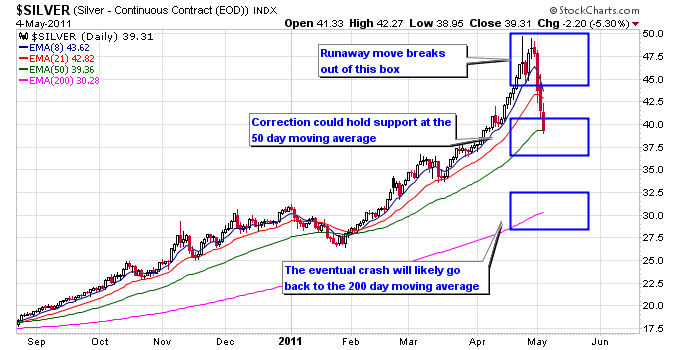

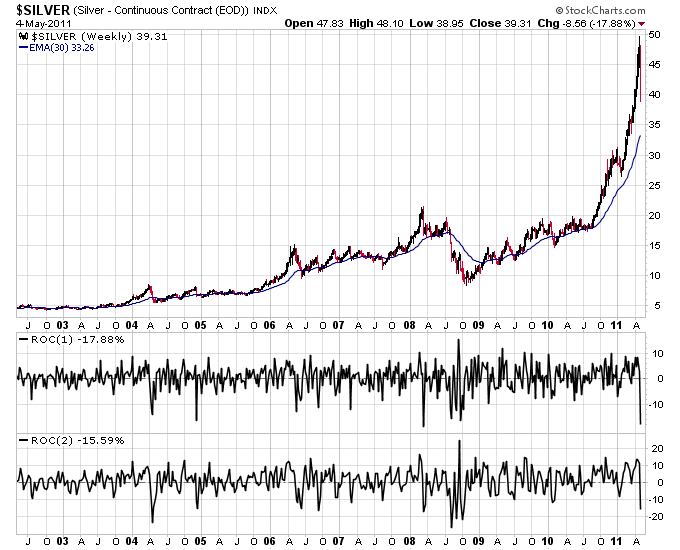

Silver has sold off hard the first 3 days of this week and is down over 17% for the week. If silver falls more this week it will be the worst weekly loss for silver during this silver bull market. The next chart shows the weely and biweekly rate of change in the silver price and only a weekly correction in 2008 was worse than this correction so far.

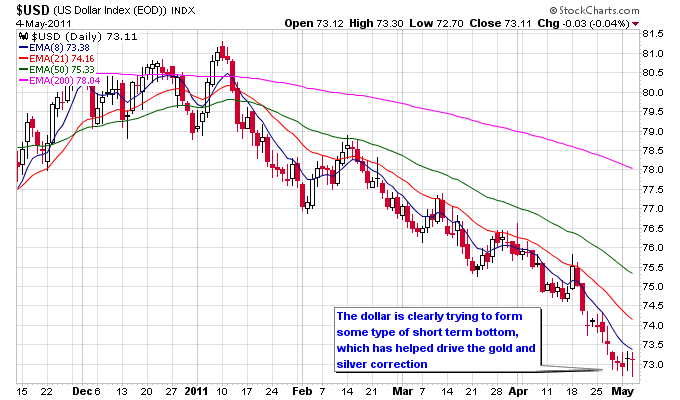

The dollar hasn’t lost any ground since the Bernanke press conference on April 27th which shows it was probably a sell the news event (which in this case would mean cover your dollar short position). The dollar is clearly trying to form a short term bottom and this is likely producing the overdue correction in gold and silver.

I discussed in a recent article that the 50 day moving average would be a likely area of support for silver. I’d like to see silver hold support around that area for the overall rally in silver to still have legs.

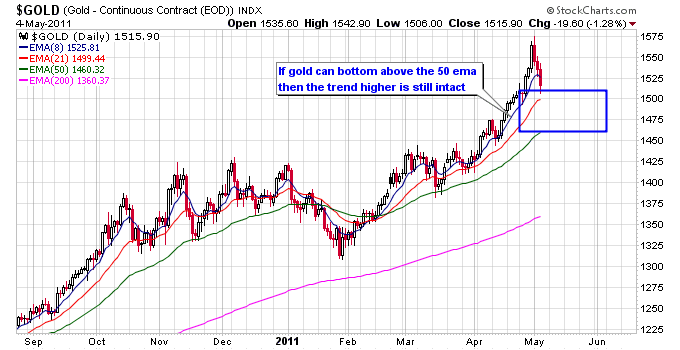

Gold also can hold either the 50 day moving average or support above 1425 and still be in an uptrend.

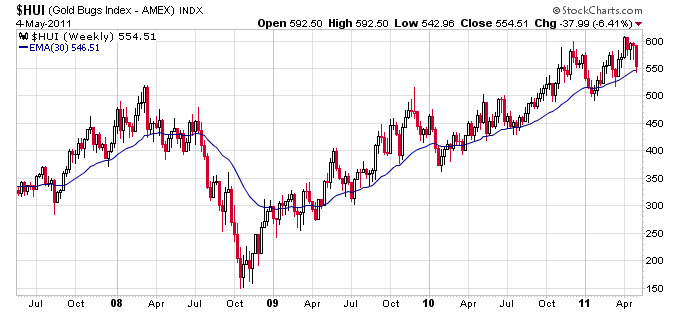

Even though gold stocks have underperformed gold recently, they are still in a Stage 2 rally on the chart. The lack of speculation in the gold stocks could be a sign that this rally still has further to go after the dollar bounce is over.

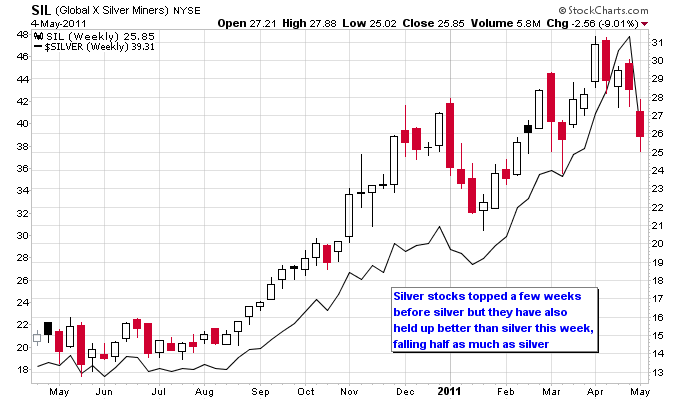

Silver stocks are only down half as much as silver this week, which is a good sign they are trying to find a bottom. They had underperformed silver for a few weeks leading up to this week.