A McKinsey study addresses the "productivity puzzle". However, there is no puzzle and there never was a puzzle.

Inquiring minds are diving into the McKinsey study on Solving the Productivity Puzzle.

While there are many schools of thought, we find three waves collided to produce a productivity-weak but job-rich recovery, with productivity growth falling on average to 0.5 percent in the 2010–14 period compared to 2.4 percent a decade earlier.

These three waves are: the waning of a productivity boom that began in the 1990s, financial crisis after effects including persistent weak demand and uncertainty, and digitization. The third wave, digitization, is fundamentally different from the first two because it contains the promise of significant productivity-boosting opportunities, yet the benefits have not materialized at scale. This is due to adoption barriers, lags, and transition costs such as the cannibalization of incumbent revenues.

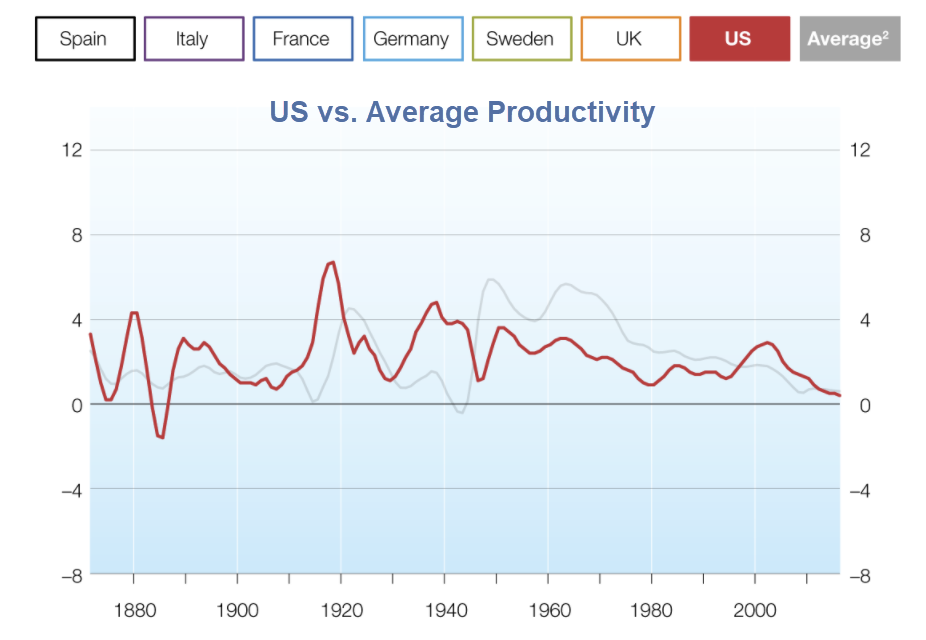

The US vs Average Productivity

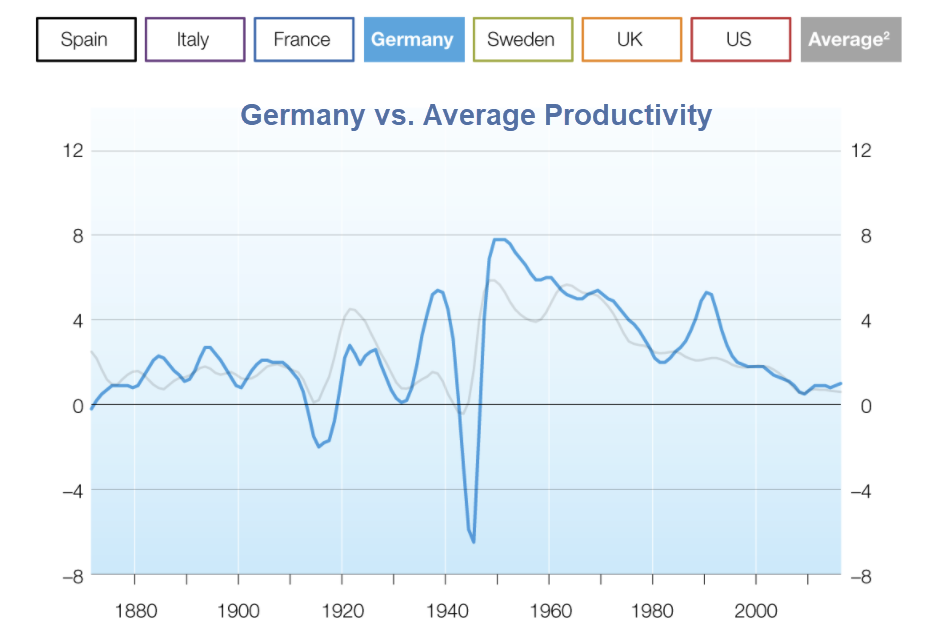

Germany vs Average Productivity

The charts of Italy, France, and Germany look the same. WWI and WW2 are heavy influences. Having a war fought in your country is not a boon to productivity.

Three Waves

Wave 1 is the declining impact of the internet revolution. Wave 2 represents the aftermath of the great financial crisis. McKinsey claims wave three will be digitization-related productivity boom.

McKinsey claims "weak demand" dampened current productivity growth. There is not weak demand and rising credit card debt proves it.

Homes sales are weak, not because of lack of demand but because they are not affordable. The study did not mention the role of the Fed as a reason.

The study states the "Rise of Amazon and the wave of digital disruption occurring in the retail industry added to productivity growth from the shift to more productive online channels. Yet the growth was accompanied by transition costs, duplicate structures, and drags on footfall in traditional stores."

We have overbuilt massive amounts of retail stores, food establishments, shopping centers, etc., each of which takes numbers of low-skill workers whether sales go up or down.

That's something I mentioned every time I posted productivity numbers.

In regards to cars, McKinsey states "If technology and regulatory hurdles are overcome, McKinsey estimates that up to 15 percent of new cars sold in 2030 could be highly autonomous."

15% by 2030. Is that a joke? Try 85% or higher by 2030.

The study accurately cites demographic trends and "an aging population that has less need for residential and infrastructure investment."

McKinsey concludes: "There is a lot at stake. A dual focus on demand and digitization could unleash a powerful new trend of rising productivity growth of at least 2 percent a year that drives prosperity across advanced economies for years to come."

No Puzzle

The study presented numerous charts but there is no puzzle and never was a puzzle.

- We amassed a mountain of debt and massively overbuilt retail stores, fast food restaurants, and malls, all of which need to employ low-skill workers.

- The Fed slashed interest rates and companies borrowed money not to invest it, but to buy back their own shares at ludicrous prices.

- The Fed's insistence on 2% inflation with a backdrop of debt-deflation and in a technological price-deflationary world explains any alleged weakness in demand.

- As factory automation increases, the rate of change in terms of the number of employees needed is at a point of diminishing return.

A productivity boom is likely on the way and it will be two-fold.

- Autonomous cars and trucks will eliminate millions of truck and taxi driving jobs.

- The push for $15 minimum wages will eventually compel stores to automate everything they can to eliminate workers.

When that happens the economists will fret over the lack of jobs.