Over the last five years natural gas production in the U.S. has increased by roughly 20% as the impact of horizontal drilling, hydraulic fracturing, and robust exploration efforts have led to what some have referred to as a ‘glut’ of natural gas.

Over the last five years natural gas production in the U.S. has increased by roughly 20% as the impact of horizontal drilling, hydraulic fracturing, and robust exploration efforts have led to what some have referred to as a ‘glut’ of natural gas.

Some experts claim that the U.S. will see a century of inexpensive natural gas production due to the development of the huge shale reserves located in North America – great for U.S. manufacturers but not necessarily for natural gas producers.

Until recently drilling and developmental activity has continued unabated even in the face of falling natural gas prices and declining rates of return on exploration expenditures. Domestic natural gas prices fell this summer to levels not seen in a decade. Meanwhile crude oil prices have tripled.

As natural gas prices have fallen companies in the chemical and fertilizer sectors have announced millions of dollars in capital expenditures to expand their production facilities. Cheap natural gas gives many of these firms a competitive advantage over European companies who are paying on average three to five times more for natural gas.

As natural gas prices have fallen companies in the chemical and fertilizer sectors have announced millions of dollars in capital expenditures to expand their production facilities. Cheap natural gas gives many of these firms a competitive advantage over European companies who are paying on average three to five times more for natural gas.

Lower natural gas prices this summer made U.S. natural gas fired electrical generation more attractive than coal fired plants. Over the last 12 months a massive amount of incremental demand has been generated from natural gas fired plants that historically has been used as ‘peaker’ plants – facilities that only operated during the summer period of peak electrical demand.

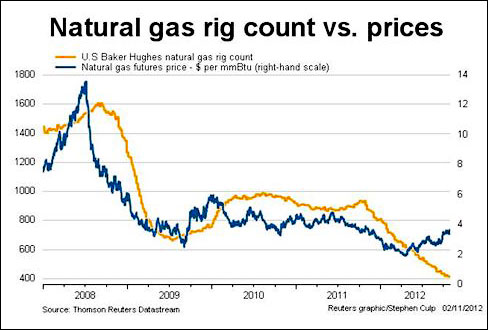

Although it has taken some time, the lack of returns on natural gas exploration and development have lead many companies to reduce investments in natural gas prospects – shifting the exploration efforts to basins that are more productive of crude oil. The number of rigs drilling for natural gas has recently hit a 13 year low, while rigs drilling for oil have predominated. (Charts courtesy Financial Times and New York Times).

Although it has taken some time, the lack of returns on natural gas exploration and development have lead many companies to reduce investments in natural gas prospects – shifting the exploration efforts to basins that are more productive of crude oil. The number of rigs drilling for natural gas has recently hit a 13 year low, while rigs drilling for oil have predominated. (Charts courtesy Financial Times and New York Times).

Spot prices for natural gas on the futures market have recovered from the sub- per million British thermal units (BTU) levels they hit this summer. The commodity currently trades at around .50 per million BTUs. Even at current prices most natural gas prospects are uneconomic, or marginally profitable at best.

While oil drilling will generate ‘associated gas’ in addition to the liquids, we find the reduction in rigs drilling for natural gas as a good step toward balancing demand and supply. Rigs today are much more efficient compared to those drilling just five years ago due to advances in fracing technology, completion methodology, and drilling productivity. As a result we expect natural gas supplies to slowly decline, but not plummet to the extent the rig count has declined.

Consultant Reports

Pointing out that economics will prevail over the predictions of some that we will see decades-long supplies of ultra-cheap natural gas, energy consultant Arthur Berman made a presentation on natural gas shale development in the U.S.at a Houston conference recently. He made the following points:

- It is doubtful that shale gas will meet supply expectations except at much higher prices.

- Decline-curve analysis indicates reserves are lower than operators claim.

- Natural gas demand has increased but recently supply has flattened.

- EPA regulations will increase demand for the clean burning fuel further.

- Shift to liquid-directed drilling & flight from dry gas will decrease gas supply.

- Capital expenditures necessary for supply maintenance are not supportable.

- Considerable uncertainty exists in natural gas price forecasts.

- Credible forecasts put average 2012 gas prices around $2.70/mmBtu.

- Credible forecast put 2013 average gas price in $3.40-$4.50/mmBtu range.

Likewise Raymond James & Associates issued a bullish report on the sector entitled “Look for Very Bullish Gas Supply/Demand Variables Through This Winter” – pointing out the following:

Our U.S. natural gas supply/demand math says the U.S. indeed setting up for a potentially large weather driven rally this winter . . . temperatures should still be considerably colder than last year due to an abnormally warm weather experienced during the 2011/2012 winter season.

We estimate that the normalizing of weather alone could tighten the entire gas market by as much as 6 Bcf/d during this winter [the Raymond James report notes that “usually a one or two Bcf/day swing in gas supply or demand is a ‘big deal’” ].

Of course, this could lead to record weekly withdrawals and a massive year over year storage deficit (using the 10-year “normal”). Gas traders should hold onto their hats, as this should be the leading driver of prices early this winter. For reference, if the market extrapolates these trends, we wouldn’t be surprised to see prices touch as high as $5/Mcf over the next 6 months.

In addition to the reports noted above, several natural gas companies have reported that they expect their natural gas production to decline in 2013. Chesapeake Production, the nation’s second largest natural gas producer, expects natural gas production to decline next year by seven percent from current levels.

One energy company executive noted “for those who question the [impact of the] natural gas rig count reduction, from 900 rigs to 400 rigs, without any associated production impacts, we can look at ourselves to see the lag . . . industry wide, you are just beginning to see natural gas production rollover. Once it begins, it will accelerate, then I think we are looking at a two year window monthly reductions in domestic natural gas supply.”

The consensus at a recent industry conference in Houston also expected domestic natural gas production to decline in 2013, with prices moving higher from the lows we have seen in 2012.