Through the third quarter, 6,752 locations were scheduled to shutter in the US according to the International Council of Shopping Centers. That's more than double the 2016 total and is close to surpassing the all-time high of 6,900 in 2008, during the depths of the financial crisis.

Bloomberg writers Matt Townsend, Jenny Surane, Emma Orr and Christopher Cannon claim America’s ‘Retail Apocalypse’ Is Really Just Beginning.

Delinquent Loans

Problem Is Debt

Don't blame this on Amazon. The authors note the "root cause is that many of these long-standing chains are overloaded with debt—often from leveraged buyouts led by private equity firms. There are billions in borrowings on the balance sheets of troubled retailers, and sustaining that load is only going to become harder—even for healthy chains."

Actually, the root cause is the Fed cheapening money and making all this building and junk loans possible.

Regardless of the reason, an explosive amount of debt is coming due in the next five years just as credit markets are starting to tighten.

Too Late to Party

"One testament to that negativity on retail came earlier this year when Nordstrom Inc.’s founding family tried to take the department-store chain private. They eventually gave up because lenders were asking for 13 percent interest, about twice the typical rate for retailers."

Concentration of Retail Jobs

The report concludes “A pall has been cast on retail,” said Charlie O’Shea, a retail analyst for Moody’s. “A day of reckoning is coming.”

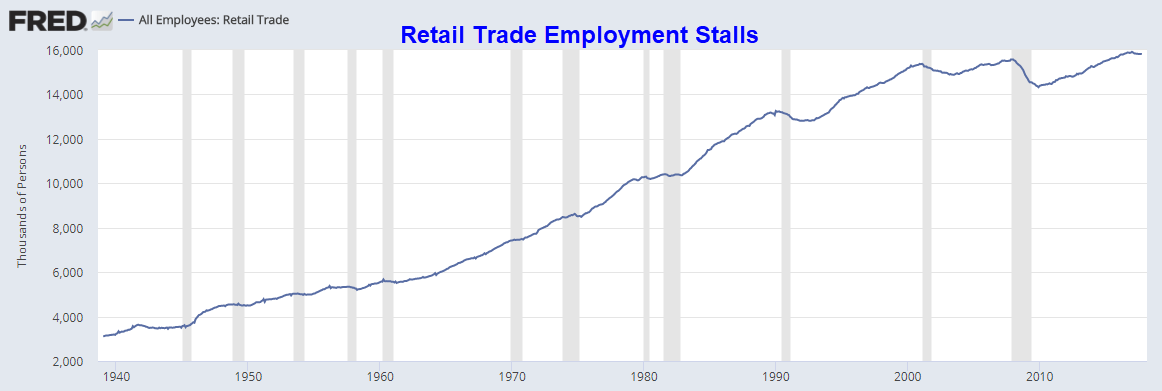

Here are some charts I created on Fred to consider.

All Employees Retail Trade

Department Store Employees

Average Weekly Hours Retail Trade

Nonstore Retail Employees

Day of Reckoning

Yes indeed, a "day of reckoning" is coming and it's not just retail.

The day of reckoning includes a stock market bubble, a junk bond bubble, real estate bubbles, a public union pension bubble, and far down on the list of importance, a bitcoin bubble.

Deflationary Trends

These are extremely deflationary trends. So is the demographic setup, so is debt in general, so are all of the bubbles mentioned above. Also, note that the coming revolution in self-driving vehicles will put millions of drive-for-a-living employees out of a job.

I confidently conclude another major round of deflation is coming up. Curiously, the Fed (central banks in general) fueled this very result with their deflation fighting tactics.

BIS Deflation Study

The BIS did a historical study and found routine deflation was not any problem at all.

“Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive,” stated the study.

It’s asset bubble deflation that is damaging. When asset bubbles burst, debt deflation results.

Central banks’ seriously misguided attempts to defeat routine consumer price deflation is what fuels the destructive asset bubbles that eventually collapse.

For a discussion of the BIS study, please see Historical Perspective on CPI Deflations: How Damaging are They?