The surprise Trump victory November 8th catapulted stock indices about 15% higher as of March without even a 2% intraday correction. Our advice since December has been to avoid waiting for dips and stay 95% invested basis the S&P 500 (SPY) and keep buying as strong corrections were unlikely with so many investors frozen on the sidelines expecting a better entry. After a 7-week flat-line consolidation in December and January, stocks took off again on a 5% surge in February with the Dow closing higher 13 times in a 14-day stretch.

The ebullient CEOs and stock indices are less sanguine over the growing mismanagement in Trump’s politically inexperienced team. One has to travel back to President McKinley in 1897 to find so few cabinet members with public policy experience. Trump’s heavy reliance upon business titans in his cabinet should pay dividends in the long run, but as they lack the public sector knowledge to navigate in the short term, it’s quite possible we have entered a new 5- to 8-week consolidation phase awaiting the logjam of Health Care and Tax Reform bills to clear major hurdles in the Senate.

While markets become muddled in legislative uncertainty they may also begin to feel lethargic amidst the voluminous vacancies at dozens of leadership positions unvetted by a streamlined Trump transition team geared for a much smaller organization. Despite these concerns, our major stock indices remain within 1% of new record highs and still appear to have only 2 or 3% risk. A larger 10% style correction could manifest this summer but, we believe, is more likely to do so from higher levels.

There is little doubt that many metrics for stock market valuations are historically elevated. The expected earnings increase by 2018 due to Trump’s pro-business agenda has sent forward Price to Earnings ratios (P/Es) above most historic stock market peaks, with the exception of the late 1990’s tech bubble. Stock prices have risen faster than earnings and a pause in prices would be normal. Given the current optimism, Trump can’t afford major legislative logjams in 2017.

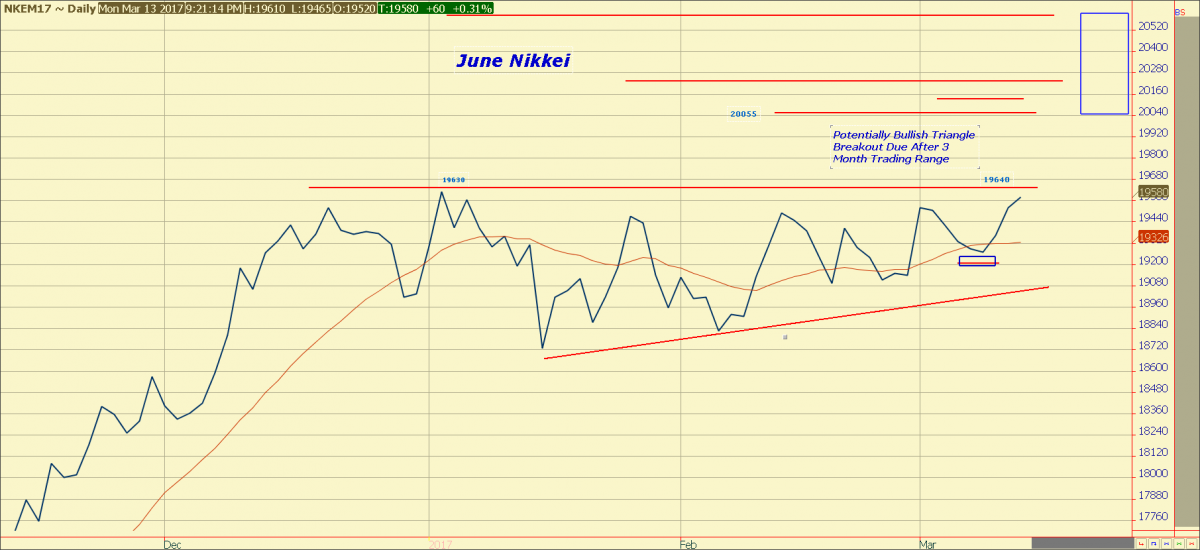

While the amplitude may vary, the US, European, and Japanese stock markets are well correlated. It’s encouraging for our US stock indices to see the lagging Japanese Nikkei 225 stock index working higher in what appears to be a continuation pattern. A further drop in the Yen currency will likely propel the Nikkei stock index to new heights, which will add a tailwind to US and European stocks. Should US stocks join in a possible breakout, then the S&P 500 Index will find its next resistance area near 2448.

Become a subscriber and gain full access to our premium weekday interviews with leading guest experts by clicking here.