For the past year or so I have espoused the opinion that chaos in Europe is good for the US because of capital flight from Europe to the US. That capital is funding the Last Ponzi Game Standing, the US Treasury market and US economy.

Here’s how that works. As Europe destabilizes, big money exits the problem markets of Greece, Portugal, Ireland, Italy, and particularly Spain. Ireland and Italy have stabilized somewhat in recent months, but money is still pouring out of Greece, Portugal, and Spain. Much of it is transferred to the US to purchase Treasuries and probably big cap stocks to some degree. These purchase funds flow into the US Treasury and US bank accounts. The Treasury subsequently spends the cash it borrowed from these sources, and it ends up in US bank accounts.

Of every dollar the US Government spends, on average over the course of the year approximately 35 cents comes from borrowing. Some of that borrowing comes from domestic sources. About 8% of it over the past year has come from foreign central banks. Of the rest, the US Treasury TIC report says that Europeans made net purchases of $76 billion of US Treasury Bonds in the second quarter. That was equivalent to 30% of the new Treasuries issued. In other words, it appears that European capital flight accounted for 30 cents of every dollar of debt the Treasury raised. That debt accounted for 35 cents of ever dollar the government spent. Therefore, roughly 10 cents of every dollar of US government spending driving the US economy came from European capital flight.

Given those cash flows, anyone who argues that what’s bad for Europe is bad for the US is simply wrong. If Europe somehow manages to ameliorate its problems, or even create the impression that it is doing something to solve them, then these flows would slow down or even stop. The obvious effect would be that long term US bond yields would be forced to rise in order to attract investors. Alternatively, the US government would need to spend less or tax more in order to reduce borrowing. Any of those outcomes would slow the economy. The other option would be for the Fed to step into the breach to monetize the debt. No doubt that would have an immediate response in the commodities pits, driving the cost of energy, materials, and food into the stratosphere, which in turn would crush the US economy.

So the last thing the US needs is for the European situation to improve. In fact, the worse things are over there, the greater the capital flows from there into the US.

It is true that some of the capital flooding out of Spain, Portugal, and Greece heads to Germany. As a result European bank deposits in total have remained relatively stable. But that doesn’t account for all of the capital flowing from those countries. Some of it heads for the UK and elsewhere, and it seems clear that some of it heads for the US where it funds the Last Ponzi Game Standing.

The following excerpts from the Professional Edition Fed Report for September 3 show ECB data on bank deposits for the Eurozone as a whole for the period through July 2012. Total deposits declined in July. Deposit growth has essentially stalled since October 2011. The right axis shows the 12 month rate of change.

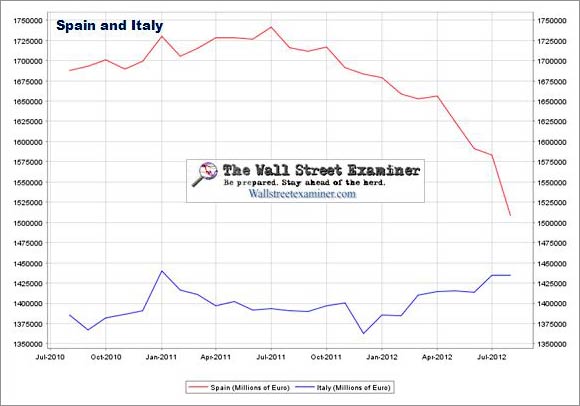

The charts of the problem countries are shown below. The run on Spanish banks accelerated in July. Italy’s deposits were flat after growing since January.

Portugal saw another fall in deposits while Greece had an uptick. Ireland has been stable.

As this chart shows, some of the outflows have gone to Germany, but the rest have probably gone mostly to the US, with some to the UK.

The correlation of outflows from some European countries with US bank inflows, strong Treasuries, and modest growth in US economic data suggest that, contrary to the conventional wisdom, what’s bad for Europe has been good for the US. It has funneled money into the US Treasury Ponzi scheme economy that has kept US economic activity afloat. The ending of these outflows, whenever they occur and for whatever reason, should be bearish for the US markets and economy.

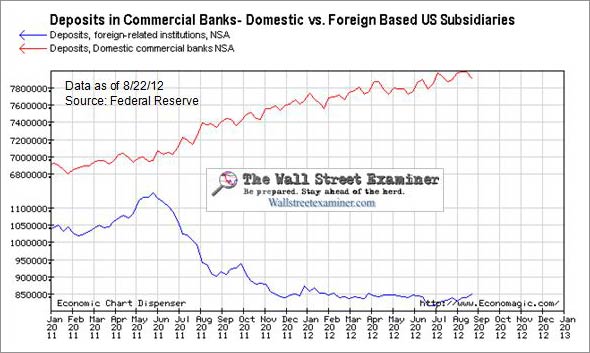

Deposits in US subsidiaries of foreign banks are available weekly with a lag of about a week. They are a near real time, indirect measure of the degree of stress in the European banking system. Declining deposits in US branches of foreign banks suggest outflows of deposits from Europe, which means that more capital is probably pouring from the Eurozone into US banks. Conversely, an uptrend in these deposits would signal a lessening of stresses and outflows to the US. That could be bad news for the US which is dependant on a constant influx of capital to keep the Treasury market, and by extension the stock market and economy afloat.

After a dramatic collapse in 2011, foreign based bank deposits in the US stabilized for much of 2012, then dropped in June. They stabilized in July, but began another modest rebound in August when hopes for stabilizing the situation in Europe began to grow on the heels of ECB head Mario Draghi’s sweeping statement that the ECB would stabilize the situation by whatever means necessary. That brought foreign based bank deposits back to the levels where they had been throughout most of 2012. Meanwhile, domestic deposits surged to a new high in early July then pulled back a bit in August. As of the week ended August 22, domestic bank deposits pulled back from a record level.

The drop in Eurozone bank deposits in July corresponded with deposits in US domestic banks reaching a record level. Correlation does not prove causation, but a reasonable case for linkage can be made. As long as the run on deposits in Europe’s biggest trouble spots apparently flow into the US, then the US Treasury Ponzi will continue as the Last Ponzi Game Standing, enabling the US economy to continue to look relatively good compared to the rest of the world.

Follow my comments on the markets and economy in real time @Lee_Adler on Twitter!

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, along with regular updates of the US housing market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW!