Moving into the New Year, hopes for an acceleration in economic activity had been relatively high, especially compared to the sequester challenged early part of the prior year. Of course the very harsh weather across a good part of the US in recent months has certainly played a bit of havoc with shorter term economic stats as of late. Whether it’s the weather will be quite the important question as we travel into the spring.

The markets were not surprised at all last week with the release of the downward 4Q GDP revision. Of course there are a few other issues globally that have been catching front page attention as of late, for very obvious reasons. Right to the bottom line, as I sifted through the GDP data, my personal feeling is that all eyes should be on capex and capex related anecdotal data in the weeks and months ahead. Why?

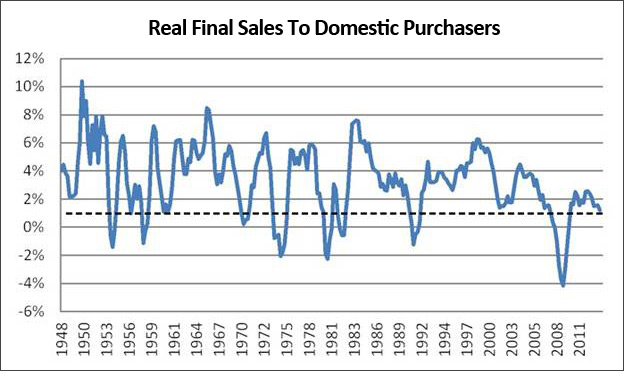

One of my must see GDP components each quarter is real final sales to domestic purchasers. As you may remember, this is GDP stripped of the influence of both inventories and exports. In other words we’re looking directly at the tone of the domestic US economy only. I believe the 2013 4Q revision to this number demands attention. Below is the history of the year over year rate of change in real final sales.

Graphically, you can easily see the reason I’m highlighting this. The year over year number for the recent quarter came in at 1.2%. The fact is that over the entirety of official US GDP data, there has only been one other quarter (3Q 1956) that saw a year over year rate of change number this low where we have not seen the US economy either in or literally on the cusp of an official recession. One year after that 3Q 1956 number appeared, a US recession was underway.

Let me get this straight. I’m not suggesting we’re in a recession now or even approaching one, but this very subdued rate of change level in domestic economic activity clearly highlights the fragility of where we find ourselves in the current cycle. Of course the key driver of domestic only economic strength? Personal consumption. Whether it’s the weather? Time will tell, but if this rate of change number continues lower in quarters ahead, it will not be a good sign for what has already been a historically muted total economic cycle to date that is absolutely more that clearly characterized in the chart.

What this also tells me is that we need to intently focus on the non-consumption side of the US economy in looking for anecdotes of change in the current and subsequent quarters. If there was an apparent bright spot in the 4Q GDP revision, it was nonresidential fixed investment – usually considered a proxy for corporate capital spending. Nonresidential fixed investment for the quarter was revised up to a 7.3% annual run rate from the 3.8% number seen in the first unveiling of the GDP numbers. Moving in the right direction. But we importantly need to remember that bonus depreciation expired at year end 2013. So the question for now becomes just how much forward capex demand/activity was pulled into the fourth quarter of last year for tax reasons and what will the rhythm of capex be in quarters ahead? I’d suggest to you that a 7.3% annual run rate is not sustainable, but given the fragility of real final sales (domestic demand), we’re going to necessarily need to see capital spending strength in order to feel good about the rhythm of 2014 macro GDP.

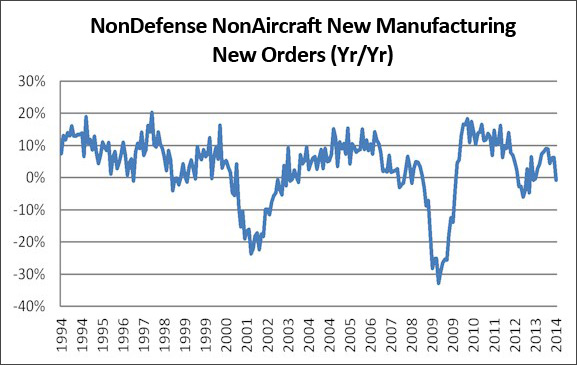

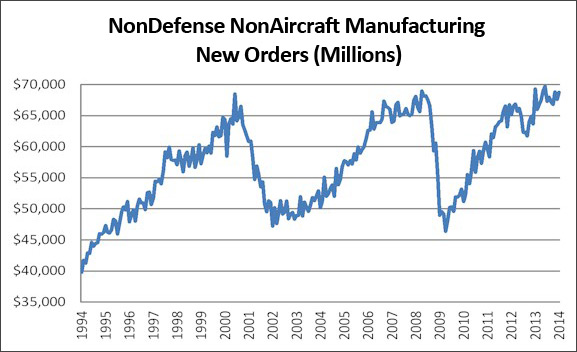

I think it’s important to have a look at some much longer term trends as we ponder and await what lies ahead for corporate capex. Personally, I like to look at the monthly nondefense and nonaircraft new manufacturing new orders numbers for a sense of the micro. As should only be expected, the weather is the issue of the moment, but surely to be resolved as a question mark in the months ahead. Below is a look at the entirety of the data series.

Of particular is that in nominal dollars, this proxy for capex is no higher today than was the case at the prior cycle peaks of 2000 and 2007. Financial markets may have “broken out” to new highs, but not so the reality of actual corporate investment. It is crystal clear that especially in the current cycle, there has been a higher implicit rate of return to corporations in share repurchases than in actually investing for tomorrow. We’ll see what lies ahead and for now, whether it’s just the weather.

Given the slowing we are seeing in emerging markets as of late, I suggest a key watch point is smaller businesses. In my opinion, the chart below says it all. Although NFIB forward capital spending plans declined in January, the 3 month moving average of the numbers that smoothes monthly volatility hit a new high for the cycle.

But the history of the numbers show that small business capex spending plans have not even come back to levels seen at the outset of the great recession in 2008. Businesses large or small cannot forestall capex indefinitely. A breakout in this data series to above the prior cycle lows of 2001-2007/8 would be more than a welcome event. Whether this occurs or otherwise will be known once the weather is no longer an issue. Stay tuned.