An old metaphor: If you take a frog and drop it into a roiling pot of boiling water, it’ll jump right out, unscathed. But if you put that same frog in a pot of cold water, and then slowly raise the heat, that frog won’t move. It’ll stay in that pot of water, calm as can be, right up until it is boiled to death.

I’ve been arguing that the unpayable Federal government debt, coupled with irresponsible Federal Reserve policies, will inevitably lead to a hyperinflationary event and currency collapse. In order to prepare for a web seminar on hyperinflation in America, I’ve been looking at the issue of how to safeguard assets before a currency collapse, and how to identify opportunities in the midst of a hyperinflationary crisis.

But along the way—inevitably—it’s led me to consider the issue of the effects of hyperinflation on the American people. Not even hyperinflation—just regular old rising consumer prices: How will they affect the average household.

It’s disturbing.

Even if you don’t buy my hyperinflation call in the least—and a lot of very smart people don’t—the recently announced Quantitative Easing 2 policy of the Federal Reserve has had and will have a profound effect on the dollar.

And a profound effect on the American people—especially the bottom 80%.

Bernanke’s stated purpose in QE2 is to spark consumer spending, and thereby reignite the economy. To do this, Bernanke and the Fed will pump 0 billion into the Treasury bond market, in monthly billion increments—at minimum. According to the Fed’s statement, if more “liquidity” is needed, then by golly, more liquidity will be pumped into the economy.

QE2 is really the official start of a race-to-the-bottom debasement of the U.S. dollar.

No one doubts this—and no one would dispute that such a currency debasement will bring about upward pressures on consumer prices across the board. Indeed, this is the explicit purpose of QE2: The Fed is trying to induce inflation, as it believes that inflation will bring about a reignition of the stagnant American economy.

A lot of commentators have been discussing what QE2 will mean for equities and the various bond markets. People are talking about the Treauries’ yield curve—but not much about what QE2 will mean for the rest of the American population: The middle class, the working poor, the poor, and even the upper-middle class.

So let’s give it a go:

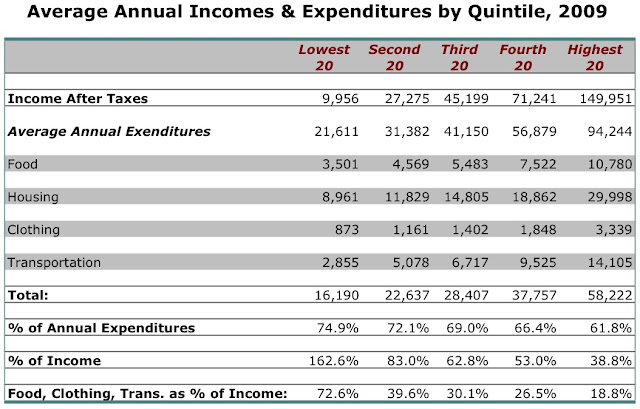

Taking Bureau of Labor Statistics data for 2009, which can be found here, we can put together this simple chart of household incomes and expenditures for last year, divided by quintiles:

Data, from Bureau of Labor Statistics, can be found here. Data in unadjusted U.S. dollars.

(A note on the data: Housing expenditures include mortgage payments or rents, utilities, and heating, including heating oil. Transportation data includes use of public transportation. Food includes “Food Away From Home”—a remarkably high proportion of expenditures, at 41% for the entire population, skewering to almost 50% for the top quintile, and almost 30% for the lowest quintile. The figure “% of Annual Expenditures” represents how much food, housing, clothing and transportation—the basic necessities—represents of the total expenditures of each quintile. The figure “% of Income” shows the basic necessities as percentages of after-tax income for each quintile.)