Since the market bottomed on October 4th, the S&P 500 has rallied nearly 14% in less than two weeks. Given the strength of the rally one would expect to see other markets confirm such a dramatic move. However, this is not the case as the credit markets do not show the same enthusiasm with credit spreads still elevated in the face of economic and financial risk. One of these markets is wrong and one is right, with resolution ahead.

Mixed Messages

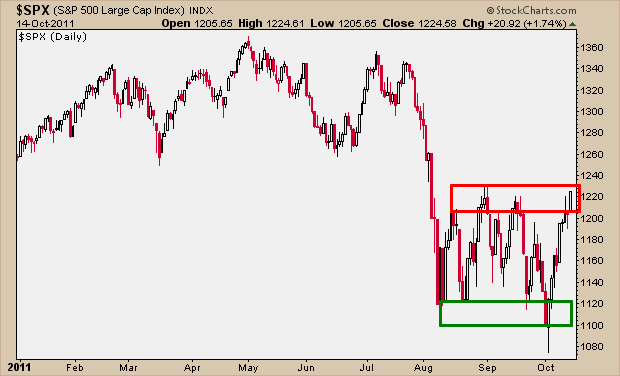

After today’s close the S&P 500 has retraced a fair amount of its prior decline and is now back up to the top of its trading range since August, and is down 2.63% year-to-date. It seems hope springs eternal as rumors of Europe taking swifter action ahead of their banking and sovereign debt crises gives the global equity markets a bid. It will be interesting to see what the S&P 500 does from here as it is bottom-up against resistance and some kind of pullback should be expected. (Click any image to enlarge)

While the markets advance over the last two weeks has been perceived by many to give the all clear in terms of European financial risk or a US recession ahead, I wouldn’t be so sure. What should give investors pause is that leading economic indicators often act coincidentally with the stock market, meaning they tend to move in concert as both discount future economic trends. Thus, when they do not move in harmony it typically means one of the two is about to play catch up with the other.

Shown below is the Economic Cycle Research Institute’s (ECRI) Weekly Leading Index (WLI) which shows a negative 9.6% smoothed growth rate, a level last seen in the mild 2001 recession as well as in early 2008 and the middle of 2010. With readings this negative it isn’t surprising the ECRI is calling for another recession (“U.S. Economy Tipping into Recession”), their first recession call since 2008. While many were calling for another recession last year given the weak WLI, ECRI actually stated we would skirt a recession as their longer-leading indicators were still heading up. Now their WLI, which is more of an intermediate indicator, is moving in the same direction as their long-leading indicators with both heading south, which is why they are making a high-conviction recession call this time around.

As seen above, the two prior periods of divergence proved to be key turning points in the market. In 2007 the WLI continued to head south while the S&P 500 rallied into October. Closing out the year the S&P 500 caught up with the WLI as it was correctly forecasting a major turn in the economy ahead of what the S&P 500 was discounting. Likewise, at the end of the last bear market and recession the WLI bottomed in 2008 ahead of the March 2009 bottom in the S&P 500 and was forecasting future improvement in the economy. Last year when the S&P 500 rallied after its summer correction, so too did the WLI which confirmed the market’s move. So, the fact that the S&P 500 has rallied nearly 14% since its low earlier in the month and yet the WLI has continued to decline should give equity investors pause as the two have, once again, diverged.

Not only are leading economic indicators not confirming the stock market’s move, neither are the credit markets. Shown below is the S&P 500 on the top panel and below are several bond market credit spreads, inverted for directional similarity. As you can see, last year when the stock market advanced after its summer correction various bond spreads began to contract to signal credit risk was easing. Credit risk began to pick up again in the middle of this year just as the stock market was peaking. Please note, however, that while the S&P 500 has been in a trading range since August, each rally we've experienced has not been confirmed by easing credit spreads, leading to a subsequent failure to breakout of the trading range in each case. Since the S&P 500 peak this summer, we have just witnessed one of the largest uninterrupted rallies, and since we have seen virtually no improvement in credit spreads, I think this rally is highly suspect and investors should remain cautious.

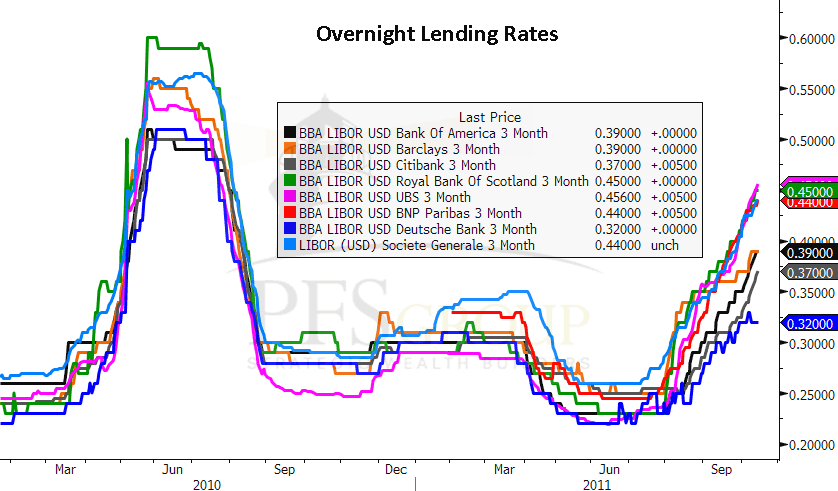

In addition to bond market credit spreads not confirming the stock market, neither are bank overnight lending rates which continue to rise even in the face of a sharply rising stock market. Back in June 2010 overnight lending rates peaked as credit risk began to stabilize and then in July and August overnight lending rates plummeted and global financial risks began to subside. This time around overnight lending rates for European and U.S. banks continue to climb and show no sign of stabilization.

Until we see the leading economic indicators and the credit markets singing the same tune as the stock market, the recent stock market rally should be viewed with a great deal of skepticism.