As highlighted last week (08.22.07 Market Observation), the housing recession has spilled over, affecting consumer spending levels. This negative spillover will only intensify as the adjustable-rate mortgage (ARMs) reset peak still continues later in the year. This is coming at a time where the state of the economy and consumer are worse off than in prior recessions.

What has been in the mainstream news over the past month is the stunning credit erosion, where toxic subprime mortgage-backed securities (MBS) have been illiquid and are leading to substantial losses, not only in the US but also abroad.

In response to the frozen market for subprime MBS's, the Fed stepped in as buyer of last resort through the Repo (repurchase agreements) market by shifting the assets it takes as collateral for short-term loans away from agency securities and treasuries to MBS's.

Fed action over this past month in the MBS market has been quite large as seen below, where Fed Repos of MBS surged in August with peak MBS repos on August 10th of $38 billion dollars and $16.3 billion on August 16th, and $118.3 billion cumulative since July 23rd.

Not only was the amount of MBS repos by the Fed large but also the percentage of the total Fed repo market that MBS's make up. This shift in Fed purchases occurred just a few days after the markets began their recent correction on July 23rd. Fed repos of MBS's on July 23rd and July 24th were 0% of total repo purchases and surged to 98.4% on July 27th. Fed repos of MBS's remained elevated and have picked up again, representing 100% of the repo market operations yesterday with the more than 250 point sell off in the Dow Jones Industrial average.

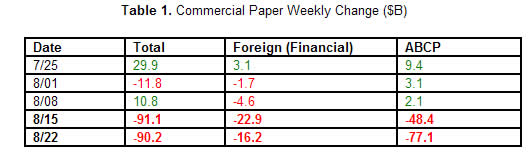

The credit crunch has now spread beyond the MBS market to the commercial paper market. The Federal Reserve releases a weekly compilation of commercial paper outstanding every Thursday (Click for link). Since the July peak in the markets, there has been a sizable decrease in the total commercial paper outstanding. In the last two weeks alone the amount of total commercial paper outstanding has fallen 1.3 billion. Of that 1.3 billion, .1 billion has been withdrawn in foreign financial commercial paper (indicating the crunch has spread globally), and .4 billion reduction seen in asset-backed commercial paper (ABCP).

With a seizure in the commercial paper markets, the Fed cut the discount rate from 6.25% to 5.75% on Friday August 17th, a day after the Fed released the commercial paper report showing .1 billion withdrawal from the commercial paper markets.

The withdrawal of funds from commercial paper since the markets sold off in the middle of the month has moved into short-term treasuries in a dramatic flight to quality as seen in the chart below, showing the S&P 500 correcting while interest rates fell sharply (bond prices rose). The plunge in the yield for 3-Mo T-Bills was the sharpest decline since the stock market crash of 1987.

Figure 3

Source: StockCharts.com

Credit Erosion

The source for all of this financial market instability has been the erosion seen in credit, which first surfaced in the subprime market earlier this year. The housing recession appears to be picking up momentum with no signs of a bottom.

The Mortgage Bankers Association of America (MBA) released their mortgage applications survey today which not only shows that housing has yet to bottom, but also deterioration in the mortgage market is ongoing, especially in adjustable-rate mortgages. Commentary and data by Patrick McPherron from Moody's Economy.com are provided below:

MBA Mortgage Applications Survey

The subprime fallout is fast becoming toxic to the market, as ARMs benchmarked on 1-year Treasury notes jumped 67 basis points in this past week and this rate is 10 basis points higher than the contract rate on the 30-year FRM. The result is that the market for alternative products is almost dry, as evidenced by the massive layoffs in the mortgage business.

Virtually all market signals, including the record lows for the April, May, June and July and August NAHB Housing Market Index, indicate the bottom in the housing market has not been reached. Also, lurking in the background is the uncertainty around additional defaults of mortgage-backed assets, which will constrain any rebound.

The spring and summer housing markets were the worst in recent memory.

Corroborating the data above comes from Angelo Mozilo, CEO of Countrywide Financial, who told Maria Bartiromo from CNBC last week in an interview that "I can't believe that when you're having a level of delinquencies, foreclosures—equity has disappeared, equity is gone, the tide has gone out—that this doesn't have a material effect, A, on the psyches of the American people, and eventually on their wallet."

He went on in the interview to even use the 'R' word (recession) in commenting that he couldn't foresee how one of the steepest housing recessions in recent memory wouldn't lead the economy into a recession.

The possibility for housing to lead the economy into a recession is real as the worst is yet to come, as commented by economist Ryan Sweet from Moody's Economy.com, provided below:

True Test for Mortgage Credit Quality Lies Ahead

Our baseline forecast calls for a manageable erosion in credit quality, but the risks are heavily weighted to the downside, specifically for mortgages. The true test still lies ahead as a large pool of loans face their first payment reset.

Figure 4

Source: Moody's Economy.com, DismalScientist

According to first quarter data from CreditForecast.com, mortgage credit is eroding quickly, with the dollar delinquency rate jumping to its highest level since the series began in 1998. Conditions will get much worse before they get better as a large pool of exotic mortgages face resets over the next several quarters. These resets, combined with slower job and income growth, will put considerable pressure on already thin household finances.

Figure 5

Source: Moody's Economy.com, DismalScientist

The majority of those loans facing resets over the next year are subprime. It is safe to assume that credit conditions among this cohort will erode substantially. The deterioration will not be isolated to mortgages as many homeowners will go delinquent on credit cards or other loans, rather than risk their homes.

The deterioration in the subprime market is going to get worse before it gets better as home prices continue to slip, leaving many homeowners that took an ARM to buy their home with negative equity, making it even harder for them to refinance at a time when banks are raising lending standards. Just yesterday Standard & Poor's released second quarter data for their nationwide housing index that showed the steepest decline since it started its index 20 years ago.

Big Fall Reported in 2Q Home Prices

US home prices fell 3.2 percent in the second quarter, the steepest rate of decline since Standard & Poor's began its nationwide housing index in 1987, the research group said Tuesday.

The decline in home prices around the nation shows no evidence of a market recovery anytime soon, one of the architects of the index said.

MacroMarkets LLC Chief Economist Robert Shiller said the declining residential real estate market "shows no signs of slowing down."

As the situation in the housing market continues to worsen, other areas of consumer credit are starting to pick up momentum in deterioration. The deterioration spreading to other areas of consumer credit raises the possibility for erosion in asset-backed securities other than mortgage-backed securities as seen by data provided by Juan Licari, Senior Economist at Moody's Economy.com, provided below:

Credit Woes Spread Beyond Mortgages

As investors adjust their positions and re-evaluate their risk exposure, many are wondering if more financial distress lurks in other consumer-credit products that were, like mortgages, also securitized and widely distributed.

Our research suggests the answer could be yes. Many US households who have large debt obligations related to credit cards or auto loans will face challenging times in the near term. As mortgage credit quality continues to erode, we expect other consumer credit products to face increasing difficulty as well. The charts below depict past and forecast delinquency rates for credit cards and auto loans in the US

Figure 6

Source: Moody's Economy.com, DismalScientist

Figure 7

Source: Moody's Economy.com, DismalScientist

The financial distress that households are currently facing will make it even harder for consumers to keep up with their monthly debt payments. Under our baseline scenario, delinquency rates for both credit products are expected to go back to levels similar to the ones observed at the beginning of this decade—during the 2001 US recession. If the economy weakens more than expected, delinquencies are expected to rise even more. Auto loans could be hit harder, due to the weight that high gas prices put on vehicle demand and the effects of soft vehicle prices on auto loan credit quality.

Like mortgages, many of these other consumer credit products were directly securitized and sold to investors all over the globe. Their importance within the asset-backed security market is considerable: Securities worth more than 0 billion were issued in 2005, collateralized by credit cards, auto, student and other consumer loans. In the same year, just over 0 billion in securities issued were backed by home equity loans.

This raises a big question about the potential damage that credit deterioration in these other consumer products might have on the whole financial market. The distress caused by the subprime meltdown might be replicated through new channels (emphasis added).

Loss of Confidence, Jobs

Yesterday the Conference Board released their consumer confidence index for August, which fell to 105 from 111.9 seen in July. Diving into the details of the report showed that assessments of current labor market conditions were a leader of the decline in confidence in August and that every component of the index fell this month. The decline in confidence was not isolated demographically, with widespread declines in confidence seen across age and income groups, as well as regions of the country.

Both the present situations and expectations sub-indices saw declines in the month, with the year-over-year (YOY) percent change in the present situations index on the verge of slipping into negative territory. This is significant as a decline into negative territory preceded that last two recessions.

Figure 8

Source: Moody's Economy.com

Confidence is not only slipping in the US but also globally, putting to question the global growth story financial pundits are touting that will prevent the US from slipping into a recession. Mark Zandi, Chief Economist and co-founder of Moody's Economy.com, Inc., highlights this risk in his recent editorial below:

On High Alert

The turmoil in global financial markets is upending business confidence. According to Moody's Economy.com's business confidence survey, sentiment fell last week and has plunged over the past month. The last time confidence was this low was during the height of the runup to the Iraq invasion in early 2003, and it is now consistent with a global economy that is very near recession. Although investors seemingly cheered the aggressive action by global central banks this past week to provide liquidity to the financial system, businesses did not.

Businesses' assessment of current conditions, which is very closely correlated to real GDP growth, has fallen even more sharply. Indeed, last week's reading was the lowest in the nearly four-year history of the survey. Not surprisingly, those in the financial services industry have sharply downgraded their views about current conditions. However, perhaps even more telling is the sharp decline in retailers' assessments.

Figure 9

Source: Moody's Economy.com

Figure 10

Source: Moody's Economy.com

It is disconcerting that business expectations regarding the outlook over the next six months turned negative last week. For the first time in the survey's history, both expectations and assessments of current conditions are negative at the same time. Even during the Iraq invasion, when businesses were very worried about their immediate situation, they remained upbeat regarding the near-term outlook.

It is often very difficult to know when a recession has started until weeks and even months after it actually has. A sharp and sustained decline in confidence is perhaps the best indication that one has begun.

This is evident from the experiences of the last recession in 2001. The minutes of FOMC meetings in late 2000 suggest that while policymakers at the Federal Reserve were nervous about the weakening economy, they were also seemingly confident that the economy would avoid an outright downturn. The sharp and sustained decline in consumer confidence during the period was correctly signaling otherwise.

The turmoil in global financial markets is weighing heavily on business psyches. Business confidence is still consistent with an expanding economy, but just barely. Sentiment could still quickly revive if financial markets remain calm, but this survey suggests that recession risks are uncomfortably high and rising.

Recessionary risks are rising and a significant contribution to these risks is a slowing employment level. It's not surprising that assessments of current labor market conditions were a leader of the decline in confidence in August for the Conference Board's consumer confidence index, as employment levels are decelerating and mortgage-related jobs losses are mounting as highlighted in the article below.

Mortgage Job Losses Surpass 40,000

Since the start of the year, more than 40,000 workers have lost their jobs at mortgage lending institutions, according to recent company layoff announcements and data complied by global outplacement firm Challenger, Gray & Christmas Inc. Meanwhile, construction companies have announced nearly 20,000 job cuts this year, while the National Association of Realtors expects membership rolls to decline this year for the first time in a decade.

It's an employment collapse that threatens to rival the massive layoffs in the airline industry that followed the Sept. 11, 2001, terrorist attacks, when some 100,000 employees lost their jobs.

"It's far from over," said Bart Narter, a senior analyst with Celent, a Boston-based financial research and consulting firm. "The subprime lending collapse will continue to ripple through the financial sector."

"It's only been weeks," Challenger said. "These companies are acting remarkably quickly, stopping on a dime."

As the technology boom led the economy and stock market in the 1990s, it also led to the last bear market and recession as technology went from boom to bust. Likewise, as housing and financial services related to housing, such as mortgage brokers, are what led the economy out of the 2001 recession, it should not be surprising that they are the major contributor to weakness in economic growth currently.

The technology sector led the last recession and pulled down the S&P 500 as the technology sector represented the greatest weighting in the S&P 500. This time around, the financial sector is likely to lead to the next recession and stock market decline as it represents the greatest weighting in the S&P 500 currently.

This topic, comparing the technology bubble burst of 2000 with housing and related financial services as the likely candidate for leading the US into a recession and possible bear market will be discussed in next week's WrapUp. Highlights will include the recent FDIC second quarter banking profile report that showed significant deterioration in the banking industry and mounting losses, as well as comparisons of previous manias and following declines.

Today's Market

The markets retraced yesterday's losses as bargain hunters initially pushed the markets higher in early morning trading. Stocks later surged on news that Bernanke said in a letter to Sen. Charles Schumer, D-N.Y., that Fed policymakers are "prepared to act as needed" if the market's turbulence hurts the economy, helping pad the market's gain. Action was put behind those words as the Federal Reserve Bank of New York said today it would inject .25 billion through a one-day repurchase agreement, where it buys that amount in collateral from dealers who then deposit the money into commercial banks.

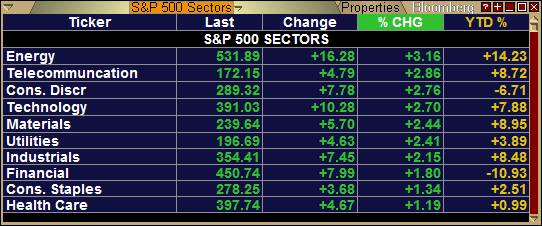

These announcements sent stocks surging in the final hours of trading with the Dow Jones Industrial Average climbing 247.44 points to close at 13289.29 (+1.90%), the S&P 500 gaining 31.40 points to close at 1463.76 (+2.19%), and the NASDAQ posted the strongest gain, up 62.52 points to close at 2563.16 (+2.50%).

Treasuries sold off with the yield on the 10-year note rising 2.3 basis points to close at 4.553%. The dollar index was down on the day, falling 0.04 points to close at 80.71. Advancing issues represented 78% and 67% for the NYSE and NASDAQ respectively, reflecting a broad rally in the markets.

Oil prices were up on the day after a bullish petroleum inventory release that showed a greater expected decline than estimated in crude and gasoline inventories, and a decline in refinery activity to 90.3%. West Texas Intermediate Crude (WTIC) rose .78/barrel to .51/barrel (+2.48%), with spot Henry Hub natural gas rising to .56/ mbtu (+4.30%). Precious metals were up on the day with gold rising .80/oz to close at 7.30/oz (+0.73%), with silver also posting a gain of __spamspan_img_placeholder__.12/oz to close at .89/oz (+1.02%).

The rally in the markets was broad based as all ten of the S&P 500 sectors were up on the day, with the energy (3.16%), telecommunications (+2.86%), and the consumer discretionary sectors (+2.76%) showing the greatest advance. Defensive sectors such as health care (+1.19%) and consumer staples sectors (+1.34%) as well as the financial sectors (+1.80%) were the day's weakest groups.

Overseas markets were mixed as Asian markets sold off in response to the declines seen in North American markets yesterday with rallies in the Japanese Nikkei 225 index (-1.69%), Chinese Shanghai index (-1.64%), Taiwanese Taiex index (-0.97%), and Korean Kospi index (-0.17%) all posting declines. Latin and North American markets posted the greatest global gains, with the Brazilian Bovespa rising 2.11% and the Canadian TSX index up 1.70%.