Everyone kept saying ‘a top is not in place yet.’ They persistently pointed to the ‘normally reached’ levels of this or that statistic that were not yet there to reinforce their desire to remain bullish. ... Apart from statistical measures of increasing blindness, this unwillingness to acknowledge what they themselves were already feeling revealed a comfortableness, a confidence, a conviction that whatever was happening—short-term survivable dips—would continue—until ‘the top,’ like a striptease artiste of our youth would, with decorum, appear on stage, bow, and then, accompanied by applause from all the bulls eager to cash in on their excitement, would begin to twirl its statistical tassels in front of everyone.

I’ve gotten so old I can’t remember the names of those ladies at the Old Howard, but I can remember that all you got was a flash of this or that, before they waltzed off. Stock market tops are like that. You know it’s there somewhere if you squint hard enough, but you never quite see it, so you keep waiting for more. And then, in the end, as the curtain comes down on the bull market you realize that the one rule about tops is not that they provide this or that signal, but that they come before anyone is ready.

... Justin Mamis

For decades, I have used the aforementioned prose from iconic market guru Justin Mamis in my market commentary. For those of you who have seen the quote before, I urge you to read it again. For those seeing it for the first time, I suggest you read it a few times because the wisdom of his words is as true today as it was when it was written some 30 years ago. Most of the time when I drudge up “The Philosophy of Tops” it is to warn of a pending market “top.” The operative line from Justin’s quip is, “One rule about tops is not that they provide this or that signal, but that they come before anyone is ready.” Manifestly, “[tops] come before anyone is ready!” But, currently EVERYONE is ready, either calling for a market “top,” or a continuation of the trading range market. I see very few of us who are suggesting that we remain in a secular bull market, and in bull markets, most of the surprises come on the upside. That happened again last Friday when the stronger than expected employment report, combined with rising inflation expectations and strengthening economic numbers, brought on worries of higher interest rates. The result left the D-J Industrial down 117 points in the first six minutes of trading. But, at 9:45 a.m. stocks stabilized and began to rise. By the closing bell, and to the surprise of most, the senior index had rallied about 107 points and the S&P 500 (SPX/2072.78) was back above its recent intraday high.

Listen to Robin Griffiths: Final Low of This Bear Market Not Likely Until 2017

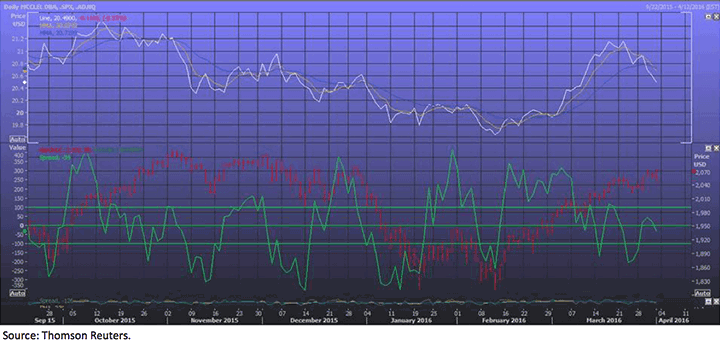

Friday’s rally put the current “buying stampede” at session 34, making today session 35. Recall that “buying stampedes” typically last 17 – 25 sessions, interrupted by one-to-three session pauses/pullbacks, before they exhaust themselves on the upside. It is true, a few have gone 25 – 30 sessions, but I can count on one hand those that have gone for more than 30 sessions. For the record, the longest “buying stampede” I have seen lasted 62 sessions and the next longest was 38. To be sure, this stampede, by some measurements, shows that stocks are near-term overbought (93.3% of the S&P 500 stocks are above their 50-DMAs), yet the NYSE McClellan Oscillator is moving from neutral back towards oversold territory (see chart, where the MO is green). Meanwhile, the NYSE All-Issues Advance/Decline is challenging its May of 2015 high, the Buying Power/Selling Pressure indicator is in balance, small/mid-capitalization stocks continue to outperform (read: bullishly), most emerging market indices have crossed above their respective 200-day moving averages, there is a dearth of new lows on the New High/New Low Indicator, and the list of positives continues.

Speaking to better economic reports, last week’s employment report showed payrolls increasing by 215,000 (vs. 205,000 estimate) with few revisions to the prior two months. The participation rate rose for the fourth straight month (to 63%, the highest since February 2014) as more people rejoined the workforce. Average hourly earnings also increased by 0.3% (m/m), bringing the y/y gain to +2.3%. March’s ISM manufacturing index traveled back above 50 (51.8 from 49.5 and the 51.0e), the University of Michigan’s consumer confidence report was also reported above the estimate (91.0 vs. 90.5e), pending home sales increased by 3.5% in February (m/m) as mortgage applications rose by 2.1% (+21% y/y), and hereto the positive list goes on.

Turning to earnings, this week marks the beginning of 1Q16 earnings reports. Wall Street is braced for a 7% - 8.5% decline in earnings, but our guess is the earnings reports will not be as bad as the lowered expectations. Obviously, the Energy sector will have the most negative impact on earnings since Energy is estimated to have a y/y decline of 101.8% according to FactSet. Excluding the Energy sector, 1Q earnings for the S&P 500 are anticipated to fall 3.7%. If correct, this will be the fourth consecutive quarterly decline (y/y) in earnings. Likewise, the S&P 500 companies’ revenues are estimated to decline for the fifth consecutive quarter by 1.1%. We think the 1Q16 earnings/revenue reports will mark the bottom for both of these metrics. Using FactSet’s 12-month forward earnings estimate for the S&P 500 ($124.43e) puts its current P/E at 16.7x with an earnings yield (earnings ÷ price) of about 6.0%. However, if one believes S&P’s 2017 earnings estimate of $135.96, it implies the S&P 500 is trading at 15.2x forward earnings.

Hear also John Graham: CFOs See Clouds on the Horizon

Despite these emerging “green shoots” of economic recovery, what are investors doing? They are liquidating stocks, for as of last Wednesday they had liquidated $44.4 billion of equity-centric mutual funds year to date (according to Lipper). This is not the kind of action one sees at stock market peaks. Recall we have opined there are six stages to a secular bull market. They are: Bear Market Low and Rebuilding, Guarded Optimism, Enthusiasm, Exuberance, Surreal, and Bubble Bust/Disillusionment. Clearly we are nowhere near Enthusiasm or Exuberance, so I believe we are only at the beginning stages of “Guarded Optimism.”

The call for this week: In last Friday’s Morning Tack I wrote, “I also think I know in secular bull markets most of the surprises come on the upside. Accordingly, we are not afraid to commit capital here to more conservative ideas featured by our fundamental analysts. We featured more speculative ideas in mid-February when we wrote that a double-bottom around 1812 (basis the SPX) was at hand. Further, it is amazing to me that various ‘seers,’ who NEVER saw the bottom at 1812 are now calling for a ‘major top’.” As confirmation of the “Guarded Optimism” stance, our friend Jason Goepfert (SentimenTrader) writes, “There have been a few pieces of evidence in recent weeks that the small individual investors are not buying into the rally over the past seven weeks. They’ve been buying a lot of ‘put’ option protection, they’re not rushing into penny stocks and overall they’re saying that they’re just not very bullish.” Ladies and gentlemen, this is NOT how major tops are made…