A person might think from looking at news reports that our oil problems are gone, but oil prices are still high.

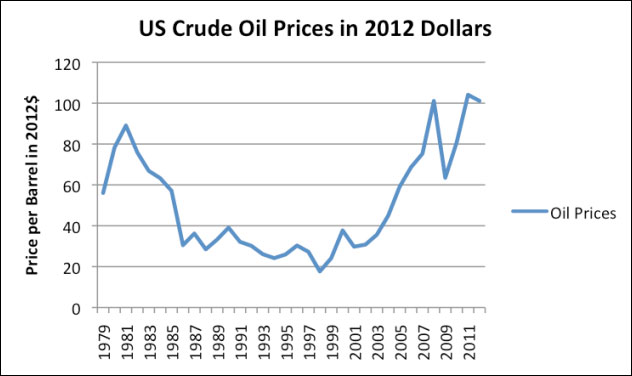

Figure 1. US crude oil prices (based on average prices paid by US refiners for all grades of oil based on EIA data) converted to 2012$ using CPI-Urban data from the US Bureau of Labor Statistics.

In fact, the new “tight oil” sources of oil which are supposed to grow in supply are still expensive to extract. If we expect to have more tight oil and more oil from other unconventional sources, we need to expect to continue to have high oil prices. The new oil may help supply somewhat, but the high cost of extraction is not likely to go away.

Why are high oil prices a problem?

1. It is not just oil prices that rise. The cost of food rises as well, partly because oil is used in many ways in growing and transporting food and partly because of the competition from biofuels for land, sending land prices up. The cost of shipping goods of all types rises, since oil is used in nearly all methods of transports. The cost of materials that are made from oil, such as asphalt and chemical products, also rises.

If the cost of oil rises, it tends to raise the cost of other fossil fuels. The cost of natural gas extraction tends to rises, since oil is used in natural gas drilling and in transporting water for fracking. Because of an over-supply of natural gas in the US, its sales price is temporarily less than the cost of production. This is not a sustainable situation. Higher oil costs also tend to raise the cost of transporting coal to the destination where it is used.

Figure 2. US Energy Prices as % of Wages and as of GDP. Ratio to GDP provided by EIA Short Term Economic Outlook – Figure 27, converted to Wage Base by author, using same wages as described for Figure 3.

Figure 2 shows total energy costs as a percentage of two different bases: GDP and Wages.1 These costs are still near their high point in 2008, relative to these bases. Because oil is the largest source of energy, and the highest priced, it represents the majority of energy costs. GDP is the usual base of comparison, but I have chosen to show a comparison to wages as well. I do this because even if an increase in costs takes place in the government or business sector of the economy, most of the higher costs will eventually have to be paid for by individuals, through higher taxes or higher prices on goods or services.

2. High oil prices don’t go away, except in recession.

We extracted the easiest (and cheapest) to extract oil first. Even oil company executives say, “The easy oil is gone.” The oil that is available now tends to be expensive to extract because it is deep under the sea, or near the North Pole, or needs to be “fracked,” or is thick like paste, and needs to be melted. We haven’t discovered cheaper substitutes, either, even though we have been looking for years.

In fact, there is good reason to believe that the cost of oil extraction will continue to rise faster than the rate of inflation, because we are hitting a situation of “diminishing returns”. There is evidence that world oil production costs are increasing at about 9% per year (7% after backing about the effect of inflation). Oil prices paid by consumers will need to keep pace, if we expect increased extraction to take place. There is even evidence that sweet sports are extracted first in Bakken tight oil, causing the cost of this extraction to rise as well.

3. Salaries don’t increase to offset rising oil prices.

Most of us know from personal experience that salaries don’t rise with rising oil prices.

In fact, as oil prices have risen since 2000, wage growth has increasingly lagged GDP growth. Figure 3 shows the ratio of wages (using the same definition as in Figure 2) to GDP.

Figure 3. Wage Base (defined as sum of “Wage and Salary Disbursements” plus “Employer Contributions for Social Insurance” plus “Proprietors’ Income” from Table 2.1. Personal Income and its Distribution) as Percentage of GDP, based on US Bureau of Economic Analysis data. *2012 amounts estimated based on part-year data.

If salaries don’t rise, and prices of many types of goods and services do, something has to “give”. This disparity seems to be the reason for the continuing economic discomfort experienced in the past several years. For many consumers, the only solution is a long-term cut back in discretionary spending.

4. Spikes in oil prices tend to be associated with recessions.

Economist James Hamilton has shown that 10 out of the last 11 US recessions were associated with oil price spikes.

When oil prices rise, consumers tend to cut back on discretionary spending, so as to have enough money for basics, such as food and gasoline for commuting. These cut-backs in spending lead to lay-offs in discretionary sectors of the economy, such as vacation travel and visits to restaurants. The lay-offs in these sectors lead to more cutbacks in spending, and to more debt defaults.

5. High oil prices don’t “recycle” well through the economy.

Theoretically, high oil prices might lead to more employment in the oil sector, and more purchases by these employees. In practice, this provides only a very partial offset to higher price. The oil sector is not a big employer, although with rising oil extraction costs and more US drilling, it is getting to be a larger employer. Oil importing countries find that much of their expenditures must go abroad. Even if these expenditures are recycled back as more US debt, this is not the same as more US salaries. Also, the United States government is reaching debt limits.

Even within oil exporting countries, high oil prices don’t necessarily recycle to other citizens well. A recent study shows that 2011 food price spikes helped trigger the Arab Spring. Since higher food prices are closely related to higher oil prices (and occurred at the same time), this is an example of poor recycling. As populations rise, the need to keep big populations properly fed and otherwise cared for gets to be more of an issue. Countries with high populations relative to exports, such as Iran, Nigeria, Russia, Sudan, and Venezuela would seem to have the most difficulty in providing needed goods to citizens.

6. Housing prices are adversely affected by high oil prices.

If a person is required to pay more for oil, food, and delivered goods of all sorts, less will be left over for discretionary spending. Buying a new home is one such type of discretionary expenditure.

US housing prices started to drop in mid 2006, according to data of the S&P Case Shiller home price index. This timing fits in well with when oil prices began to rise, based on Figure 1.

7. Business profitability is adversely affected by high oil prices.

Some businesses in discretionary sectors may close their doors completely. Others may lay off workers to get supply and demand back into balance.

8. The impact of high oil prices doesn’t “go away”.

Citizens’ discretionary income is permanently lower. Businesses that close when oil prices rise generally don’t re-open. In some cases, businesses that close may be replaced by companies in China or India, with lower operating costs. These lower operating costs indirectly reflect the fact that the companies use less oil, and the fact that their workers can be paid less, because the workers use less oil. This is a part of the reason why US employment levels remain low, and why we don’t see a big bounce-back in growth after the Great Recession. Figure 4 below shows the big shifts in oil consumption that have taken place.

Figure 4. Percentage growth in oil consumption between 2006 and 2011, based on BP’s 2012 Statistical Review of World Energy.

A major part of the “fix” for high oil prices that does takes place is provided by the government. This takes the place in the form of unemployment benefits, stimulus programs, and artificially low interest rates.

Efficiency changes may provide some mitigation, as older less fuel-efficient cars are replaced with more fuel-efficient cars. Of course, if the more fuel-efficient cars are more expensive, part of the savings to consumers will be lost because of higher monthly payments for the replacement vehicles.

9. Government finances are especially affected by high oil prices.

With higher unemployment rates, governments are faced with paying more unemployment benefits and making more stimulus payments. If there have been many debt defaults (because of more unemployment or because of falling home prices), the government may also need to bail out banks. At the same time, taxes collected from citizens are lower, because of lower employment. A major reason (but not the only reason) for today’s debt problems of the governments of large oil importers, such as US, Japan, and much of Europe, is high oil prices.

Governments are also affected by the high cost of replacing infrastructure that was built when oil prices were much lower. For example, the cost of replacing asphalt roads is much higher. So is the cost of replacing bridges and buried underground pipelines. The only way these costs can be reduced is by doing less–going back to gravel roads, for example.

10. Higher oil prices reflect a need to focus a disproportionate share of investment and resource use inside the oil sector. This makes it increasingly difficult maintain growth within the oil sector, and acts to reduce growth rates outside the oil sector.

There is a close tie between energy consumption and economic activity because nearly all economic activity requires the use of some type of energy besides human labor. Oil is the single largest source of energy, and the most expensive. When we look at GDP growth for the world, it is closely aligned with growth in oil consumption and growth in energy consumption in general. In fact, changes in oil and energy growth seem to precede GDP growth, as might be expected if oil and energy use are a cause of world economic growth.

Figure 5. Growth in World GDP, energy consumption, and oil consumption. GDP growth is based on USDA International Macroeconomic Data. Oil consumption and energy consumption growth are based on BP’s 2012 Statistical Review of World Energy.

The current situation of needing increasing amounts of resources to extract oil is sometimes referred to one of declining Energy Return on Energy Invested (EROEI). Multiple problems are associated with declining EROEI, when cost levels are already high:

(a) It becomes increasingly difficult to keep scaling up oil industry investment because of limits on debt availability, when heavy investment is made up front, and returns are many years away. As an example, Petrobas in Brazil is running into this limit. Some US oil and gas producers are reaching debt limits as well.

(b) Greater use of oil within the industry leaves less for other sectors of the economy. Oil production has not been rising very quickly in recent years (Figure 6 below), so even a small increase by the industry can reduce net availability of oil to society. Some of this additional oil use is difficult to avoid. For example, if oil is located in a remote area, employees frequently need to live at great distance from the site and commute using oil-based means of transport.

Figure 6. World crude oil production (including condensate) based primarily on US Energy Information Administration data, with trend lines fitted by the author.

(c) Declining EROEI puts pressure on other limited resources as well. For example, there can be water limits, when fracking is used, leading to conflicts with other use, such as agricultural use of water. Pollution can become an increasingly large problem as well.

(d) High oil investment cost can be expected to slow down new investment, and keep oil supply from rising as fast world demand rises. To the extent that oil is necessary for economic growth, this slowdown will tend to constrain growth in other economic sectors.

Airline Industry as an Example of Impacts on Discretionary Industries

High oil prices can be expected to cause discretionary sectors to shrink back in size. In many respects, the airline industry is the “canary in the coal mine,” showing how discretionary sectors can be forced to shrink.

In the case of commercial air lines, when oil prices are high, consumers have less money to spend on vacation travel, so demand for airline tickets falls. At the same time, the price of fuel to operate airplanes rises, making the cost of operating airplanes higher. Business travel is less affected, but still is affected to some extent, because some long-distance business travel is discretionary.

Airlines respond by consolidating and cutting back in whatever ways they can. Salaries of pilots and stewardesses are reduced. Pension plans are scaled back. New more fuel-efficient aircraft are purchased, and less fuel-efficient aircraft are phased out. Less profitable routes are closed. The industry still experiences bankruptcy after bankruptcy, and merger after merger. If oil prices stabilize for a while, this process stabilizes a bit, but doesn’t really stop. Eventually, the commercial airline industry may shrink to such an extent that necessary business flights become difficult.

There are many discretionary sectors besides the airline industry waiting in the wings to shrink. While oil prices have been high for several years, their effects have not yet been fully incorporated into discretionary sectors. This is the case because governments have been able to use deficit spending and artificially low interest rates to shield consumers from the “real” impacts of high-priced oil.

Governments are now finding that debt cannot be ramped up indefinitely. As taxes need to be raised and benefits decreased, and as interest rates are forced higher, consumers will again see discretionary income squeezed. New cutbacks are likely to hit additional discretionary sectors, such as restaurants, the “arts,” higher education, and medicine for the elderly.

It would be very helpful if new unconventional oil developments would fix the problem of high-cost oil, but it is difficult to see how they will. They are high-cost to develop and slow to ramp up. Governments are in such poor financial condition that they need taxes from wherever they can get them–revenue of oil and gas operators is a likely target. To the extent that unconventional oil and gas production does ramp up, my expectation is that it will be too little, too late, and too high-priced.

Note:

[1] Wages include private and government wages, proprietors’ income, and taxes paid by employers on behalf of employees. They do not include transfer payments, such as Social Security.

Source: Our Finite World