In our latest Big Picture podcast (see The Recession That Isn't), Jim goes through a large number of indicators that show economic growth has weakened and also repeated his forecast for a possible US recession in 2017 based on current economic and financial trends.

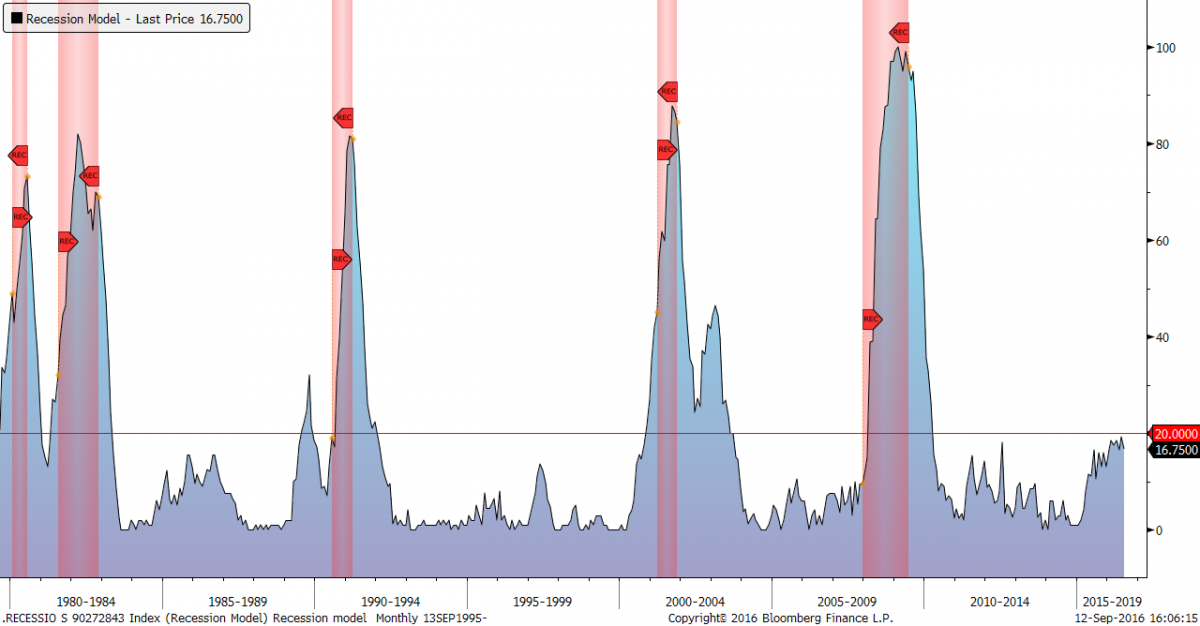

Here's a look at our own recession model, which is sitting at some of the most elevated levels we've seen during this entire economic cycle. At a few points below 20, it is very close to crossing into recessionary territory.

With it being so close to recessionary territory and even above where we entered the 2008 recession, why do we think a recession is not likely until 2017 vs. this year in 2016? The answer to that is found in other leading economic indicators (LEIs) we follow. Here, for example, is the Conference Board US Leading Index, which is still showing 1.2% growth year-over-year and has yet to contract into negative territory, something that typically happens prior to a recession.

That being said, one of the forward-looking components it tracks is "New Orders" provided by the Institute for Supply Management. Even with the manufacturing sector of the US economy in and out of contraction, the much larger services sector has continued to show strength via the US consumer. However, the longevity of that trend is now being questioned as non-manufacturing/services companies recently reported a very steep plunge in new orders.

Lastly, here's a look at the 12-month moving average in the Fed's Labor Market Conditions Index (LMCI) next to US GDP. Labor market conditions as measured by the Fed have deteriorated strongly since early 2015 and show downside risk for US economic growth in the months and quarters ahead. Here's what Deutsche Bank recently had to say on this:

"On the surface, the labor market is healthy. Jobless claims are hovering near four-decade lows and the unemployment rate (4.9%) is just a shade above the Fed’s median estimate of the natural rate (4.8%). Moreover, nonfarm payroll growth has averaged 232k over the last three months and 182k year-to-date. As a result, several Fed speakers have delivered upbeat assessments of the labor market. The Fed’s LMCI, however, suggests that caution is warranted." (source)

For more information on current economic and financial trends, you can listen to this full Big Picture podcast with Jim Puplava, founder of Financial Sense, on our Newshour page here or on our iTunes page here. Subscribe to our weekday premium podcast with various guest experts, strategists, and book authors by clicking here.