Now that the elections and the Fed meeting have passed, the market is focusing more on fundamental issues. The next bearish driver for risk assets could be Ireland and Greece-like concerns related to Irish debt. Risk aversion may provide investors a reason to flock back to the “safe haven” of the U.S. dollar for a time.

According to Bloomberg:

While Ireland has the funds to avert the need for an immediate rescue, its cash may run out in the middle of next year unless it can raise money from the bond market in 2011. Ireland led a surge in the cost of insuring sovereign debt to a record on Nov. 5 as the government struggles to convince investors it won’t be the next Greece, whose economy was rescued by the EU and International Monetary Fund in May.

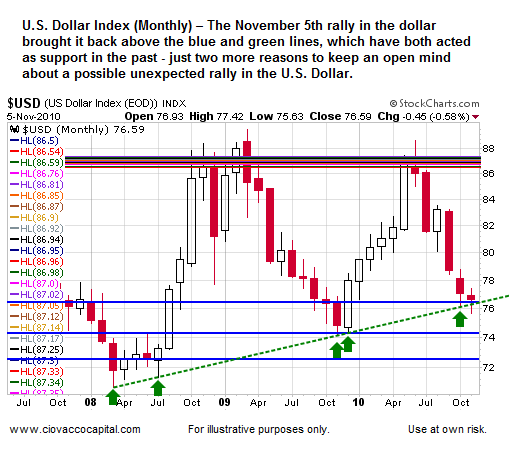

While the long-term fundamentals related to the U.S. dollar (UDN) remain bearish, Friday’s significant rally in the greenback leaves the door open for a possible countertrend rally. The conditions highlighted below may be cleared in a matter of days, but as of the close on November 5th the dollar remains susceptible to a surprise countertrend rally.

As shown below, a short-term bullish divergence remains in place between price and the dollar’s relative strength index. The condition can be cleared if RSI drops over the next few trading sessions. A trendline from December of 2009 is also in a position to lend possible support to the dollar (see blue line).

If we move to a broader timeframe using a monthly chart, we see the trendline extends all the way back to 2008 (see green dotted line). A trendline on a monthly chart is more significant than one on a short-term daily chart.

The dollar’s daily chart is also showing some potentially bullish divergences. While the U.S. Dollar Index recently made a lower low, several technical indicators have not followed.

The chart below contains several indicators that continue to support a possible short-term rally in the dollar. ADX (shown at the bottom of the chart) is of particular concern. According to Dr. Alexander Elder in Trading For A Living:

When ADX rallies above both directional lines (red and green), it identifies an overheated market. When ADX (black line) turns down from above both directional lines (red and green), it shows that the major trend has stumbled. It is a good time to take profits. If you trade multiple contracts, you definitively want to take partial profits.

Notice how well Dr. Elder’s comments relate to the recent action in the U.S. dollar. The black ADX line recently turned down from above both the red and green directional lines, which is a textbook red flag relative to a possible change in trend from down to up.

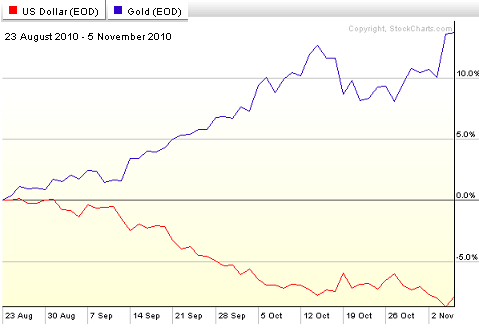

Many believe, including us at CCM, the current rally off the summer lows was sparked mainly by the expectation the Fed would print more money. The chart below shows as the U.S. dollar (red line) began to weaken again in August of 2010, weak dollar assets, like gold (blue line), began to rally. If the dollar rallies, then weak-dollar assets may consolidate for a time or experience pullbacks. Our concern is correlation risk between the dollar, gold, silver, oil, and copper.

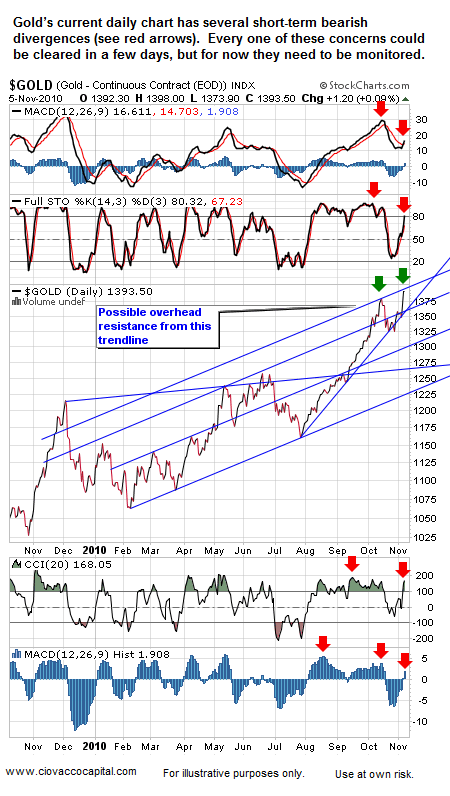

Gold has rallied again recently, but not in a convincing manner thus far. Divergences and overhead trendline resistance (blue line), could come into play, especially if the dollar rallies.

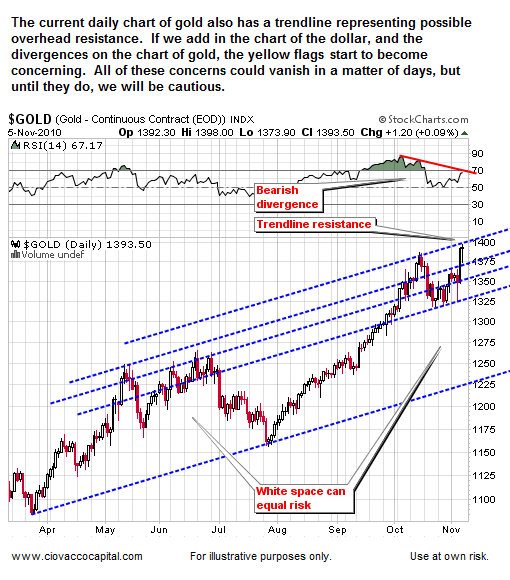

Below is a similar look highlighting the trendlines in gold and the short-term divergence in RSI which has not yet been cleared.

Our concerns extend to other inflation-protection assets, like copper. These divergences do not mean copper and gold cannot advance, but they do mean the downside risks have increased relative to the upside potential, as least for the short-term.

Could the dollar continue to fall? Yes. Could gold, silver, copper, and oil continue to rise? Yes, but we have to decide how much risk we are willing to take in order to seek additional gains. While we still hold gold, silver, and copper, our decision to reduce our exposure to these assets was based on deteriorating short-term, risk-reward profiles. When the conditions outlined above are no longer present and the risk-reward profiles improve, we will revisit our exposure to inflation-friendly assets. As we outlined in the FSO post Misunderstood QE Focuses on Asset Prices, Not Banks, we believe the Fed's money printing policies favor a lower dollar and higher commodity prices, but contertrend rallies are to be expected from time-to-time.