So on Monday, Standard & Poor’s cut its ratings outlook for U.S. sovereign debt—and the markets had what can only be described as a tizzy.

Stocks fell—commodities rose—I noticed things were off when my gold ticker shot up a full percentage point in under sixty seconds. Yikes! (Well, actually, as far as my own portfolio goes, it was more like, Yeay!)

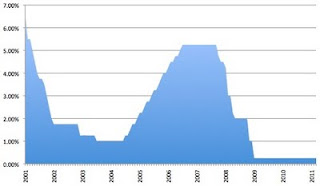

(click to enlarge)

“Not as sexy as a naked chick, I know, I know!” The Fed Funds Rate, 2001–2011.

Tons of people started scratching their heads, stroking their chins, and pompously wondering What It All Means.

Oh brother. Like Capt. Willard said: The bullshit piles up so fast, you need wings to stay above it. Most of the navel gazing was a waste of time—the lone discussion that I’d recommend was the New York Times’ “Room for Debate”, which more or less summed up smart-money thinking on the S&P announcement. (Paywall, but if you really want to read it, refresh the page, then stop the refresh before the page fully reloads.)

My own thinking is that the whole S&P announcement is meaningless—literally a non-event.

What really matters is something people are starting to consider, as inflation begins to rise, and which the S&P announcement alludes to: The colossal interest payments on the U.S. fiscal debt.

First, let’s put away the S&P nonsensical non-event:

If you start analyzing the rating agency’s announcement from any angle, you realize it is nothing more than a blip in The Downward Trajectory.

First of all, a “downgrade in the ratings outlook” doesn’t mean that U.S. Treasury bonds have lost their AAA-rating—it means that in the next two year, S&P will review the rating it gives them. And then after that review it might lower the AAA-rating. It’s basically the S&P saying to the Treasury bonds, “Play nice, or else I might be forced to think about punishing you—maybe.” So in and of itself, the announcement signals nothing.

Second, the S&P and everyone else is acting as if its rating matters—as if Standard & Poor had even a shred of credibility and respectability left, when really, it doesn’t. After all, this ratings agency was busy whoring itself out to the mortgage markets, effectively selling ratings to the highest bidder, slapping that precious AAA-rating on all sorts of assets that were garbage—the garbage that created the real estate bubble, and directly led to the 2008 Global Financial Crisis. We don’t call the crap they rated AAA “toxic assets” for no good reason—Standard & Poor was a key player in creating these toxic assets, and the ensuing crisis.

Third, the S&P is highlighting a fact that everybody already knows: Treasuries are nowhere near as gilded as people would like to believe. Hell, I wrote about Treasuries being the new and improved toxic asset—in August. And if you don’t believe me, believe in PIMCO: Bill Gross and Mohamed El-Erian are out of Treasuries—that’s right, PIMCO! Out of Treasuries! That’s like McDonald’s deciding not to buy any more hamburger meat.

Now, a lot of people are saying that S&P’s announcement is really a wake-up call for the politicians—or the markets—or the people—or a wake up call for someone at any rate. But really, a wake-up call for whom? (Is it “who” or “whom”? I always get them mixed up.)

The people who matter in this situation—that is, the people who can make a change in the Treasury bond market, be it government officials or market participants—have already cast their lot...