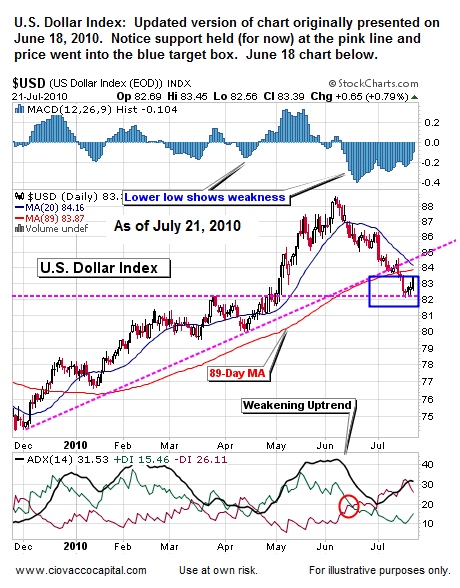

On June 18, 2010, we presented the second chart below, which stated a move back toward 83 in the U.S. dollar was possible. This morning (07/26/10) the U.S. dollar is trading at $82.27 (7/21 close shown in first chart). Ben Bernanke recently told the Senate Banking Committee, “We remain prepared to take further policy actions as needed to foster a return to full utilization of our nation’s productive potential in a context of price stability”. This means the Fed stands ready to take further action to support the economy and asset prices. You may think there is nothing the Fed can do with interest rates already near zero, but with deflation a real threat, the Fed has a few tricks left up their sleeve. The dollar may end up being the sacrificial lamb.

U.S. Dollar as of July 21, 2010

The Fed is a wild card in making portfolio decisions in the coming weeks and months. Let’s use an example to illustrate. Let’s assume, hypothetically, the S&P 500 falls to somewhere between 945 and 1,000. As we approach these levels, the threat of deflation starts to become very real. The average investor, driven understandably by fear, sells their entire portfolio moving to 100% cash. The next day, the Fed announces they are no longer going to pay interest on bank reserves held at the Fed (to encourage lending). Stocks rally, but the incoming economic news continues to disappoint. Ten days later, the Fed announces a new asset purchase program to pump more money into the economy. Commodities rally strongly; stocks rally; gold and silver rally; the U.S. dollar tanks. Driven by the Fed’s actions (right, wrong, or indifferent), the S&P 500 finishes the year between 1,200 and 1,325. Investors who sold out between 945 and 1,000 on the S&P can’t sleep at night. Some investors, who knew the Fed would not remain on the sidelines as the threat of deflation rose, held their positions and breathed a sigh of relief as they began to wrap holiday gifts in December of 2010.

U.S. Dollar as of June 18, 2010

The above scenario is not a forecast, it is simply a scenario investors must understand and respect in the present day. We firmly believe the Fed will not remain on the sidelines if asset prices begin to fall rapidly again in the next few weeks. In the longer-term, we believe this “solution” will fail as inflation eventually will eat into corporate profit margins. However, a bigger than anticipated rally in risk assets could occur in the meantime. If you do not consider this hypothetical scenario to be a realistic possibility, we suggest you use the link below to Chairman Bernanke’s remarks from November of 2002, “Deflation: Making Sure “It” Doesn’t Happen Here”. The following appears on our Inflation vs. Deflation page:

At a time when interest rates are near historic lows around the globe, it is important to understand possible nontraditional ways for policymakers to fight deflation. These 2002 comments made by then Fed Governor Ben Bernanke outline in detail Federal Reserve options in a low interest rate environment. It may help us better understand the possible range of Fed actions in the next 24 months.

After you read the paper above, you may want to consider how commodities, like gold, silver, oil, and copper, may fit into your future contingency plans (as hedges against a falling U.S. dollar). In our view, there is quite a bit of “Fed risk” to short positions in the current market. The Fed can announce anything at anytime; and they most likely would do so when the markets are closed, giving the shorts little or no time to prepare. The odds are probably greater than 50% we will see some type of non-standard move by the Fed in the next six to eight weeks. We have to build those odds into our portfolio management decisions. We are not making predictions; we are simply trying to understand all possible scenarios and outcomes. Some additional market developments are outlined in Short Takes.