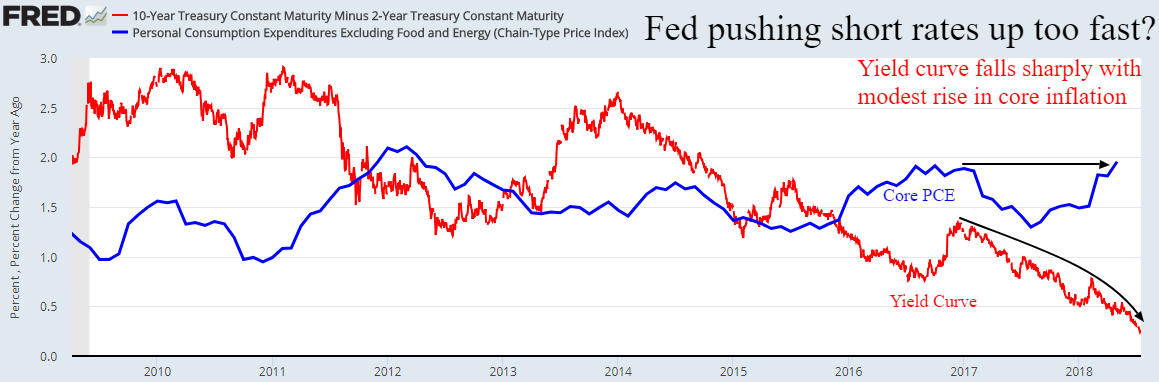

Awareness of the yield curve and the dreaded potential for inversion as a harbinger of a recession has never been more prominent in the news. Esteemed Federal Reserve members, commercial banking CEO’s and economists have acknowledged recently that an inverted yield curve is a powerful indicator of a coming recession. The yield curve measures the spread between similar bonds along the maturity spectrum. An increasingly positive sloping yield curve, with long rates above shorter-term rates, generally connotes a supportive financial environment. On rare occasions, the yield curve inverts when short-term maturities are pushed above long-term yields, usually in an effort to quell an overheating economy and credit risk. Many experts are quite worried that US Treasuries are headed for an inverted yield curve no later than 2019, which is a major reason now that many are targeting a recession in 2019 or 2020. Certainly, the chart below appears ominous with short-term maturities quickly approaching longer-term bond yields.

Over the past 18 months, we can see here that short-term rates have risen much faster than long Bonds. Since March the 2 Year yield has continued to rise while the 10 Year has been flat. Hopefully, the Fed is aware of its finger on the yield curve scale that may help trigger a panic reaction if they prematurely allow an inverted curve (<0%).

While accelerating economic growth rates over the past 6 quarters naturally pushes the yield curve closer to inversion, the Fed’s fixed path toward boosting short-term rates has negatively impacted the curve before inflation has become a concern. A 2% core inflation rate is more an excuse than a need for a higher Fed Funds rate. Our Central Bank is taking advantage of a strong economy to lock in higher inter-bank lending rates that will be used as a primary tool to ease when the next recession threatens. Ironically the Fed may speed recessionary expectations and volatility if they move too fast.

In 2017 the German economy grew at its quickest pace in 6 years at 2.2%, yet their 10 Year interest rates barely rose while the US 10 year surged from 2 to 3%. The aggressive continuation of European Quantitative Easing (QE) 4 years after cessation of US QE has artificially depressed rates in Germany and the US on the long end, widening the yield spread between our countries. With near zero returns on Euro bonds, investors have flocked to strong yields in the US, further depressing our Bonds and flattening the yield curve. The correlation of US yield curve inversions before each recession so far has been a US phenomenon, perhaps due to the US economy leading global economic trends.

Historically, a flatter US yield curve correlates with improving economic growth until it reaches a degree of inversion that leads to tighter credit conditions and a slowing economy. While we don’t want to be dismissive of this logical relationship between the cost of credit interest rate spreads and the economy (stocks), we would note an inversion event is now well anticipated and more artificially influenced than ever due to the quadrupling of the Fed balance sheets from Quantitative Easing (QE). While a full-blown Trade War could trigger an unforced recession error, we suspect that the Fed will react quickly to prevent a slowing GDP from turning into the first official contraction since 2008.