Almost a third of Banks are experiencing a spike in consumer credit card defaults to levels associated with recessions. While it could be a canary in the coal mine warning of a crisis rumbling through this strong economy, it may also be an errant spark by the feeble financial sisters supplying credit. With almost two-thirds of the nearly $17 Trillion in US commercial banking assets comprised of the top 15 mega-banks, we remain close to record low delinquency rates on credit cards on the aggregate.

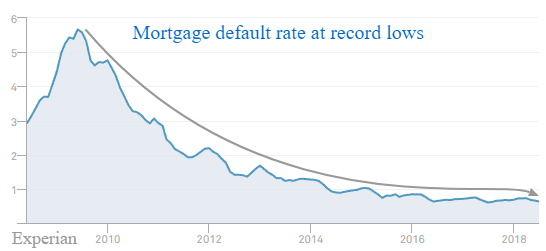

Bank credit cards, auto, and mortgage loans are all experiencing low or near record low default rates. If consumers were feeling overextended we would expect some signs of trouble here.

In spite of the clamor over record debt levels, it seems rational that delinquencies and defaults on the consumer and industrial sectors should be so low with such historically cheap borrowing rates, major tax cuts, excess bank reserves and a full employment jobs picture.

There is a Black Swan event lurking out there (China?) to mar this increasingly Goldi-locks economy and stock market someday. For now, we await flashing lights from these charts turning sharply higher and a spike above 1.00 in the Ted Spread as the canaries in our coal mine. TED is a measure of the spread between our rock solid 3 month Treasury Bill rates and leading Global bank offers for 3-month rates. This lending spread between leading global banks often warns of extreme risk, as in 1987, 2000 and 2007. At this juncture, there are no brake lights visible on the economic road ahead.