The broad-based S&P 500 and Russell Indices are hitting multi-month highs while the tech-heavy Nasdaq has been reaching record peaks with regularity this year. Despite the Wall of Worry over China Trade, the Bullish behavior of stocks hitting higher highs and higher lows is becoming obvious to the masses. We don’t want to be complacent as we watch for a potential August peak and September correction, but we can’t ignore the positive technical action that favors a higher trend before overbought signals appear.

Read China Slowdown Baked in the Cake

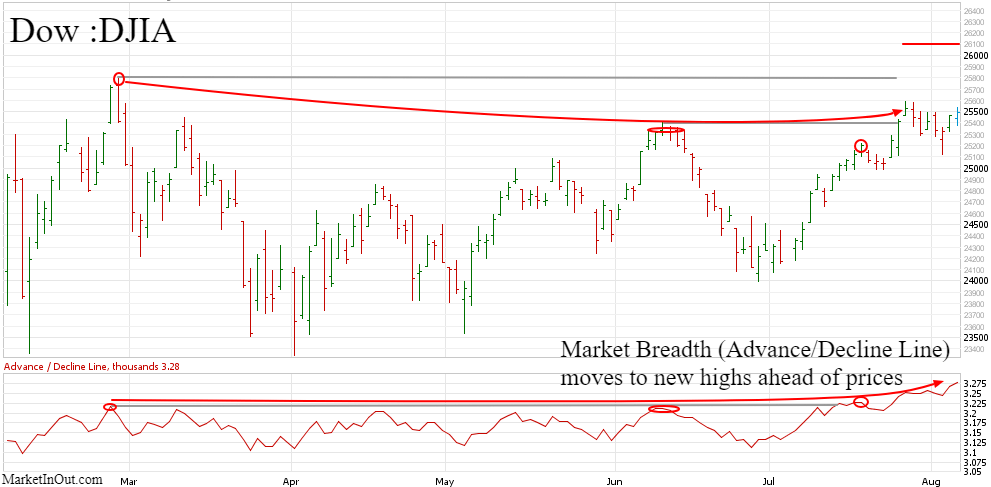

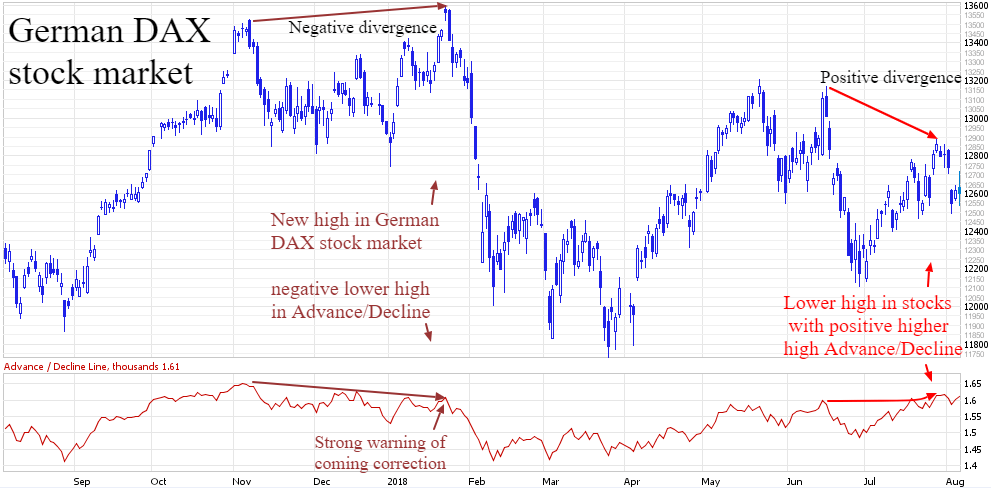

The Advancing stocks divided by declining (A/D) in various indices in the US and around the world have been giving positive divergences relative to the overall price of the stock index they represent.

We can see what a negative divergence of the A/D line and stock prices looks like with the German DAX. The DAX hit a new high along with the US in late January, but it’s underlying A/D line did not, foreshadowing the severe correction in the first quarter. Recently German stocks registered another lower high while their A/D line moved to almost 8 months high. This is a very positive divergence and is supported by the positive A/D divergences in the UK, Australia and elsewhere.

While the price action is certainly impressive in a year of potentially market-moving news uncertainty on global Trade Wars, our composite of Sentiment and seasonality measures have yet to push to the overbought extremes we often witness prior to market corrections. Market turns don’t require technical indicator crystal balls, but should sentiment measures such as Put/Call option ratios become extreme, it would greatly increase the odds of a strong short-term inflection point approaching.

The weighted signals below are ranked from 2 to 5 as warnings of price inflection zones. With the current trend being higher since early July, we can only judge sentiment as mildly supportive by avoiding an overbought condition despite a strong 1,500 points up in the Dow. Should prices on the Dow/S&P/Nasdaq and others continue to multi-month highs in August, we will be watchful for our overbought measures to trigger a consensus Sell signal. The 2nd half of August is a vulnerable time to expect a top in our timing cycles and sentiment favors another 1 to 3 weeks of rising prices before there is a chance of an overbought consensus.

They say Bull Markets love to climb a Wall of Worry. This adage has been true since the first quarter correction lows as Global Trade fears began escalating along with appreciating equities. The longer stock prices move higher without a negative impact on earnings or GDP, the more this Worry Wall becomes one of complacency or over-optimism. The Fear of Missing Out (FOMO) condition at the record market peak in January is the normal quality to look for prior to a significant peak in prices. Short term support at the intraday August lows should hold if this uptrend is valid.