It’s that time of year again when the media is abuzz with that old stock market saying, “so goes January, so goes the year.” With the D-J Industrial Average (INDU/17164.95) off by 3.69% for the month of January, and the S&P 500 (SPX/1994.99) down 3.10%, it is worth revisiting the January Barometer. Devised by Yale Hirsch in 1972, as reprised in his publication The Stock Traders’ Almanac, the January Barometer states, “As goes the month of January, so goes the year,” obviously referring to the direction of the equity markets.

According to the Stock Trader’s Almanac (as paraphrased by me):

The January Barometer has registered eight major errors since 1950 for an 87.7% accuracy ratio. This indicator adheres to the propensity that as the S&P 500 goes in January, so goes the year. Of the eight major errors, Vietnam affected 1966 and 1968. 1982 saw the start of a major bull market in August. Two January rate cuts and 9/11 affected 2001. The market in January 2003 was held down by the anticipation of military action in Iraq. The second worst bear market since 1900 ended in March of 2009 and Federal Reserve intervention influenced 2010 and 2014. Including the eight flat years yields a .754 batting average. ... [For 2015] it’s official; our January Barometer indicator is negative again for the second year in a row and five of the last eight years. Since the start of the secular bear market in 2000 January has been down 7 of the last 15 years with an average loss of 1.2% on the S&P and Dow, and a fractional gain of 0.1% for NASDAQ. Five of the indicators’ eight major errors have occurred in this 15-year timeframe.

While the January Barometer has a decent track record there is another tried and true indicator to be considered. Again, as scribed by the astute Hirsch Organization (paraphrased):

When the Dow closes below its December closing low in the first quarter, it is frequently an excellent warning sign. Jeffrey Saut, managing director of investment strategy at Raymond James, brought this to our attention a few years ago. The December Low Indicator was originated by Lucien Hooper, a Forbes columnist and Wall Street analyst back in the 1970s. Hooper dismissed the importance of January’s first week and the entire month. Instead, said Hooper, “Pay much more attention to the December low. If that low is violated during the first quarter of the New Year, watch out!”

In the current case, 2014’s December low for D-J Industrials was 17068.87 and 1972.74 for the S&P 500. Alas, it feels like almost yesterday when Lucien imparted the December Low Indicator to me at “Harry’s at the Amex Bar & Grill” over cocktails in 1971. I miss Lucien, but I never forgot his indicator, which when taken in concert with the January Barometer produces an unbelievable combined track record. That said, there is one problem with the January Barometer, it includes the performance of the month of January in the yearly returns! Since investors typically have to wait until the end of January to see what the January Barometer “says,” one has to wonder what the yearly gains look like excluding January’s performance, but that’s a discussion for another time.

Given these thoughts, investors will be watching the December Low Indicator very intently this week, which is shaping up as a do or die week. As often stated, the SPX has basically been trapped between its support zone of 1990 – 2000, and its overhead resistance zone at 2060 – 2080, since late October of last year. Also as stated by Andrew Adams and myself, if the 1990 level is violated to the downside, it would present a disturbing chart pattern. This year’s action, however, should come as no surprise because since late December I have repeatedly opined that the first few months of 2015 were going to be rocky and volatile, Q.E.D. Now that I have discussed some of the “bad,” let’s talk about the “good.”

[Listen to: Jeffrey Saut: The Federal Reserve Is the Wild Card for 2015]

Recently, I have been “clubbed” with the statement that the equity markets have never been up seven years in a row. While true, such mantras have little meaning on the Street of Dreams. Recall those same “clubbers” said the equity markets couldn’t go down three years in a row and they certainly did. So, what’s the good? Well, since World War II the SPX has never suffered a loss in the third year of the presidential cycle; and, this is the third year of said cycle. Moreover, January was a down month in 2014, and the equity markets still turned in a decent performance. Then there is the “Rule of 5’s.” To wit, since 1885 there have been 13 years ending in the number 5. In 12 of those 13 years the equity markets have been up. Or how about this, since its inception there have been seven instances where the U.S. Dollar Index has rallied more than 10% in a year, like it did in 2014, and in the following year the SPX was up every time. Further, since 1962 there have been only four occurrences where the yield on the S&P 500 has been greater than the yield on the 10-year T’note like happened in mid-January 2015. In the three previous instances the SPX’s performance three months later has shown a median gain of 9.5%. Meanwhile, 63.5% of the companies that have reported 4Q14 earnings have beaten estimates and 57% have bettered revenue estimates. That said, it is worth mentioning the spread between companies raising versus lowering forward earnings guidance leans toward lowering guidance by more than 8%. As for sectors, Healthcare and Technology currently have the best 4Q14 earnings momentum, while Consumer Staples, Telecom, and Utilities have the worst.

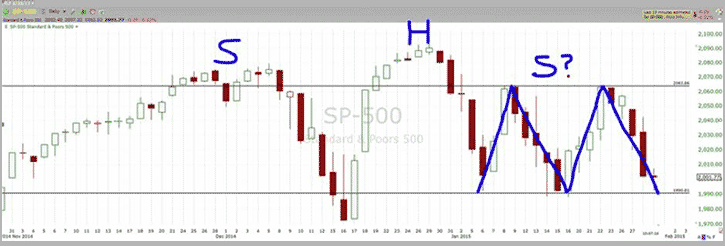

Turning to the technicals, as my colleague Andrew Adams pointed out in last Thursday’s “Morning Tack,” as featured in this week’s Barron’s, “The range-bound trading we have experienced this month looks to be forming an almost picture-perfect Double Top pattern (see chart 1), which resembles the letter ‘M,’ and a daily close below 1990 would complete this pattern and signal further losses are more likely than not.” I would add the chart pattern also looks conspicuously like a “head and shoulders” topping pattern whose “neckline” would be broken to the downside with a close by the SPX below 1990 (read: negatively). Also of interest is that the SPX has fallen below its 150-day moving average at 1996.94, a moving average that has supported the S&P 500 for the past few months. Obviously, all of this makes the upcoming week very important in the scheme of things for the near-term direction of the equity markets. A close below 1990 would indeed activate lower price targets on a short-term trading basis of 1972 and then 1952. Failing to hold those levels would suggest a drop to the 1900 – 1920 level. We remain cautious.

To conclude, last Friday a TV anchor surprised me by asking “on air,” “What did you think was the biggest surprise in the markets this week?” I responded, “The new Greek PM and Finance Minister who said there will be no cooperation on the debt situation with the EU. Those comments sent the Athens stock market down 14% with Greek bank stocks, and the Greek debt complex, getting crushed.” On more contemplation, I would amend that answer by noting crude oil looks to have bottomed. Indeed, on Thursday the March futures crude oil contract made an “undercut low” (a lower print low than the previous reaction low). Then on Friday that same contract traded higher by more than 8% (see chart 2). Ladies and gentlemen, this is how the October 4, 2011 “undercut low” was made by the S&P 500, and it just may be the way the now eight-month mini-crash in crude prices ends.

The call for this week: Interestingly, given what crude oil did on Friday, I am hosting a conference call with my friend Troy Shaver. With a background in geology, Troy embraces immense knowledge about the battered energy complex and the stocks du jour. He is captain of Dividend Assets Capital and was chosen a number of years ago as the outside portfolio manager for the Goldman Sachs Rising Dividend Fund (GSRAX/$20.79), which I own. Those of you that have heard the two of us at last year’s Raymond James national conference, or on previous conference calls, know the verbal exchange tomorrow will be informative. The call is slated for Tuesday at 4:15 p.m. and the phone number and password are: (888) 329-8905; 6106339. As for the equity markets, over the weekend we went to the symphony to hear the celebrated cellist Yo Yo Ma. In certain dialects the term “yo yo” means “come back-come back.” Hopefully, this week the stock markets will “come back ... come back.” And this morning that’s exactly what the equity markets are trying to do as Greece unveils a new debt relief program to the EU. Regrettably, I do not trust the early morning strength.