Warren Buffet has such a trove of insightful investment quotes, and one of his best came in 2004. In his annual letter to shareholders, he wrote, “And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.”

There’s no doubt you’ve heard this quote before, as it’s a guiding light for contrarian investors, but I think it’s worth taking a moment to reflect upon it again. The reason, of course, is because we’re beginning to see greed permeate the markets for the first time in many years.

To be sure, I haven’t received any stock tips from shoeshine boys yet, so the market should continue to rise for some time, but this is the type of environment where we need to be careful with our emotions.

No matter what we do in life, whether it’s buying a car, structuring our beliefs on a certain topic, or investing, we always look for social validation. We derive comfort from knowing that others are making and have made the same decisions that we have. But unfortunately, this can get us into trouble late in a bull market’s run.

During an extended period of low volatility and high returns, such as we’ve had recently, the notion of risk tends to fade away. This draws more investors into the market and before you know it, everybody who was sitting on the sidelines is buying stocks. This is bad for two reasons.

The first is that when “everyone else is doing it,” it becomes a lot easier for us to justify to ourselves that we should do it too. In some cases, this dynamic can shift so profoundly that those who previously felt stupid being in the market, now feel stupid being out of the market. When the crowd changes its tune so dramatically, it has a profound effect on us and can cause us to question our own judgment. What does everyone else know that we don’t?

The second reason it’s bad to see a mad dash into the stock market is because it leaves very few buyers once the rush is over. This means there is less support beneath stocks in the event that they begin to slip.

Now consider the following two charts. This first chart shows the American Association of Individual Investors’ bullish/bearish survey. Bulls now outnumber bears by the most since 2010.

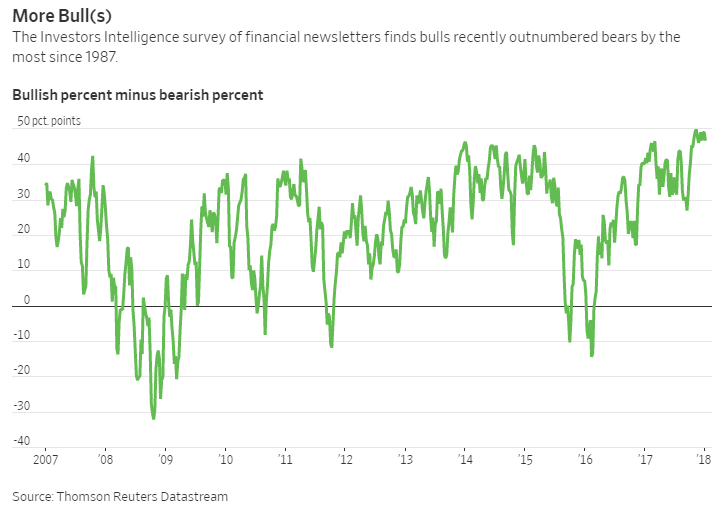

And apparently, it’s even worse with newsletters … Investors Intelligence’s survey of financial newsletters shows the highest number of bulls since 1987. I guess that would include us…

These readings are by no means a death warrant for the market, but the higher they go, the more likely it is that we’ll finally see a correction. This would be healthy, as frankly it’s been way too long since we’ve gone through a period of consolidation.

Getting back to Warren’s quote, being fearful amongst this rising greed does not necessarily mean selling. In fact, I would highly advise against that. But it does mean paying extra attention to things like economic fundamentals, to ensure that the gains we’re seeing in the stock market are not being fabricated completely out of thin air.

It also means paying especially close attention to our emotional state to make sure that we don’t get swept away by groupthink. As mentioned above, it’s easy to find comfort in numbers, and risks often get downplayed when we see everyone else behaving in a certain way. But just because we perceive the risks as being lower does not mean they really are; it’s often the opposite.

Another thing we should keep in mind is that sentiment has an inverse relationship with future returns. Many studies have born this out, including one by Malcolm Baker and Jeffrey Wurgler in 2011.

They looked at the effect of global and local components of investor sentiment on major international stock markets, and arrived at some interesting conclusions. For one, investor sentiment plays a significant role in international market volatility – just as we’ve seen, when investors are rampantly bullish, volatility is nowhere to be seen.

More importantly, total sentiment (at the global level) is a strong contrarian predictor of country-level returns … even more so than country-level sentiment.

They found that at the country level, a one standard deviation increase in sentiment was associated with 4.3% per year lower equal-weighted returns. Global sentiment actually had a stronger effect, with a one standard deviation move leading to 5.6% per year lower equal-weighted returns.

This is fascinating because it implies that sentiment is contagious and that each country’s stock market performance is heavily dependent on the moods of international investors … perhaps another reason why we’re seeing all stock markets around the world rise in sync. The only problem is that when the time comes, there’s a good chance they’re all going to fall together as well. That’s one reason why international diversification does not provide the safety net that it once did.

So enjoy this continued melt-up, but don’t allow yourself to get complacent. The higher this market goes, and the more euphoria we see, the more cautious we should become.

I’ll leave you with one last little factoid that may help you feel better in the event you’ve been late to this equity party. According to Longview Economics, roughly 40% of a bull market’s gains occur during the first 12 months, and an additional 32% of those gains come in the final 12 months. So there’s a good chance that even latecomers will see some solid profits; the trick is going to be locking those in before the final inflection point.

The preceding content was an excerpt from Dow Theory Letters. To receive their daily updates and research, click here to subscribe. Matt is also the Chief Investment Strategist at Model Investing. For more information about algorithmic based portfolio management, click here.