Our theme that a new business cycle expansion began in 2016 is easy to see when looking at the renewed strength in the basic industrial and material sectors, which we have highlighted in past newsletters. Less obvious—and just as important however—is the persistent consumption trends since the 2008-2009 Great Recession.

While consumers have been the backbone of most expansion cycles, they have been the only GDP component keeping our economy from a long economic winter this decade. Now that the industrial sector is making a comeback with a rare boost to the investment component of GDP, consumers are even more optimistic. Euphoria surged upon Trump’s election and boosted our merriment to finish 2016. It looks like 2017 will be even merrier as the National Retail Federation estimates record spending in their most recent survey after the subdued decade that preceded.

Strong December data is not confirmed, but retail sales through November are now expanding at the best pace since February 2012. With tax cut benefits looming where even fast food workers are estimated to receive a 19% reduction in taxes, there should continue to be strong consumption trends in the 2nd half of 2018.

Weekly same-store sales reported by Redbook are also very strong. In the 12-year history of same store sales reports, 5 to 6% rates of growth are the ceiling. We may breach 5% again soon. Don’t be surprised to see near 4% growth on average in 2018.

Most of us increasingly embrace the online shopping wave. Walmart, Alibaba, and Amazon dominate. The e-commerce terminator has years to go before its steady usurpation of store purchases will slow. Current online trends are very healthy, replacing the record 7,000 brick and mortar stores that closed in 2017 during a “good economy”. Post-Thanksgiving “Cyber Monday” set a new record day of .6 billion in sales, more than double the 2015 record. This is also the first year that online sales over the holiday shopping season will surpass in-store purchases. Maybe FedEx and UPS need to arrive in costume next season for the declining in-store customers deprived of seeing their local mall Santa.

Don't miss America’s ‘Retail Apocalypse’ Is Just Getting Started, Says Bloomberg’s Matt Townsend

Carbon concerns and demographics argue that auto sales will move into secular decline in the 2020s, certainly those related to the carbon consuming cars of yore. Yet vehicles, led as usual by SUVs, are holding near long-term record sales levels. Total miles driven stagnated from 2007 until early 2014 along with the economy but reached new record highs in each of the past 12 months (YoY). The economy can handle lower auto sales as other areas of consumption and modes of travel rise, but so far the consumer looks healthy along with record low debt service burdens. While the tiny subprime auto loan default rate is rising back to past recession rates, overall default rates are extremely low in autos, credit cards, and, most importantly, mortgages.

Tight labor markets will guarantee healthy wage growth and maximum employment. Low-interest rates will keep consumer budgets ready to consume more. Now tax cuts will add even more to both the investment-oriented rich and consumer-oriented 95+% out there.

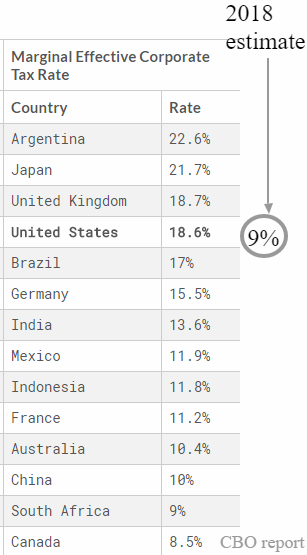

The US corporate tax cut is more significant in that the effective tax rate in the US will move from the 2nd highest of the industrialized world to being on par with the lowest according to a current estimate by University Penn Wharton. Resulting economic acceleration, small business recovery, and new investment will boost retail along with commensurate appreciation of retirement accounts, paychecks, bonuses, record job openings and easy credit helping to make this a Merry Christmas and on pace to be even merrier next year!