The Japan quake is a game changer and tipping point. I can’t see how news networks can compare this to Kobe’s 1995 incident. For Japan, the classic measure of interest expense (red line) is rapidly pushing up to the 30% debt trap demarcation line, versus 22% in 1995. Debt service as a percent of tax revenues is pushing 60%, versus 28% in 1995. This is despite that nominal interest rates on almost all JGB are trading below 1% yield. It has gone on so long that the conventional wisdom accepts it as normal and not an aberration. Talk about a so-called black swan event. If these yields erupt, it will be over for Japan in a heartbeat.

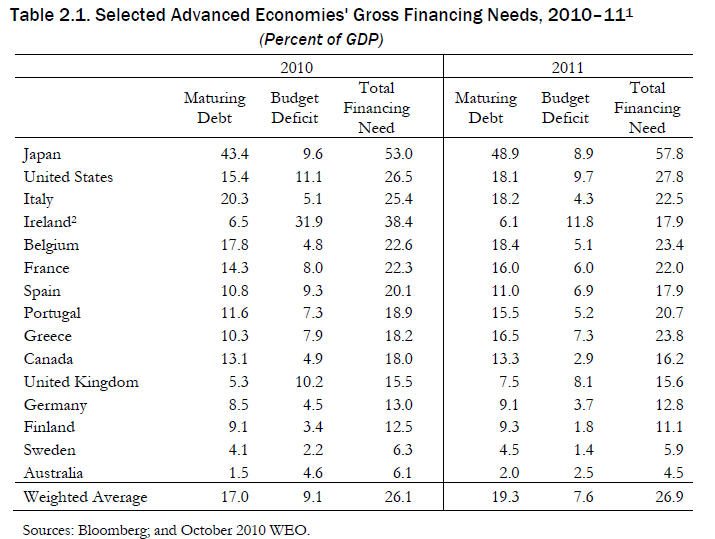

Japan’s fiscal situation has rapidly deteriorated since 2007 and has an increasingly parabolic dimension to it. Japan has about half its debt maturing in the next year and a sky high budget deficit, about 9% of GDP, thrown in for good measure. "Mother of all government finance train wrecks" comes to mind.

Yes, Japan holds a trillion in Turbo Timmy bonds at a time when its trade and power infrastructure is not just disrupted, but is likely impaired for some time. Nor will the Japanese be as involved in speculative purchases of PIGGS bonds. Japan’s Treasury is insolvent, and the country will need their foreign reserves. Printing money as a bandage will just spike more inflation and chaos, the last thing they need for effective project planning and rebuilding. My first order actionable is to short 5-year U.S. Treasuries and the Japanese Government Bond (JGB).

The charts from above are from before the earthquake. Is Japan really going to be able to borrow and print as though this was the same scenario as Kobe quake in 1995, when there was little global inflation and Japan’s debt service to tax revenues were half what they are today? Even in that more solvent environment, Japan’s market dropped 20% before recovering six months later. Now the markets act like non-Japanese overpriced sectors, such as machinery and industrials, are going to be booming rebuilding bankrupt Japan right in the aftermath of this earthquake.

In reality, Japan’s weak economy is going to contract severely, and this will have a global impact. About a third of the country’s power is nuclear, and about a third of that is going to go away for good. They will need to cover this gap via imported fossil fuels. This is not a mobilized, total-war economy where a Albert Speer persona can reorganize production and resources by dictatorial edict. FT. com covered part of the gambit of high-value, supply chain technology disruption out of Japan that will add to low value supply chain woes out of China.

Among the core parts made in Japan that could be at risk of supply disruption are capacitors and transistors – components contained in almost every electronic product. Also at risk of earthquake-related shortages could be high-end cells for batteries used in notebook computers and cars. Japanese companies – which have to contend with rolling blackouts imposed to manage electricity supplies – account for about 40 per cent of the world’s technology components.

This sample article is reprinted in its entirety from Russ's premium service, Russ Winter's Actionable. Learn more about Russ Winter's Actionable, and get instant access.

Source: Wall Street Examiner