Note: This commentary has been updated to incorporate the April data for Industrial Production.

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. This committee statement is about as close as they get to identifying their method.

There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process. They are:

- Nonfarm Employment

- Industrial Production

- Real Retail Sales

- Real Personal Income (excluding Transfer Receipts)

The Latest Indicator Data

Today's report on Industrial Production for April shows a 1.0% change month-over-month (0.98% to two decimal points), which was above the Investing.com consensus of 0.4%. The previous month was revised downward from 0.5 percent to 0.4 percent and revisions were made going back to November. Industrial Production peaked in November 2014, only one point higher than its pre-recession peak in November 2007. The year-over-year change is 2.19 percent, up from last month's YoY increase.

Here is the overview from the Federal Reserve:

Industrial production advanced 1.0 percent in April for its third consecutive monthly increase and its largest gain since February 2014. Manufacturing output rose 1.0 percent as a result of widespread increases among its major industries. The indexes for mining and utilities posted gains of 1.2 percent and 0.7 percent, respectively. At 105.1 percent of its 2012 average, total industrial production in April was 2.2 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.6 percentage point in April to 76.7 percent, a rate that is 3.2 percentage points below its long-run (1972–2016) average. [view full report]

The chart below shows the year-over-year percent change in Industrial Production since the series inception in 1919, the current level is lower than at the onset of 15 of the 17 recessions over this time frame of nearly a century.

Capacity Utilization

The Fed's monthly Industrial Production estimate is accompanied by another closely watched indicator, Capacity Utilization, which is the percentage of US total production capacity being used (available resources includes manufacturing, mining, and electric and gas utilities). In addition to showing cycles of economic growth and demand, Capacity Utilization also serves as a leading indicator of inflation.

Here is a chart of the complete Capacity Utilization series, which the Fed began tracking in 1967. The linear regression assists our understanding of the long-term trend. We've highlighted the post-recession peak in November 2014.

The latest reading is off its interim peak but has recently climbed above the regression.

The Generic Big Four

The chart and table below illustrate the performance of the generic Big Four with an overlay of a simple average of the four since the end of the Great Recession. The data points show the cumulative percent change from a zero starting point for June 2009.

Assessment and Outlook

The US economy has been slow in recovering from the Great Recession, and the overall picture has been a mixed bag for well over a year and counting. Employment and Income have been relatively strong. Real Retail Sales was weak for many months but now shows signs of improvement. Industrial Production was lagging for much of 2014 through the first half of 2016 but started showing signs of improvement in 2017.

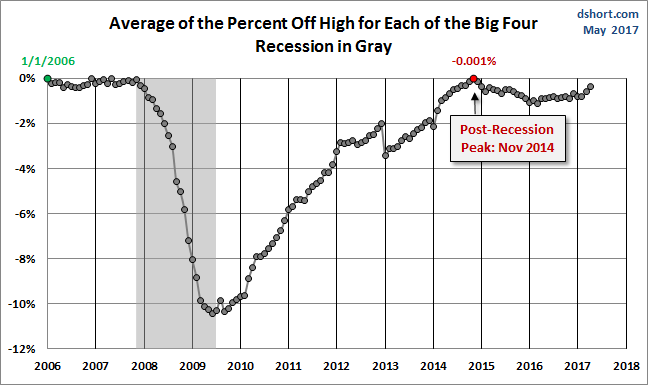

Here is a percent-off-high chart based on an average of the Big Four. The interim high was in November 2014 (fractionally below zero at three decimal places). The indicator primarily responsible for this decline is Industrial Production. Incidentally, the last time the average of the four set an all-time high was in January 2006.

The next update of the Big Four will be the latest numbers for Real Personal Income.