Five Easy Pieces for the World-As-It-Is

Our story so far...

In the second half of 2014, export volumes in every major economy on Earth began to decline, the result of divergent monetary policies that crystallized with the Fed’s announced tightening bias in the summer of 2014. This decline in trade activity – which is far more impactful than a decline in trade value, because it means that the global growth pie is structurally shrinking – accelerated in 2015 and 2016 as Europe and Japan intentionally devalued their currencies to protect their slices of the global trade pie. In game theoretic terms, Europe and Japan have been “free riders” on the global system, using currency devaluation to undercut the prices of competing for US and Chinese products in a way that avoids domestic political pain.

But if there’s an iron law of international politics, it’s this: once the strategic interaction between nations begins to shift from cooperation to competition, once a principal player decides to defect and go for free rider benefits, then the one and only equilibrium of the new game has ALL principal players abandoning cooperation and competing with each other. Moreover, once one principal player begins to compete with a new and terrible weapon (i.e., mustard gas in World War I or negative interest rates in monetary policy or Trump-esque debate tactics in a Republican primary), then all principal players must adopt those tactics or lose the game. Universal competition is a highly stable equilibrium, both on the international stage and the national stage, particularly in the way it plays out in domestic politics, where there is never a shortage of populist politicians ready and willing to blame global trade for a host of ills. And because universal competition is such a stable equilibrium, typically only a giant crisis – one that shakes the principal players to their domestic political cores – gets you back, maybe, to a Cooperative game.

Listen to Dr. Ben Hunt on Broken Models, Extreme Outcomes, and Liquidity Shocks

Yikes, that sounds pretty dire, Ben. Are you sure? What about some prominent sell-side economists who recently published notes saying that you’re wrong about global trade? While it’s true, say these voices of consensus, that global trade values as measured in dollars are declining as commodities slide, and the dollar gets stronger, aggregate global trade volumes are not contracting, so we don’t have anything to worry about.

Hmm … here’s what the World Trade Organization (the gold standard in the field) says about seasonally-adjusted quarterly export volumes in the four economies that matter for international relations. The chart below starts with the low-water mark of all four geographies in Q1 2009, draws a line to the respective high-water marks hit in the second half of 2014, and then connects to the current index value. I find this sort of minimum-to-maximum-to-current data representation to be a very effective way of isolating inflection points in data series that should (if all is well with the world) grow at a pretty steady linear clip. And no, that’s not an error in the Japan and China graphs. Both countries' export volumes peaked more than five years ago, essentially flatlined (a dip and recovery around the European crisis of 2012 not shown), and rolled over in late 2014. It’s pretty stunning, right? This is the primary reason I think Japan gets no respect with their monetary policy experiments, and why I think we are already past the event horizon for China to float or otherwise devalue their currency. China has been trying to jumpstart industrial production growth for years now, nothing has worked, and the downturn since Q3 2014 not only puts them embarrassingly behind both the US and Europe in export activity but also gives the lie to the idea that they can stimulate their way out of this.

Source: World Trade Organization, as of 12/09/15. For illustrative purposes.

To paraphrase George Soros, I’m not expecting a shrinking of the global trade pie and an expansion of aggressive, protectionist domestic policies; I’m observing it. Something derailed the global trade locomotive in the second half of 2014, and it doesn’t take a genius to figure out that this something was divergent monetary policy, with the Fed embarking on a public quest to tighten, and the rest of the world doubling down on monetary policy easing. This is Exhibit 1 to support the case that we've entered a new, more competitive international political environment, as all four major global economies suffer a simultaneous contraction in trade volumes. I'm often asked what would need to happen for me to change my structurally bearish views about the world. So here you go. If this chart changes, then my views will change.

As you can see, the published WTO data currently goes through Q3 2015. Now maybe the Q4 2015 WTO data will come out and show a new high-water mark for these principal players in the global economy. But I don’t see how. First, I've looked at Q4 year-over-year trade values in local currency. Not a perfect measure of volumes, but indicative. The US, Japan, and China are all clearly down year-over-year in Q4; it’s hard to tell for the EU without including intra-EU trade. Second, I've looked at the raw data of container volume in the major ports in the world. 2015 data isn’t available for China and Japan, but partial data is available for the largest EU port (Rotterdam) and full data for the largest two US ports (Los Angeles and Long Beach). Rotterdam is down a little in 2015 total volumes; Los Angeles and Long Beach are down a lot in export volumes, with the declines accelerating in Q4 (partially labor issues, but still). Want more? Read this FT article on structural shifts in global trade. Read this WSJ article on the expanding January US trade deficit driven by disappointing exports, or this WSJ article on enormous new US tariffs on Chinese cold-rolled steel (while you're at it, look who the biggest direct beneficiary of these tariffs is: Indian mega-billionaire Lakshmi Mittal ... I swear to god, you can't make this stuff up ... and you wonder why Bernie Sanders strikes a chord with his message?). Take a look at Chinese electricity consumption data for 2015 (highly correlated with industrial production) and tell me that we do not see continued declines.

How, then, do consensus sell-side analysts claim that global trade volumes are increasing? Two ways. First, they include countries that don’t matter, like Canada and Brazil. Sorry, my friends to the north and south, but you can increase your export volumes all you like, and it matters not to the Great Game. Second – and this is the egregious data interpretation mistake – they report global trade growth by including intra-EU trade! It’s a statistic that the WTO reports (as they should), and they include it in their aggregated global trade number (as they should). But if you can’t see that you need to back this number out if you’re trying to understand the strategic interaction between central banks … if you can’t see that intra-EU trade is as extraneous to this analysis as trade between Texas and California … well, I don’t know what to say.

Now even though I think it's totally disingenuous to claim that all is well with global trade volumes, I will be the first to admit that all is not lost. Yet.

First, export volumes have rolled over since the second half of 2014, but they haven't collapsed, certainly not in the US, anyway. Export values, on the other hand, have taken a nose dive, particularly in the US (the total value of merchandise goods exported by the US is currently off more than 15% from its high-water mark). Keep in mind, though that I don’t think that a decline in export values is as much of an emergency alarm as a decline in volumes. Why? Because a decline in export values impacts industrial sector earnings, while a decline in export volumes impacts actual industrial sector production. I think this is exactly why we’ve seen an earnings recession in the US, particularly in any sector with a connection to trade, but not a jobs recession. When export values decline, companies are missing their revenue targets. When export volumes decline, companies are shutting down factories. This is the big question I have for the US economy: will export volume declines start catching up to export value declines? If yes, then I think we’re going to have a “real” recession. If no, then I think we’re likely to muddle through in the real economy.

Second, it’s not like you can hide the fact that this enormous barge called global trade has reversed course over the past year and a half, and it’s not like central bankers or the IMF are oblivious to what’s going on. They’re going to respond, and who knows, maybe they’ll be successful in turning this barge back around. I don’t think they have the proverbial snowball’s chance, for reasons I’ll talk about in a second, but they’re certainly going to try.

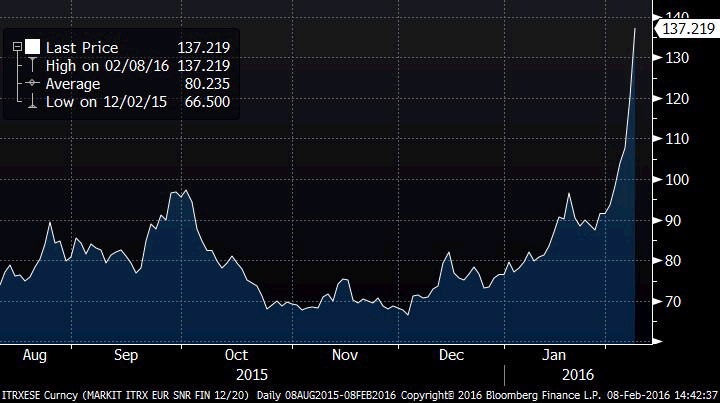

Here’s a chart of the CDS spread (the premium you have to pay to insure your bond against default) for a senior credit index of the 33 largest European financial institutions as of February 8. I used this chart in the Epsilon Theory note “Snikt” to show what it looks like when the claws of systemic risk pop out.

© Bloomberg Finance L.P., as of 02/08/16. For illustrative purposes.

But now here’s a chart of the same CDS spread as of March 11. We’ve retraced the entire move.

© Bloomberg Finance L.P., as of 03/11/16. For illustrative purposes.

What happened? Exactly what occurred in August 2012, the last time Draghi built up huge expectations for a miracle cure, blew the press conference and had to be bailed out by the Powers That Be. In short, I suspect that the allocation heads at one or two European mega-insurance firms were informed that they would be supporting risk assets, I can observe how the Narrative machine got into gear, and I am certain that real world investors do what they always do, they play the Common Knowledge Game. Hopefully, if you’ve seen this movie before, you traded around the spike in February, got out of the position entirely, and are looking for a reprise.

Is there some reality to what the Narrative machine is pumping out? Sure, there always is. I think we have to take seriously the idea that the G-20 Shanghai meeting of the world’s central bankers and finance ministers in late February was more productive than anyone thought, and that maybe the joint communiqué calling for fewer beggar-thy-neighbor currency devaluations is a temporary truce of sorts. What would this truce look like? China agrees to give it the old college try one more time with domestic credit expansion and money printing, to replace feeble foreign demand for their products with goosed-up domestic demand and fiscal deficit spending. Europe agrees to lower its negative rates as little as humanly possible, and instead, concentrate on good old-fashioned asset purchases. The US agrees to sit on its hands for a while with any more rate hikes, and Japan agrees to sit on its hands for a while with any more rate cuts. Sounds like a plan to me.

So we’re in the early days of a perfectly investable rally, driven by a plausible Narrative of central bank cooperation on currencies. Reminds me for all the world of September 2007, right after every quant-oriented multi-strat fund in the world was gob-smacked in July and August (and if you’ve seen the returns for quant-oriented multi-strat funds this January and February you’ll get my point). We had an investable rally then, too, driven by the Bernanke Narrative that the subprime crisis was “contained” and that the real economy was just in a “mid-cycle slowdown”. All good, until Bear Stearns was taken out into the street and shot the following March. Which was itself followed by a perfectly investable rally from April to mid-summer 2008, under the pervasive Narrative that “systemic risk was off the table.” Until it wasn't.

So forgive me if I call this a temporary truce, an investable rally before the next “shock” that no one sees coming. Forgive me if I note that yet another FT puff piece on the unappreciated genius of Mario Draghi is ultimately small comfort given that we are smack-dab in the middle of an endemic of political polarization and anti-liberal sentiment (that’s small-l liberalism, of course, the Adam Smith and John Locke sort), the sort of political plague that the world hasn’t seen since the 1930s.

We are now in a world where principled politicians are called fascists, and fascist politicians are called principled. In most Western countries, we are one Reichstag Fire away from a complete up-ending of the core liberal principles of limited government and individual rights. At least, the ascendant candidates on the right have the guts, for the most part, to wear their authoritarianism on their sleeves. The other side of the political spectrum, equally ascendant, is no less anti-liberal, they’ve just adopted the façade of smiley-face authoritarianism.

Politics always trumps economics, and until someone can show me that the structural advance in anti-liberal politics is any less pronounced than the structural decline in global trade volumes, I can’t get away from my structurally bearish views about this market. Or about this world, for that matter.

So what do we do about it?

After all, as fictional gangster Hyman Roth patterned after real-life gangster Meyer Lansky, would say, “This is the business we have chosen.” It’s all well and good to bemoan the thin gruel we are served in modern politics and markets, but it’s the only food we’ve got, and we have a responsibility to make the most of it. I've got some ideas, but to be useful; these ideas need to fit the reality of the investment world and the business we have chosen. Let's talk about that for a minute.

I think that many investors, allocators, and financial advisors today find themselves in the position of Bobby Dupea, the character played brilliantly by a young Jack Nicholson in “Five Easy Pieces.” In that movie's iconic scene, Bobby just wants to get a side order of wheat toast with his breakfast at the local diner. But he is faced with what game theorists call a Hobson's Choice, which is part of a more general class of games that includes ultimatums and dilemmas. A Hobson's Choice is best understood as a strategic interaction where you are presented with what at first glance seem to be multiple opportunities for free will and free choice, but where in truth you only have a single option. Bobby has an entire menu to choose from, and the diner makes toast for sandwiches all day long, but it is impossible – despite a smart proposal of pair trades and long/short exposures that would isolate the wheat toast factor – for Bobby to get what he wants. He can have an omelet with a roll, or he can have nothing. Those are his actual choices.

A Hobson's Choice is Henry Ford telling you that you can have your Model-T in whatever color you like, so long as it's black. A Hobson's Choice is a Klingon telling you to surrender or die. A Hobson's Choice is Vito Corleone making you an offer that you can't refuse.

Today we have what appears to be a wide-ranging menu of investment strategies and ideas to choose from. But like Bobby Dupea, our true range of choices turns out to be terribly limited if we show the least preference for something that goes against the grain of conventional wisdom. Specifically, the dominant conventions of modern investment are "stocks for the long haul", "you can't time markets", "focus on the fundamentals", and "buy quality". Everything you order from the investment menu has these conventional items embedded within them, and the more you question the conventional wisdom (not that it's all wrong or a big lie, but simply to inquire whether the conventional wisdom is perhaps less useful in unconventional times, and maybe – just maybe – you might want to have some wheat toast with your omelet) the more you risk getting kicked out of the diner.

The Hobson's Choice that nearly every investor, allocator, or financial advisor faces today is always some variation of the famous quote from John Maynard Keynes: it's better for your reputation (i.e., your business) to fail conventionally than to succeed unconventionally. Every investment professional I've ever met – every. single. one. – wrestles with this dilemma. So do I. We've all seen examples of our portfolio results that the conventional tools aren't working. We know that the words we hear from our Dear Leaders and the articles we read from our Papers of Record are designed to manipulate and entertain us, not inform us. We want to succeed, and we feel in our gut that we should be trying something new and (maybe) better. But not if it means losing our clients or losing the support of our Board or losing the support of that little voice of convention inside each of our heads. It's that last bit that's probably the most powerful. As George Orwell was so correctly observed about human psychology, a terrifying part of hearing Big Brother say that two plus two equals five isn't that they might kill you for believing otherwise, but that you think they might be right!

And make no mistake about it, our Hobson's Choice is getting worse. Investing according to conventional wisdom has always been the reputationally safe decision, but in the policy-controlled markets to come, investing according to conventional wisdom may well be the only legally safe decision.

So here's what I'm not going to do. I'm not going to discuss "alternative strategies" that are always set off to the side in a little section of their own on an investment menu, intentionally organized and presented as if to say "Careful now! Here are some exotic side dishes that you might use to spice up your core portfolio a bit, but you'd be crazy to make a meal out of this ... not that we'd let you do that anyway." I'm not going to perpetuate the Hobson's Choice game and its charade of false choices and hidden ultimatums. Instead, I'm going to recommend alternative thinking about your portfolio here in the Silver Age of the Central Banker. I'm going to recommend five specific ideas – Five Easy Pieces – that challenge conventional wisdom and (I hope) will spark readers to think differently about their entire portfolio and investment process, not just whatever small slice of the pie is reserved for "alternative strategies."

Five Easy Pieces for the World-As-It-Is

Because this is how we escape a Hobson's Choice. We must look beyond the false choice. We must reject the ultimatum (act conventionally or risk your business) and find a new dimension that avoids the false choice entirely. This was the genius of Mad Men's Don Draper: "If you don't like what's being said, change the conversation." Or to use a far more trite and shopworn phrase, this is what "thinking outside the box" means – expanding our field of vision to incorporate not only the specific choice we're presented with but also the act of choosing. To escape a Hobson's Choice we can't look at the world as (x) OR (y), as a series of options we make from a menu that's handed to us. We have to step back and see the menu itself as a choice, that what we thought was (x) OR (y) is really (x OR y), and there's a big world outside of (x OR y). Expanding our perspective and changing our conversation changes everything. It allows us to re-engage in an entirely new way with whatever investment menu we might have in whatever our World-As-It-Is might be, such that whatever investment decisions we make are truly OUR choices, not THEIR choices. Maybe for the first time.

This is a good example of what I'm talking about. Investment convention holds that you should be fully invested throughout a market cycle. Otherwise, you must be—gasp!—a market timer. Boo! Hiss! If there's a worse insult in the investment world or a quicker way to get fired by your client than to be called a market timer, I'm not aware of it. And God forbid that you propose an "alternative strategy" that embraces market timing. But of course, we're ALL market timers; we just do it in a conventionally acceptable way by "shifting to defensive sectors" or "keeping our powder dry" or "managing risk" (whatever that means). We're all hypocrites when it comes to our professed faith in full investment because we don't believe in it. We all want to get out of markets when they're going down, we all want to get into markets when they're going up, and we all think that we have some insight into what's next.

And that, of course, is the source of the actual wisdom in this conventional wisdom. We don't have a crystal ball to predict whether the market will be up or down tomorrow or over the next week or the next month or the next year. We do have biologically evolved social behaviors that push us to sell low and buy high. Whatever you think you should do as a short-term trade, you're probably wrong. Left to our own devices, almost all of us are almost always better off to put our investments in a drawer, close our eyes, and walk away.

So here's the question. How do we change the conversation so that a rigorously conceived adjustment in portfolio exposure to risk assets isn't characterized as market timing? Because as soon as a strategy is characterized as market timing, then it's a Hobson's Choice situation, where you don't have a choice but to reject it. Now I'm not talking about reading ZeroHedge and selling because you got all freaked out by an article, and I'm not talking about watching CNBC and buying because you got all bulled up by a talking head. That IS market timing, of an indefensible sort. But is there a defensible sort of exposure portfolio adjustment, one that has a foundation strong enough to allow a non-Hobson's Choice implementation? My answer: yes. In fact, I think there are two such approaches.

First, markets are more volatile when countries are playing a Competitive game than when they're playing a Cooperative play. Now granted, this is a prediction of a sort, but it's a prediction of political dynamics – which is exactly what the game theory toolkit is designed to do – as opposed to a market prediction like whether the S&P 500 will be up or down next week. I think this is where Epsilon Theory can make a unique analytical contribution. The international political regime matters to markets. It matters a lot. I am convinced that we have entered a new, analyzable, competitive regime of domestically stressed nations, and that means that we have a deflationary hurricane brewing. What I don't know (yet) is whether this is going to be a Category 1 hurricane, a Category 3 hurricane, or a Category 5 hurricane. If China floats the Yuan – and that's the big catalyst I think has a decidedly non-trivial chance of occurring – then it's Category 5. If they don't, it's something less. But regardless, a Competitive global trade game is going to be a big storm. Trim your sails. Whatever that means to you and your investment process, whether it's increasing cash, reducing net or gross exposure, shifting to long-dated Treasuries ... whatever ... that's what I think you should do when the world plays a Competitive game. Does that make me a market timer? Well, if that's the conversation you're stuck in ... yes. But it's not the conversation I'm having, either with others or myself.

Second, although I can't predict future market returns, I can observe how volatile the market has been in the short, medium, and long-term past. It's that George Soros quote again: I'm not predicting; I'm observing. I can also tell you about my personal appetite for risk and volatility. Put these two items together and you have the foundation for a new conversation about investing, a conversation based on observable risk rather than predicted reward. Is observed volatility going up above a level where I am personally comfortable? Well, let's take my market exposure down. Is observed volatility going down below that level? Well, let's take my market exposure up. There are a dozen variations on this theme: call it risk balancing or risk parity or volatility targeting or whatever. But whatever you call it, I think it is a better way of staying invested in markets through thick and thin. Just less invested when thick and more invested when thin.

A systematic risk balancing strategy is at the core of what I have been describing as Adaptive Investing over the past two years. That and appreciation for the political dynamics that underpin markets creating different investment regimes as the game-playing moves from one equilibrium state to another. There is zero crystal ball gazing in a risk balancing strategy – zero. In that sense, it is entirely compatible with the investment convention of not trying to time markets. But the alternative thinking I'm suggesting here is that "full investment over a market cycle" works better if its risk being fully invested over a market cycle, not dollars. It's a new twist on an old idea, and once you start thinking of risk budgets first and dollar budgets second, everything changes.

The usefulness of the game theory toolkit isn't limited to understanding the dynamics of strategic interactions between international political players like central banks. It's also useful in understanding the dynamics of strategic interactions between market players. It's also the rigorous foundation for changing the conversation about another market convention: focus on the fundamentals. Are fundamentals important? Of course, they are. Knowing the fundamentals of investment is like knowing how to play the cards you're dealt in a poker game. But as any successful poker player will tell you, it's not enough to play the cards well. More importantly, you also have to play the player.

Wall Street players today aren't like a historical Jay Gould or a fictional Gordon Gecko, ruthless seat-of-their-pants robber barons with a great eye for arbitrage and leverage. To be sure, it's not the ruthless part that's missing today or the eye for arbitrage and leverage. No, what's changed from the past and what Hollywood still doesn't get is that the whole instinctive, seat-of-the-pants thing is entirely dead.

Wall Street players today are creatures of a process. They are Bill Belichick and Nick Saban, seemingly joyless automatons who do nothing but win (Roll Tide!) because they are monomaniacally focused on efficient process in every aspect of their organization and constant incremental adaptation to new information. It's not just the quants that have uniformly adopted a process-focused business strategy, but every successful investment firm, regardless of discipline or market focus. Ray Dalio at Bridgewater, certainly the most out-there proponent of Belichick-ian process discipline in the investment world, is best known for creating the largest hedge fund in the world. More interesting to me, though, is how the meme of the process and incremental adaptation – principally authored by Dalio – is now part of the internal Narrative of every investment firm on Earth. Note that I'm saying this meme is part of the Narrative of these firms, not their investment DNA. Like all good memes, the belief in process and incremental adaptation is principally an instrument of internal social control, part of the modern day Panopticon ("what, you don't believe in process? hmm, not sure that you're going to fit here."), as well as an instrument of external social expression ("you can trust us ... we're process-oriented!").

Why is this primacy of process so important for understanding market dynamics? Because it means that while there is no single mode of market participant behavior, no single way of playing the market game, there is an underlying dimension – a common behavioral denominator, if you will – of a prioritizing process and incremental adaptation. To torture the poker analogy a bit more, you have tens of thousands of poker tables in operation every day, with hundreds of different poker variations being played ... No Limit Texas Hold 'Em here, 5 Card Draw there, etc. Some players have big stacks, some have small stacks, some play tight, some play loose. But they are ALL process-oriented players. They are ALL watching each other and the cards closely, they are ALL reacting to each other and the cards in an incremental process-oriented way, and they are ALL "learning" in an incremental process-oriented way.

I don't think you have to be a poker expert to recognize that there's game-playing power to be found in the recognition of a common behavioral denominator, no matter how deeply it runs. In truth, the deeper it is, the more powerful it is. This is the structural reason the Common Knowledge Game is such a useful way to analyze market dynamics in the modern age. The market-playing crowd is always looking at the market-playing crowd, and the crowd is hardwired – not by biology but by business process – to "learn" a similar reaction to similar Missionary statements.

This is also the structural reason I believe trend-following strategies are so interesting and effective in modern markets. In a very real sense, all of these process-focused and iteratively-learning investors are themselves augmenting whatever initial stimulus they're all looking at, creating trends where none was present before. If you've never read George Soros's "Alchemy of Finance," now might be a good time to start. What's perhaps even more interesting – and this will have to be a tease because it deserves several Epsilon Theory notes on its own – is whether it's possible to design a learning-following investment strategy. Now that would be something.

Okay, this is a big one. What is a negative carry? It's time working against you. It's the price you pay to carry or hold a position. Investors HATE negative carry because almost all investment conventions are based on the assumption that time works for you, not against you. What's the basis of "stocks for the long haul"? Time working for you. What's the basis of compounding, which is nothing less than the most powerful investment idea in all of human history? Time working for you. What's the basis for retirement planning, saving, and – in a very real sense – the entire concept of investment? Time working for you.

The damaging impact of negative interest rates on bank earnings and all that is very true and very real. But far more damaging is the impact of negative interest rates on these basic IDEAS about what it means to be an investor in public markets. If you see the world as principally a market of ideas and memes, rather than as a market of capital and labor – and this is exactly the perceptual lens I'm trying to explore with Epsilon Theory – then I don't see how you can't be freaked out by what's happening today. Certainly it's why I've gotten much more alarmist over the past few months in what I write. We are seeing huge chunks of stone being taken out almost daily from these central idea pillars of public markets. As market participants lose faith in the idea that time is on your side, as they start to question the idea that there's an inherent up-and-to-the-right arrow to any price-over-time chart ... the entire financial advisory world is going to burn.

So what do you do?

I suggest we start thinking like a short seller. We don't have to BE short sellers, but we all need to THINK like short sellers. Why? Because short sellers naturally live in a negative carry world, both in their investments and their ideas. Dividends and yield-bearing securities constantly chip away at the value of a short seller's portfolio. Similarly, the long-biased information flow promoted by corporate management and the sell-side constantly chips away at the investment theses embedded in a short seller's portfolio. Time always works against a short seller (particularly in a zero or negative interest rate world … boy, do I miss the 5% interest paid on the cash generated from borrowing shares), and successful short sellers have learned to think differently as a result.

1) If you're wrong on timing, you're just wrong. A successful short seller focuses on near-term catalysts, and that's precisely the focus that I think most investors could adopt, or at least incorporate, in this environment. If there's no catalyst to force investors to recognize the value that you think exists in stock, then it doesn't exist. When a short seller reads a sell-side buy recommendation that begins with something like "For the patient, long-term investor..." they almost always look to short the stock, because it almost always means that the near-term catalysts are very negative for the company. But by the same token, a long-biased investor who thinks like a short seller is happy to buy a company with near-term positive catalysts even if the long-term prospects don't look so great. In fact, that's exactly how I would characterize risk assets in general today – structurally awful in the long-term as global trade and global cooperation and the idea of a positive risk-free rate and the liberal tenets of free markets die a little more every day, but with positive short-term catalysts as central bankers and their sell-side apologists rally the troops one more time. Every position is a rental if you're thinking like a short seller. Nothing is owned.

A catalyst-oriented, everything-is-a-rental way of thinking sounds easy, but it's the hardest thing you'll ever do. It's hard because it's utterly unforgiving. Meaning, you can never forgive yourself. Here are the two thought processes that have ruined more catalyst-oriented investors than anything else:

"Huh? No price reaction yet to this realized catalyst that I so brilliantly anticipated? Well, I suppose the market just needs a little more time to absorb its importance."

"Golly, the earnings call just ended and the company didn't make the announcement I thought they would. Oh, well, I'm sure they'll announce it next quarter."

Bzzzzt! Sorry, that's our tacky buzzer, and you've just been eliminated from the game. When the catalyst happens – whether or not it impacts the price of the stock or bond like you think it should – you get out. If the time frame or event frame for the catalyst expires – whether or not the catalyst occurs – you get out. Thinking like a short seller means no excuses, particularly in the easiest place to make excuses – inside our heads.

2) The question that matters: is the story broken? I've written about this at length, so I won't repeat all that here. But I'll give you an example of a story that ALWAYS breaks in a squirrely market: financial engineering. If you're long a company because "management is buying back lots of stock" or "there's a tax-advantaged spin-out possible here" or something similar ... well, good luck with that in a risk-off environment. I'm not saying that financial engineering is bad. On the contrary, I love financial engineering. Seriously. It's an incredibly powerful tool for potentially making money. What I'm saying is that a financial engineering STORY is inherently pro-cyclical – it always works better than you expect in a rising market and worse than you expect in a declining market. Stock with a weak story will go down a lot more than what's "fair", and that's a very unpleasant ride. Fortunately, all stories heal, and all stories evolve, which makes for some potential buying opportunities. But you won't recognize those opportunities (or you'll probably butcher the timing) unless you're focusing on what matters – the story.

So what strategies inherently "think" like a short seller? Managed futures and trend-following, for sure. Everything is a rental for a trend follower, by definition, and trends – because they are created by market behaviors, not the underlying qualities of a company – are inherently linked to the stories and narratives that shape behavior. More basically, any trader and any trading strategy tend to think like a short seller, and I believe there's room for these strategies to work in markets dominated by a Competitive international game. Ditto for some global macro strategies. Doesn't mean any of these strategies will work, of course, only that they possess what I think are some of the necessary qualities (as opposed to the sufficient conditions) to succeed.

But when I say it's important to think like a short seller in a negative carry world, I don't mean that we have to go out and hire short selling managers. Because I will tell you that there are plenty of short-sellers who think like long-only guys, and are thus the worst possible discretionary managers to turn to in this environment. The crucial action, though, and it's an action we can all take inside our heads even if we're not able or not allowed actually to do short selling, is to step back and reconsider all of our investment menu choices if time no longer works so clearly in our favor. That's the existential issue every investor, allocator, or advisor needs to wrestle with, no matter how painful that is. Otherwise, to use Ken Kesey's phrase from "One Flew Over the Cuckoo's Nest," you're choosing to let yourself be lost in the fog. And that's a Hobson's Choice of an entirely different sort.

I’m pretty sure that I was the first to come up with the phrase “Central Bank Omnipotence.” It was in one of my very first notes – “How Gold Lost Its Luster, How the All-Weather Fund Got Wet, and Other Just-So Stories” – back in the summer of 2013, a note that even today remains one of the most popular in the Epsilon Theory canon. For the next six months or so, however, I would go around and talk with institutional investors about the Narrative of Central Bank Omnipotence – that markets acted as if central bank policy determined market outcomes – and I got enormous pushback. No, no, I heard, we’re on the cusp of a self-sustaining real economic recovery here in the US, and whatever the Fed and other central banks are doing, whatever the market reaction might be, it’s just a bridge to the happy days of “normal” markets ahead. And this is after the Taper Tantrum, mind you. It really wasn’t until the spring of 2014 that the steady drip, drip, drip of the Central Bank Omnipotence meme became a tsunami, and by the fall of 2014 it was impossible to find anyone who didn’t believe in their heart of hearts that Central Banks, for good or for ill, determined market outcomes.

I bring this up because I've read lots of suggestions, particularly after the one-day half-life of effectiveness for Kuroda’s negative rates announcement on January 28 and the one-hour half-life of effectiveness for Draghi’s negative rates announcement on March 11, that the Narrative of Central Bank Omnipotence is dying. But then you get a day like March 12, where the Narrative engine springs to life in support of Draghi's "bold move", and now I read that the Narrative of Central Bank Omnipotence is alive and well.

Here's what I think. As the strategic interaction between the four largest economies in the world shifts from self-enforced cooperation to self-enforced competition, from a Golden Age to a Silver Age, so does the market's Common Knowledge or Narrative regarding that strategic interaction. But it doesn't die, any more than the strategic interaction dies. Think of it as the same song, but now in a minor key. So long as every CNBC talking head genuflects in the direction of central banks in every single conversation, so long as front page articles about central banks dominate every day's issue of the WSJ and FT ... then the Narrative of Central Bank Omnipotence is alive and well. The power of the Narrative is that we believe that all market outcomes are somehow the result of central bank policy, not that central bank policy necessarily generates a good or even intended market outcome. It's a narrative of Omnipotence, not Competence or Omniscience. The day that central bankers give up, the day that Yellen or Draghi appears on stage and says, "Well, there's nothing more we can do. It's just out of our hands now. Sorry 'bout that." ... that's the day that we lose our religion and the Narrative dies.

Ultimately, we’re no closer to “normal” markets driven by fundamentals here in the Silver Age of the Central Banker – the age of strife and competition – than we were in the Golden Age of the Central Banker – the age of cooperation and great deeds. In fact, we’re farther away than ever. It’s a policy-driven market just as far as the eye can see.

Policy-driven markets change the rules, both the formal rules of regulation and – more importantly – the informal rules of correlation and they change these rules in predictably surprising ways. That is, the regulatory rule changes will always be surprising to the left or surprisingly to the right, never what you might expect by a tendency central theorem. That goes for correlation surprises, too. Both tails are equally fair game for a shock. I mean, the euro had a four percent trough to peak move on March 11! Two percent down and then two percent up. You think that didn’t blow up some correlation and volatility trades?

When I say don't trust the models – and by models I mean pretty much of all mainstream portfolio and investment analysis, basically anything that says "Here's a pattern we observe for some period of time over the last 40 years, and now we're going to extrapolate what the future holds because of that observed pattern." – I mean two things. First, we haven't had a policy-driven market like this since the 1930s, so whatever historical data was used to power whatever model you're using needs to be taken with a grain of salt (read "I Know It Was You, Fredo", "Inherent Vice", "Funny How?", and "Ghost in the Machine" for more, and, of course, you can read anything by Nassim Nicholas Taleb or Benoit Mandelbrot for the same message presented in book form). Second, investors are not only risk/reward maximizers, but they also regret minimizers. Almost all of modern econometrics, particularly portfolio analysis, is an exercise in risk/reward maximization and thus fails to connect with investors who are focused on concerns of regret minimization (read "It's Not About the Nail" for more).

What this means in practice is that most portfolios are too flabby in what I’ll call the Big Middle – the large portfolio allocation that most investors, large and small, maintain in large cap stocks. The easy way out when it comes to investment conventions and the Hobson's Choice we all face when it comes to portfolio construction is always to add more S&P 500 exposure. The old IT's saying used to be that no one ever got fired for buying IBM, and the current financial advisory saying should be that no one ever got fired for buying more Apple. Although maybe they should.

I'm not saying that capital invested in the Big Middle must always be reallocated to make for a more convex, more diversified portfolio. But I am saying that every bit of your portfolio should be purposeful.I am also saying that there's a lot of wisdom for investing in what Plato said about politics almost 2,500 years ago (and he was quoting a guy who lived 400 years earlier), that the half is often greater than the whole. Meaning? Meaning that you get better outcomes when half of your citizens or half of your investments are organized efficiently and with right purpose than if all your citizens or all of your investments are arranged haphazardly or without common purpose. Or for a more modern slant, I like George Carlin's take, which while some see a glass half-full, and some see a glass half-empty, he sees a glass that's twice as big as it needs to be. Many portfolios are twice as big as they need to be. Not in dollars, of course (may your portfolio get much larger in that regard), but concerning inefficient, mushy allocation to low risk, low reward, highly correlated investments.

What goes into a purposeful portfolio in the Silver Age of the Central Banker? A lot of optionalities, for one thing, which does not necessarily require expression through options and derivatives (although that certainly makes it easier) and is another way of saying convexity. A keen sense of correlation and correlation change, for another, which does not necessarily require expression through covariance matrices (although that certainly makes it easier) and is another way of saying diversification. While the terms can be daunting, the logic and practice aren't so much. Like thinking regarding a risk budget instead of a dollar budget, it's more of a matter of perspective than anything else.

One exercise I find useful is to think of different future scenarios for the world (not because I'm trying to predict which one will happen, but precisely because I can't!) and then to consider how my current exposures and strategies are likely to fare in those futures. My goal isn't to figure out the scenario where I think I'll do the best because then I'll start hoping for it and consciously or unconsciously will start to assign a higher probability of it occurring, but to figure out the scenario where I'll do the worst(both in absolute terms and relatively to whatever I compare myself to). I'm trying to minimize my maximum regret – minimax regret, a powerful game theoretic tool for dealing with technical uncertainty, where you're not sure that you've identified all the potential outcomes, and you're certainly not sure of the probability distribution to assign to those outcomes – and I do so by planting seeds (buying exposure with either embedded or overt optionality) in that least happy scenario. I find that this iterative, new information-friendly exercise changes the conversation you can have with others or yourself, away from a needlessly daunting conversation on risk/reward maximization and towards a more fruitful conversation on being an investment survivor in a decidedly dangerous time.

And now for the big finish.

Last summer I wrote a note called “The New TVA,” which made a direct comparison between the political dynamics of the 1930s and the political dynamics of today. What amazes me (still), is how the political conversations then are almost identical to the political conversations now.

Just switch out FDR for Obama and you could easily imagine this cartoon being about healthcare or some such rather than New Deal legislation.

Here's the skinny on that note: in the same way that FDR had an existential political interest in generating inflation and preventing volatility in the US labor market, so does the US Executive branch today (regardless of what party holds the office) have an existential political interest in generating inflation and preventing volatility in the US capital markets. Transforming Wall Street into a political utility was an afterthought for FDR, a nice-to-have but not a must-have, as Wall Street was not yet a Main Street phenomenon. Today the relative importance of the labor markets and capital markets have completely switched positions. Wall Street is now decidedly a Main Street phenomenon, and every status quo politician – again, regardless of party, and let's remember that the Fed is part of the Executive Branch – keenly desires to keep the genie of unfettered fear and greed firmly stopped up in its bottle. Georges Clemenceau, French Prime Minister before and after World War I, famously said that "war is too important to be left to the generals." Today, the quote would be "markets are too important to be left to investors."

But it was only after Draghi's ECB announcement last Thursday that I think I see how a policy-driven market becomes a policy-controlled market. The ECB took a page from the Bank of Japan's playbook and announced that they would now buy non-bank investment grade corporate credit as part of their QE asset purchases, and that's at least as big of a deal as the BOJ taking a page from the ECB playbook in January and adopting negative interest rates. When two of the Big 4 adopt any policy, a point becomes a line, and an idiosyncrasy becomes a pattern. The direct purchase of corporate securities by central banks is now in the official tool kit of every central bank. You cannot un-ring this bell. It is a "Goodfellas moment" of enormous consequence.

In one fell swoop, Draghi has essentially made useless the most effective portfolio hedge I know against systemic risk – shorting investment grade credit through the CDS market. And he conceived this plan when senior bank debt CDS spreads (the best indicator of systemic risk levels I know) were only 120 bps wide! Imagine what's going to happen the next time spreads blow out to 200 bps wide, much less if we ever got close to the 350 bps spread of 2011. My point, of course, is that Draghi isn't going to allow CDS spreads to blow out again. Ever. Not even a little bit. The ECB will intervene directly in credit spreads from here to eternity, first in sovereign debt, now in non-bank corporate debt, tomorrow in bank corporate debt. That's how a policy-driven market becomes a policy-controlled market, not by outlawing short sales or credit default swaps, but by sitting down at the poker table with an infinitely large stack of chips relative to any other player. The ECB can now run over anyone who sits down at the European corporate credit poker table. Thanks, but I'd rather not play, no matter what cards I'm dealt.

So if I can't protect my portfolio through effective shorts, and the Powers That Be are determined to turn public markets into political utilities, but I'm structurally bearish on the ability of the Powers That Be to prevent domestic political shocks and international political conflict of 1930-ish proportions, what's to be done with public market investing other than the occasional short-term trade? Two things, I think.

First, I think it makes sense to use public markets for their liquidity and for tapping whatever this utility-like rate of return the Powers That Be have in mind. But I also think it makes sense to tap global beta through risk balancing strategies, because I do think we're in for a bad storm, and I don't trust Captain Yellen or Captain Draghi to guide the ship for my benefit rather than their political benefit. As for any effort to find alpha in public markets? Forget it.

But, Ben, what about stock picking? Yeah, what about stock picking? You can read the S&P scorecard here. How did that actively managed US equity fund work out for you last year? Or the last five years? Or the last ten years? Here's my issue with stock picking. Most stock pickers look at companies pretty much exclusively through the lens of "quality" – a quality management team, a quality earnings profile, a fortress balance sheet, etc. Unfortunately, this is the worst possible investment perspective to use in a policy-driven market, much less a policy-controlled market. It does not outperform a broad passive index. It does not generate alpha. Again with the George Soros quote: I'm not expecting it; I'm observing it. I know, I know. Heresy. But ask yourself this. Do you think that the mandarins of the Fed or the ECB or the BOJ care one whit about whether this company or that company has a higher stock price? Of course not. They want ALL companies to have a higher stock price, and as a result, the policies they are going to implement will inevitably help the weakest, lowest quality companies the most. Now if investing in quality-uber-allies is the conventional conversation you need to have to justify participating in public markets, I get it. But to me, it's just another form of fighting the Fed, and for me it's always a losing conversation.

Second, I think it makes sense to use public markets if that's the best way to own real assets. Why have real assets? Because while nothing is immune to the predation of illiberal governments and the capricious rulemaking and rule-breaking of central banks, real assets are at least insulated from both. What have real assets? I have a very broad definition, including not only the obvious suspects like real estate and infrastructure and commodities but also gold and intellectual/digital property. I think of gold as very similar to many forms of intellectual property, as its worth is found in behavioral preferences and affect, not in some particular or commercial use case.

All real assets are not created equal, of course. I'd much rather own an asset that generates some cash flow than one that just sits there, but the price will usually (although not always) take care of that differentiation. The most important consideration, I think, particularly when using public markets, is to get as close as you can to the fractional ownership share in the asset itself and as far away as you can from the casino chip. What that means in practice is getting as high up in the capital stack as you can while still having an equity claim on assets. For a highly levered or distressed company that probably means being in the senior secured debt. For a more typical company that might mean being in the preferred equity shares, if they exist, or choosing between this company's equity and that company's equity. It's making this sort of evaluation where I think that active managers, whether it's in equity or fixed income, can prove themselves, and where I think there's a role for fundamentally-oriented, stock-picking active managers. It's not because I think they can stock pick their way to outperformance versus a passive index while we're in a policy-driven or policy-controlled market, but because I believe that they can identify a margin of safety in my public market ownership of real assets and real cash flows better than a passive index. Now that's a conversation worth having with active managers here in the Silver Age of the Central Banker.