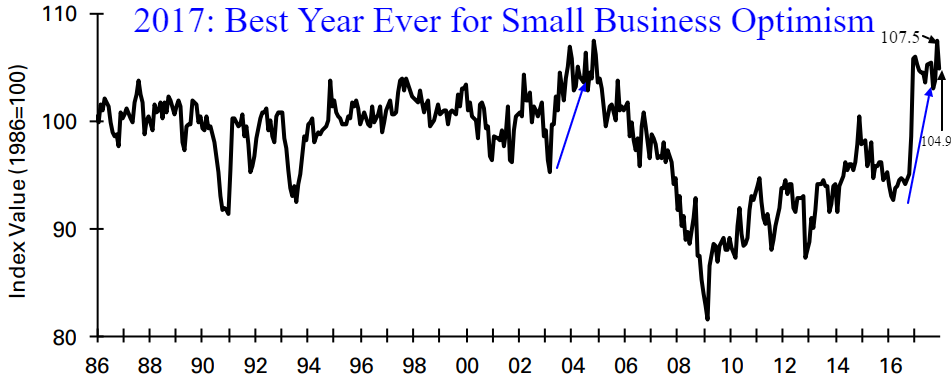

Since the 2016 elections, NFIB surveys of small business optimism have soared, generating the most dramatic jump in expectations on record. With corporate tax cuts still ahead of us and restrained capital spending data, it appears there is room for growing euphoria in 2018.

Advisor Perspectives does a great job presenting financial data, but a look inside the NFIB business survey reveals interesting support for the high expectations. Businesses are declaring now is one of the best times ever to expand.

While finding workers is THE number one problem businesses have when surveyed, those planning to hire more workers are at record levels. Planned hiring surges often occur early in an economic growth cycle (1994 & 2004), which augurs well for 2018.

The current labor shortage is secular (long-term) in nature with particularly troublesome trends for the next decade as workers retire, which should keep wages and automation buoyant.

Don’t believe the naive claims that 95 million workers are available to enter the workforce – implying that unemployment is nearly 40%. Such claims forget the source of this number is always high and includes the rapidly growing senior population and disabled.

The more relevant prime 25-64 year old worker participation rate has only fallen modestly, perhaps due to health and self-employed measurement errors, with only a 3.4% unemployment rate. Along with a record number of post-retirement age seniors working to fill the growing skills shortage, there is not much slack in the labor force.

Bank lending rates naturally spike with each post-recession economic expansion. The near record duration of the current growth cycle has yet to see borrowing rates hinder business optimism. Rates are low, credit is easy, and there is plenty of slack for growth.

It’s far too early to take away the punch bowl when small business has so much slack with below normal capital spending and borrowing. When NFIB shows record factory capacity and equipment allocations, record sales and earnings along with a spike in borrowing costs, then look for headwinds. For now, we await the tax cut stimulus tailwinds and global expansion to filter down to the bottom line of the small business sector.