Investors get fearful ahead of a big election because the outcome is unknown. Unknown risks are what investors fear most. Now that the result is decided, we have known risks to deal with.

Investors were also fearful ahead of the 2012 election, which also had a surprising (for some) result. Recall that Gov. Romney had been up by 1-4% in the last polls leading up to that election. Polling that year was admittedly disrupted by the arrival of Hurricane Sandy, which also shut down the stock market for 2 days.

Read What Investors Can Expect From the Trump Revolution

And interestingly, the market now is doing a pretty good imitation of the path of price movements 4 years ago. In 2012 there was a dip into mid-November after the Nov. 6 election. This time it was a dip the week before the Nov. 8 election. But in each case, there has also been a strong rebound after that dip.

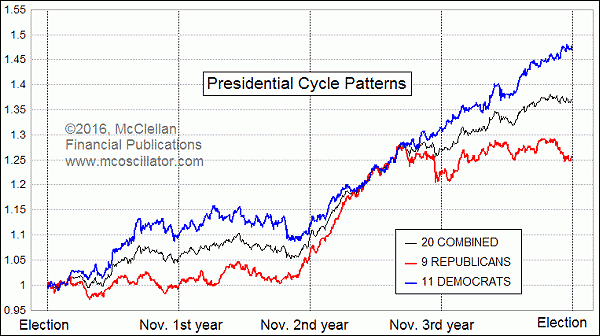

You may have heard before that having a Democrat president is better for the stock market than having a Republican president, and there are statistics which can be used to support that. In the following chart, the averages for each category since 1933 are plotted:

The real truth is a lot more nuanced than just saying one is better than the other. On average, the market has performed better for the first 16 months of Democrats’ terms, but then by the 3rd year that advantage completely disappears. And market performance in the 4th year is worse on average under a Republican president. A big part of that is the weakness after the Oct. 1987 crash, and from the 2008 bear market, both of which happened under Republican presidents.

Recent interview Tom McClellan: Stock Market Will Determine the Next President

Another differentiation among presidents concerns whether there is a new president from a different party, versus a 2nd term president or a new one from the same party. This one is a much bigger deal, especially during the first year of a new presidential term.

Generally speaking, investors respond more favorably at first to getting a new president from a different party. This has to do with celebrating that they got the change they wanted (or so they think). That positive emotion tends to wear off right around inauguration day when they realize that the new president has not fixed all of the problems already.

The negativity under a new president persists as the year runs on, because of a habit they all seem to have. I have seen this same behavior repeatedly over my lifetime. A new president comes in and spends his first year “discovering” that conditions are even worse than we were told during the campaign, and then tells us that “the only solution” is whatever package of tax hikes/cuts or spending adjustments he wants to make.

Bill Clinton did this in 1993. Despite 5% GDP growth then, Clinton asserted that “This is the worst recession in 50 years,” and he wanted to jam through a billion package of pork barrel spending (mostly to reward campaign contributors). Congress wisely said no. When I think back on that, I realize that billion is such a cute little number compared to the size of the “fixes” that have come since then.

With Bush 43 in 2001, it was tax cuts, although he could not get all he wanted right away and had to do another round in 2003. With Barack Obama in 2009, it was the American Recovery and Reinvestment Act, with 1 billion in stimulus spending (see why billion is a cute little number)? They all seem to do it.

Investors generally don’t like hearing that things are worse than previously believed, and that creates a depressing effect on stock prices during the first year. Generally speaking, 2nd term presidents do not spend very much time blaming the immediate predecessor or finding things wrong, and so investors don’t get frightened away as much. But as noted previously, that difference in stock market performance between 1st and 2nd term presidents generally goes away by the end of the 2nd year.

Every instance is different, and these charts just show what the average behavior has been.

Related Charts

Oct 20, 2016 | Aug 07, 2014 | Feb 11, 2016 |