Raising taxes is the "solution." Too bad incomes are declining. What will raising taxes do to household savings, spending and the economy?

We all know cutting Federal spending is politically impossible, so that leaves raising taxes as the only "solution" to the "fiscal cliff."

Since most income tax revenues flow from household income, let's look at some charts of the workforce and household income:

As a percentage of the population, the workforce has contracted to levels of the late 1970s.

As a percentage of national income, labor's share is in a free-fall:

Hourly earnings have been trending down for years:

Income for every age group other than 65+ seniors has declined sharply:

The income of those in their peak earning years 45-54 have been slammed:

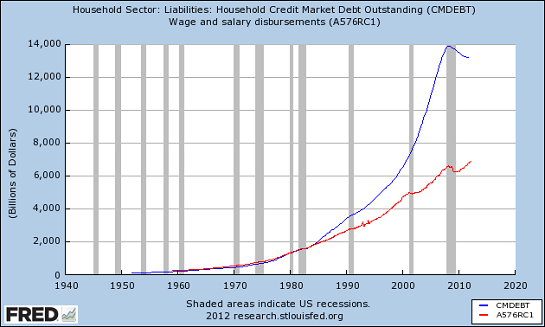

Household debt loads have soared far above wages:

Meanwhile, government expenditures are up, up and away:

Yes, I know: the solution is to "tax the rich." The Problem with "Tax The Rich": It Won't Work (May 28, 2010)

Will "Tax the Rich" Solve Our Deficit/Spending Crisis? (December 28, 2011)

Do the Parasitic Elite Pay Any Taxes? (June 13, 2012)

The parasitic Elites should certainly pay as much as the heavily taxed middle class (The Real-World Middle Class Tax Rate: 75% (July 5, 2012), but since the parasitic Elites have captured the machinery of governance, the chances of Congress actually raising taxes on the top 1/10th of 1% are nil.

There will be noises made, of course, for perception management and public relations, but when April 15th rolls around we will find tax revenues are stagnant: loopholes and tax breaks will have blossomed like mushrooms, magically enabling the parasitic Elites to escape any serious reduction in their income.

Even if we were able to squeeze some additional taxes out of the parasitic Elites, their income stream is dwarfed by the Federal spending that looms ahead: The Fiscal Cliff and Demographic Drag. The top 1/10th of 1% cannot pay the rapidly expanding Federal benefits of the 99.9%, even if we confiscated every dollar of their incomes.

How can tax revenues increase when household incomes are declining? Transfer more of the national income to taxes and that leaves less for savings, investment and consumption. The economy contracts, reducing the workforce and wages further.

If that isn't a death spiral, it is a close approximation of one.

Source: Of Two Minds