Thoughts from our recent Big Picture podcast, "Helicopter Drops in the Post Debt-Supercycle," which can be listened to on the Newshour podcast page here or on iTunes here.

After an almost sixty-year long debt binge, expectations for above average economic growth or double-digit investment returns in the stock market aren’t realistic. Jim Puplava, Chief Investment Strategist at PFS Group and founder of Financial Sense, predicts at least six to eight more years of low-interest rates since deleveraging cycles can take quite a bit of time to complete.

While this can be a good thing for debtors, continued low-interest rates represent a serious challenge that no saver or investor can afford to ignore.

Related: Ultra-Low Rates Could Last Another Decade

Jim explains that after 2008, the habits of taking on ever-increasing amounts of debt to move asset prices higher, or of lowering interest rates to encourage more borrowing among consumers, have simply stopped working. This is what is meant by the end of the “debt supercycle.”

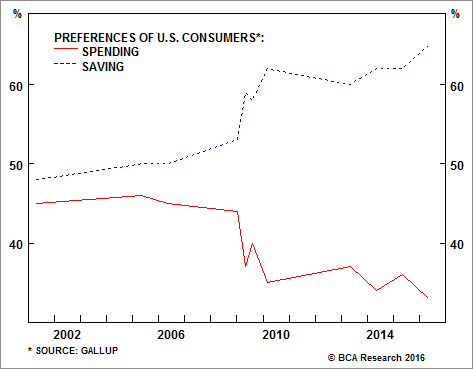

Currently “debt to income ratios remain high, well above historical norms. Consumers right now are not in the mood to increase debt as the savings rate recently went up to 5.4%,” Jim points out.

“What has happened is that governments are adding debt to replace what is lost from consumers.” But these efforts are often ineffective, or worse, have come along with “stifling new regulations or fiscal uncertainty” that hold back entrepreneurs and damage consumer confidence.

Source: BCA Research

Another way for central bankers to stimulate the economy—by increasing asset prices—has certainly been tried, whether we are talking about zero percent interest rates, quantitative easing, or even negative interest rates. But these policies come with plenty of risks and a high degree of collateral damage to savers.

Related: The Four Horsemen of the Retirement Apocalypse

The option of debasing one’s currency is still another policy designed to increase exports—and, therefore, stimulate economic growth—but this policy has the obvious problem that if every country tries to devalue their currency at the same time the benefits are canceled out. While Jim notes that some countries and some individuals have decreased their debt burdens, the process “takes quite a while to play out” and he points to the example of Japan regarding the difficulties associated with deleveraging.

For Jim, the challenge facing world governments is a simple one: “there is too much debt…and there is a lack of comprehension (or willingness) among politicians regarding the issue.” Jim believes that “this era of uncertainty” will continue for some time as investors remain dependent on the government to find its way through the deleveraging process.

Related: OECD's William White: In Terms of Debt, the Situation Is Way Worse than 2007

For the moment, investors should be realistic. Jim favors reliable dividend stocks and says investors “should forget about double-digit returns in the market,” citing a recent McKinsey report that predicts low single-digit capital gains for equities. In terms of country exposure, Jim still thinks “the US is the best-looking house in a global neighborhood.” Jim also likes shorter term corporate bonds, where one can find yields as high as three or four percent. “When you consider that nearly two-thirds of sovereign bonds have negative yields…corporate bonds become more attractive.”

Since he believes we are now in the latter phases of the economic expansion and moving closer to a recession, it is also possible that corporate spreads will widen, thus offering opportunities for investors. Finally, Jim likes gold—“the ultimate currency”—in a world of uncertainty and one where governments try to devalue as a response to the end of the debt supercycle.

Related: Bianco: Gold a ‘High Yield’ Asset in a Negative Rate World

Listen to this full podcast with Jim Puplava, Chief Investment Strategist at PFS Group and the founder of Financial Sense on our Newshour page here or on our iTunes page here. Subscribe to our weekday premium podcast with various guest experts, strategists, and book authors by clicking here.