Financial Sense recently spoke with Caroline Miller, Senior Vice President and Global Strategist at BCA Research, one of the world’s leading providers of investment analysis and forecasts, to discuss the details of her recent webcast, Global Reflation: Where Next for Policy, Profits, and Prices?

As Caroline explained to FS Insider last week, given the current trends underway, BCA believes that the US business cycle has another year left before a possible recession around the 2019 timeframe, preceded by a potential market peak next year, as monetary conditions edge into “overly restrictive” territory from their presently accommodative levels. Caroline also outlined their current investment strategy and weightings on global equities, bonds, and other asset classes, while also commenting on signs of froth in commercial real estate and the dangerous levels of corporate debt.

Here are some key sections and charts from that conversation.

Ultra-Easy Money No Longer Required

Source: BCA Research

"So, absolutely we've observed in recent weeks a retreat from emergency level monetary accommodation and, at the outset, I think this really reflects the synchronized recovery in global growth that we're seeing really for the first time since the end of the crisis. No particular part of the world is on fire politically, economically, or fiscally so what you're seeing, if you look at chart 1 of the slide deck [above], is our own proprietary central bank monitors—which are discrete for each country—showing that this exceptionally easy monetary setting is just no longer necessary. And so, for the moment, we think this is reflective of stronger growth…”

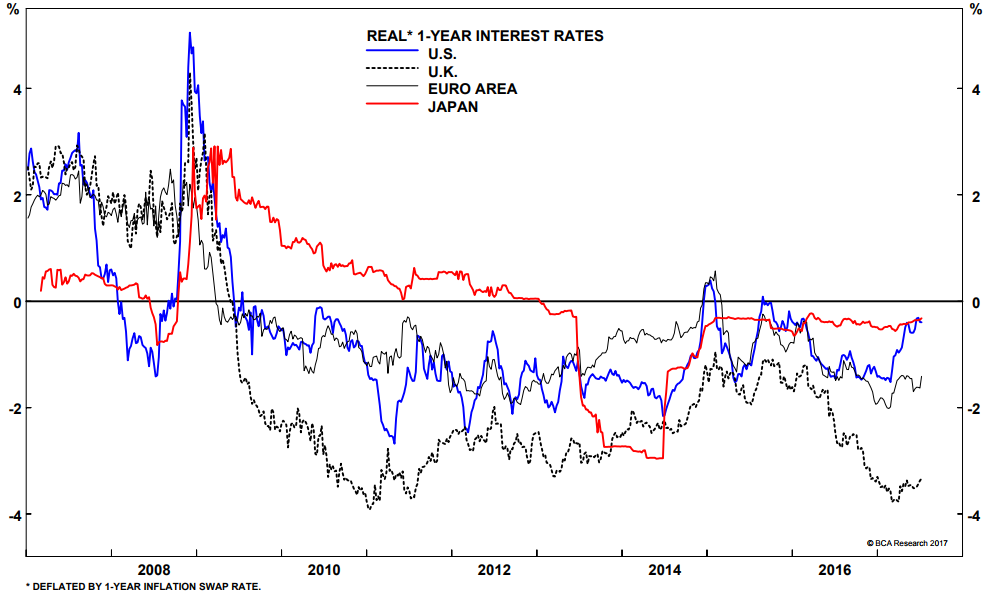

Real Interest Rates Still Negative

Source: BCA Research

“If you actually look at page 2 [above] you can see that despite the recent rise from very low levels in bond yields…real interest rates—real short rates—are still negative. So, given that growth is above trend in some countries, the fact that real interest rates are still negative I think suggests that this shift in monetary policy is not yet outright restrictive. Also, the thrust of profit growth in the global equity market is so solid [right chart below] that this is what is really underpinning equity markets right now and I don't see this initial pivot as being too much for equity markets to digest."

Business Cycle Still Has Room to Run

Source: BCA Research

“So there are two reasons why we think that this window for the business cycle has at least a few more quarters to run even before equities start to discount fading global growth. One is the fact that we've had a substantial easing in financial conditions in the last six months so notwithstanding this recent pivot from central bank narratives [toward tightening], you've had a decline in credit spreads, a decline in risk asset volatility, rise in equity prices, and certainly with respect to the US, you have the US dollar that is softer to the tune of about 8% year-to-date and as you can see in this left hand chart on page 4 [above], changes in financial conditions tends to lead GDP growth so that's one of the tailwinds that we think is continuing to support this business cycle. Also, the US still has a pretty strong labor market, strong housing market, as the permits and starts showed yesterday in the US, and then, importantly, also, the profit backdrop is looking pretty solid as the chart on the right of page 4 [above] shows. So…there are a variety of reasons why the party will come to an end but we still see a decent picture for the next 12 months.”

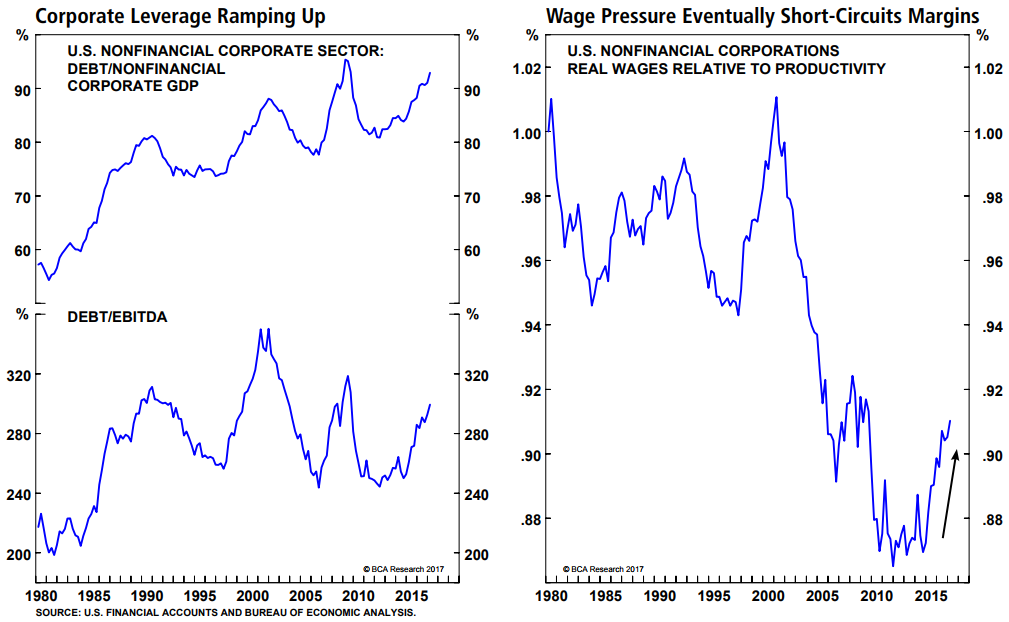

How Will It End?

Source: BCA Research

“We think it will really come down to pressure on margins: the confluence of, inevitably, as the labor market tightens and slack is removed, we are seeing the very early innings of monetary settings moving from exceptionally accommodative to neutral. However, by the Spring of next year we would expect that threshold to be past and we'll be moving into outright restrictive territory at a time when wage growth should be reflective of the fact that the labor market has tightened and so this unusual window for profit margins where pricing power is outpacing the expansion of cost structure will end. I think you've also got a situation where, very quietly, if you turn to page 11 [chart above], you can see that in the US, the corporate sector has been in a bit of a borrowing binge and so nonfinancial corporate leverage—debt as a percent of corporate GDP—is really, on the left hand side of page 11, climbing back to previous highs, and so debt relative to cash flow generation is also rising and, at the moment, that is not a problem because cash flow itself is being supported by top-line growth. But, if you look at the right hand side of page 11, you can see that, simultaneously, you do have slowly the rise of real wages relative to productivity and so it will be the intersection of those two trends, which are inherently hostile to margin expansion that comes into sharper focus we think by the middle of next year. This will cause the corporate sector to pull in its horns, this will I think take the labor market off the boil, and reduce confidence in the longevity of the cycle, at which point we would expect to see given the high level of corporate leverage, a rise in the corporate default rate, which I would say has been medicated by this profit recovery for now. So, watch profit margins, watch the tight labor markets generating wage pressure relative to pricing power—those are the things we are watching for evidence that this very long business cycle is coming to an end.”

Watch Commercial Real Estate

“We don't see major imbalances in the real economy in terms of cyclical spending but we are starting to see froth, for example, in the commercial real estate space where the vacancy rate has certainly bottomed and where underwriting standards are starting to tighten. That could be the leading edge of the end of this credit cycle.”

BCA Research is the one of the largest and oldest providers of independent global macro insights and research for the investment community. A sample of their work can be accessed through their blog or on Twitter @bcaresearch.