds are expected to lose 0.8% per year compared to a -2.8% return for internationally hedged bonds. The one area GMO is forecasting positive returns are from the emerging market sector for both equities and bonds.

Source: GMO, used with permission

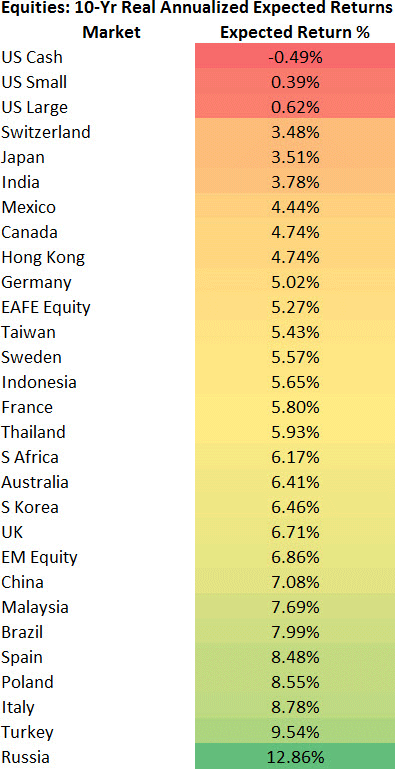

Expectations of poor returns for the US stock market are also supported by data released by Research Affiliates. In the Equities: 10-Yr Real Annualized Expected Returns shown below, are countries ranked from lowest to highest for expected rates of returns. They forecast 0.39% annualized returns for US small-cap stocks only to be outdone by a dismal 0.62% for large-cap stocks. Further, they forecast that over the next 10-years, cash (short-term savings deposits) will lose nearly 0.49% in purchasing power, as inflation is expected to remain above short-term interest rates.

Given the steep valuation discounts abroad (relative to the US market), much like GMO, Research Affiliates expects returns in foreign markets to well outpace US returns. This overwhelming supporting data is why we have begun reallocating portfolios to increase our international exposure.

Source: Research Affiliates

The Resurrection of Active Management

“We often miss opportunity because it's dressed in overalls and looks like work.”

– Thomas A. Edison

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

– Winston S. Churchill

“If opportunity doesn't knock, build a door.”

– Milton Berle

Active management is not a new concept to our firm. We have been making a case for this type of hands-on approach for years. As the US market has seemingly marched squarely into frothy valuation territory, we feel more strongly than ever for its need. With investing, there are times to be active and there are times to be a passive, utilizing a buy-and-hold approach. Identifying which type of investor you need to be is critical to long-term investing success. A simple analogy we’ve used for years is the concept of “Sailing vs Rowing.” When the winds are at your back, you raise the spinnaker, relax and let the wind carry you forward. This is very similar to being a buy-and-hold investor in a long bull market sparked from low valuations, as we saw with the strong returns from 1982-2000. There are, however, those times when the wind has vanished, and to get any movement at all, it takes a lot of hard work like rowing through the flat investment returns of the 1970s and 2000s.

When markets enter into extreme valuation territory, history has shown that future returns are flat for many years. If there is no wind in the sails of the market, a buy-and-hold passive investor will flounder out at sea. History has also shown, while returns starting from high valuations are flat for a prolonged period of time, they are often quite volatile, which when it comes investing is synonymous with opportunity.

While the chart below shows the Dow Jones Industrial Average spent most of 1970s price capped at 1000, you can see there were four bear markets and four bull markets that put investors on quite a roller coaster ride.

Though the 2000s were filled with fewer bear and bull markets, the magnitudes were much larger with a max drawdown of 56.61% and a max gain of 131.71%.

As previously stated, it is our contention that active management will become more relevant in the coming years, with minimal to negative returns in the forecast. As Thomas Edison suggested, opportunity takes work and so will active management. An investor can easily invest money into a passive index like the S&P 500; however, surviving and thriving during prolonged periods of weak returns will take work and skill. Having a full understanding of the market and economic conditions and having the skill set to look at the big picture and get it right, is what our firm strives to achieve.

Many market technicians and strategists have called for the end of the long-running bull market time and again. Conversely, we have remained bullish throughout as our models and indicators have kept us on track. Now, our various economic and market signposts are suggesting that we are in the latter stages of this bull market, a theme strongly discussed during the last two investment strategy seminars. Many of our indicators were beginning to flash warning signs prior to the Presidential election in November, but none strong enough to indicate an outright bear market or imminent recession. Since the elections, we have seen many of these indicators improve, which is why our firm has remained in the bullish camp.

We are, however, cognizant of the risks of being too heavily weighted in a market of elevated valuations. In an attempt to “buy low and sell high,” it may make sense for investors to begin taking chips off the table by reducing their exposure to the stock market and reallocating assets into cash and short-term bonds. These assets should serve to lower the risk within the portfolios and reduce portfolio volatility acting as stabilizers. Historically, bonds have done a great job counterbalancing down years in the stock market. The below chart illustrates years that saw negative returns for the S&P 500 (blue bars). Years of negative returns typically witnessed positive returns for investment grade bonds (green bars).

Source: Fidelity Capital Markets, Investment Themes 2017

We will continue to monitor our economic and financial models to help guide us through the bumpy roads ahead. We will use market data as a guideline to determine how bearish to become on the stock market to prepare for the next downturn, and also rely on market data on when to re-engage with the market at safer levels. The road ahead is likely to be challenging and disappointing for many, but with a little active work and sound risk management, we will continue to move forward by taking advantage of the market volatility and seizing the opportunities presented.